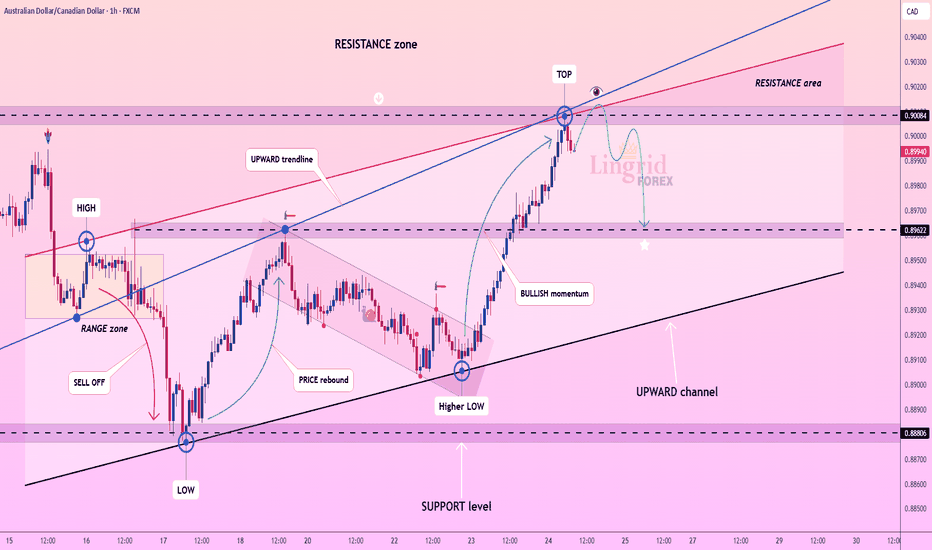

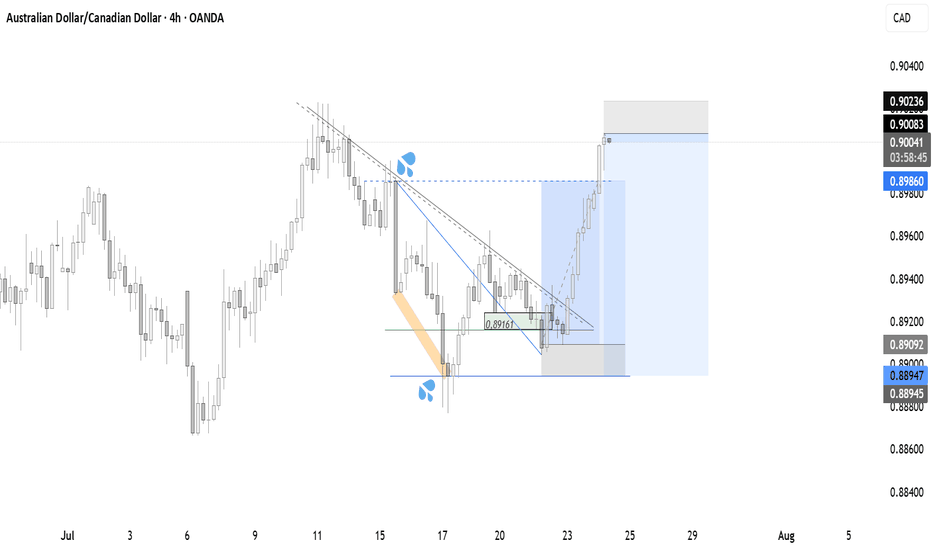

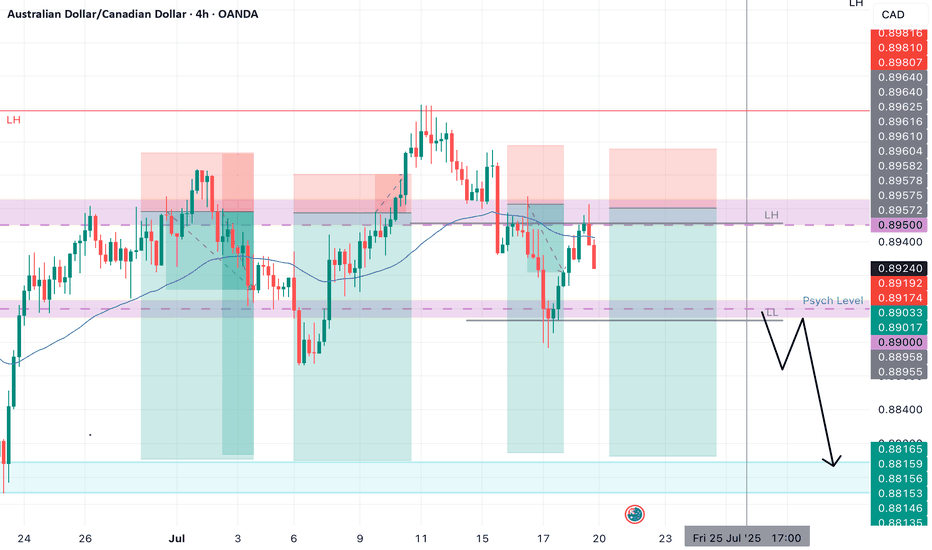

Lingrid | AUDCAD Short Following Resistance Fake Breakout The price perfectly fulfilled my last idea . FX:AUDCAD is rejecting from the top of the resistance zone after a strong bullish impulse and has started forming a rounded top pattern. Price remains inside an upward channel but is showing signs of exhaustion with the blue arrow projecting a pullback

About Australian Dollar/Canadian Dollar

The Australian Dollar vs. the Canadian Dollar. Both of these currencies are regarded as commodity currencies and are considered to be a relatively stable currency pair. The CAD fortunes are closely related to the U.S. because it is their largest trading partner and neighbor. The AUD is more effected by its alignment with Australia and emerging Asian markets.

Related currencies

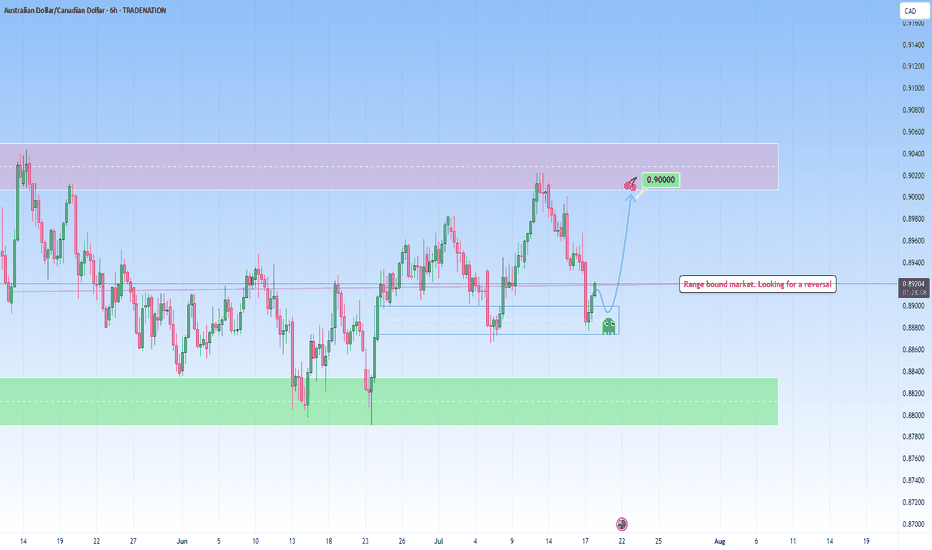

AUDCAD: Respecting Structure, Repeating OpportunityWhat we’re looking at here is a beautifully balanced range market, the kind I love trading, because it speaks so clearly when you take a moment to listen. Price is respecting both sides of this range clearly. The lows are being protected and respected multiple times before.

We’ve already tapped int

AUDCAD I Daily CLS I Model 2 I HTF DOL TargetYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The i

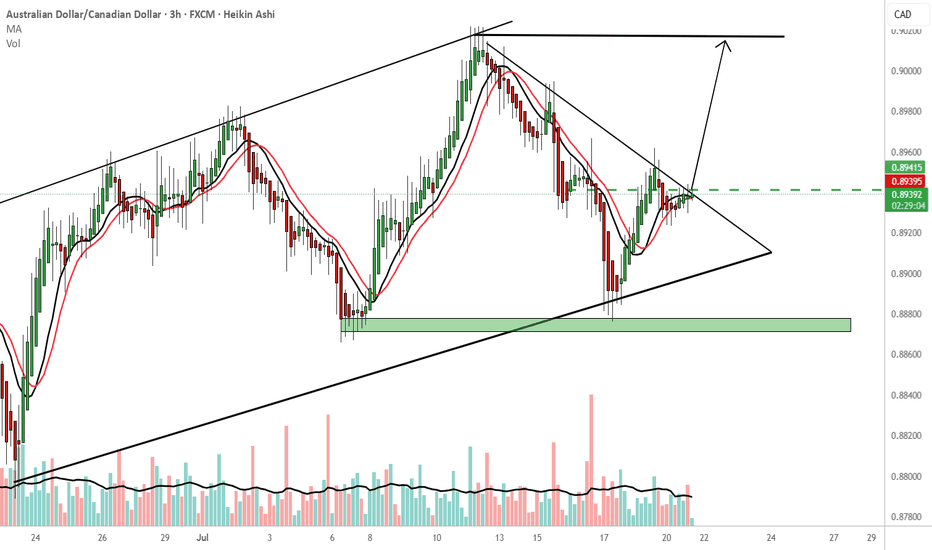

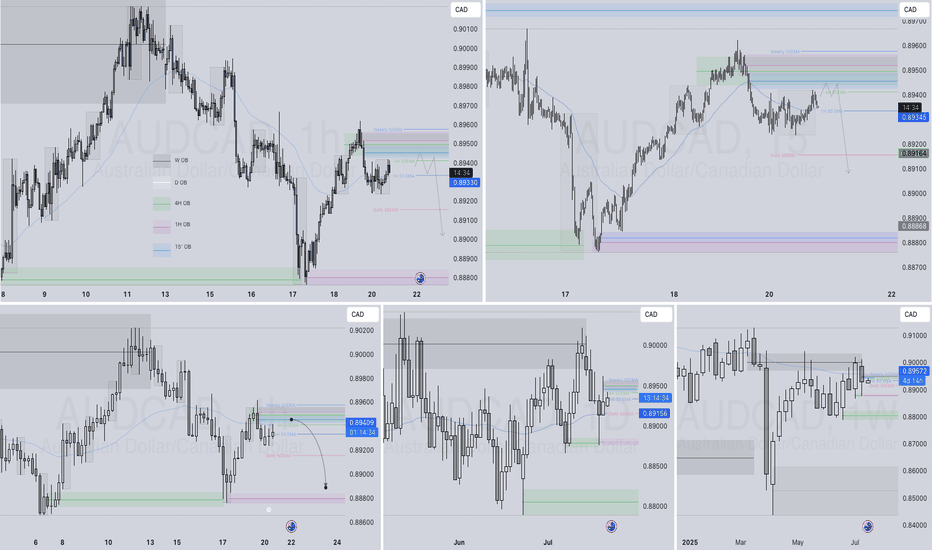

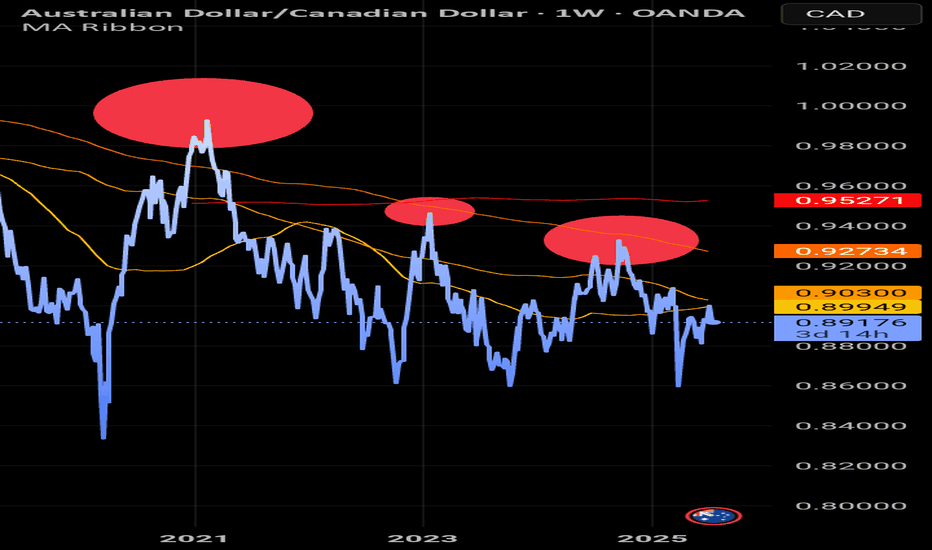

AUDCAD Q3 | D21 | W30 | Y25 📊AUDCAD Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

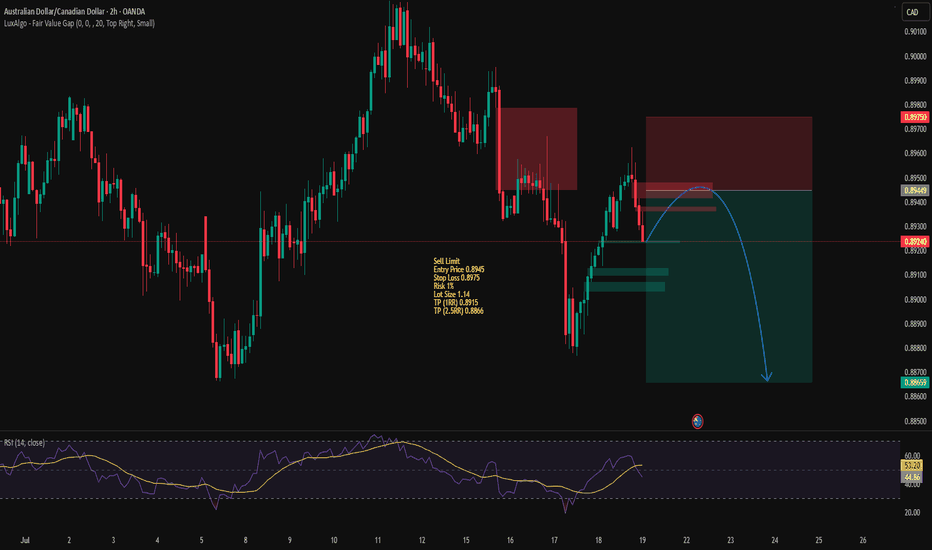

Australian Dollar to Weaken Against Canadian Dollar Over Next 6 AUD/CAD has broken below key support at **0.8900**, confirming a bearish trend. The pair is trading below the 200-day MA (~0.8950), with RSI holding below 50, indicating sustained selling pressure. Next downside targets: **0.8750** (2024 low) and potentially **0.8600** (2023 support zone).

Canada’s

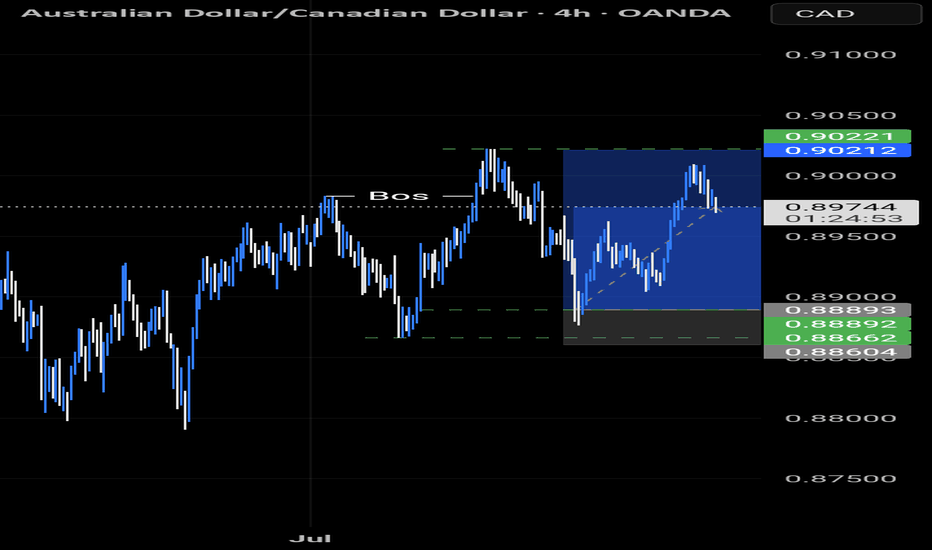

AUDCAD SHORTMarket structure bearish on HTFs DW

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Weekly Previous Structure Point

Weekly Rejection at AOi

Daily Rejection at AOi

Daily Previous Structure Point

Around Psychological Level 0.89500

H4 EMA retest

H4 Candlestick rejection

Levels 4.17

Entry 10

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The value of the AUDCAD pair is quoted as 1 AUD per x CAD. For example, if the pair is trading at 1.50, it means it takes 1.5 CAD to buy 1 AUD.

AUDCAD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade AUDCAD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.