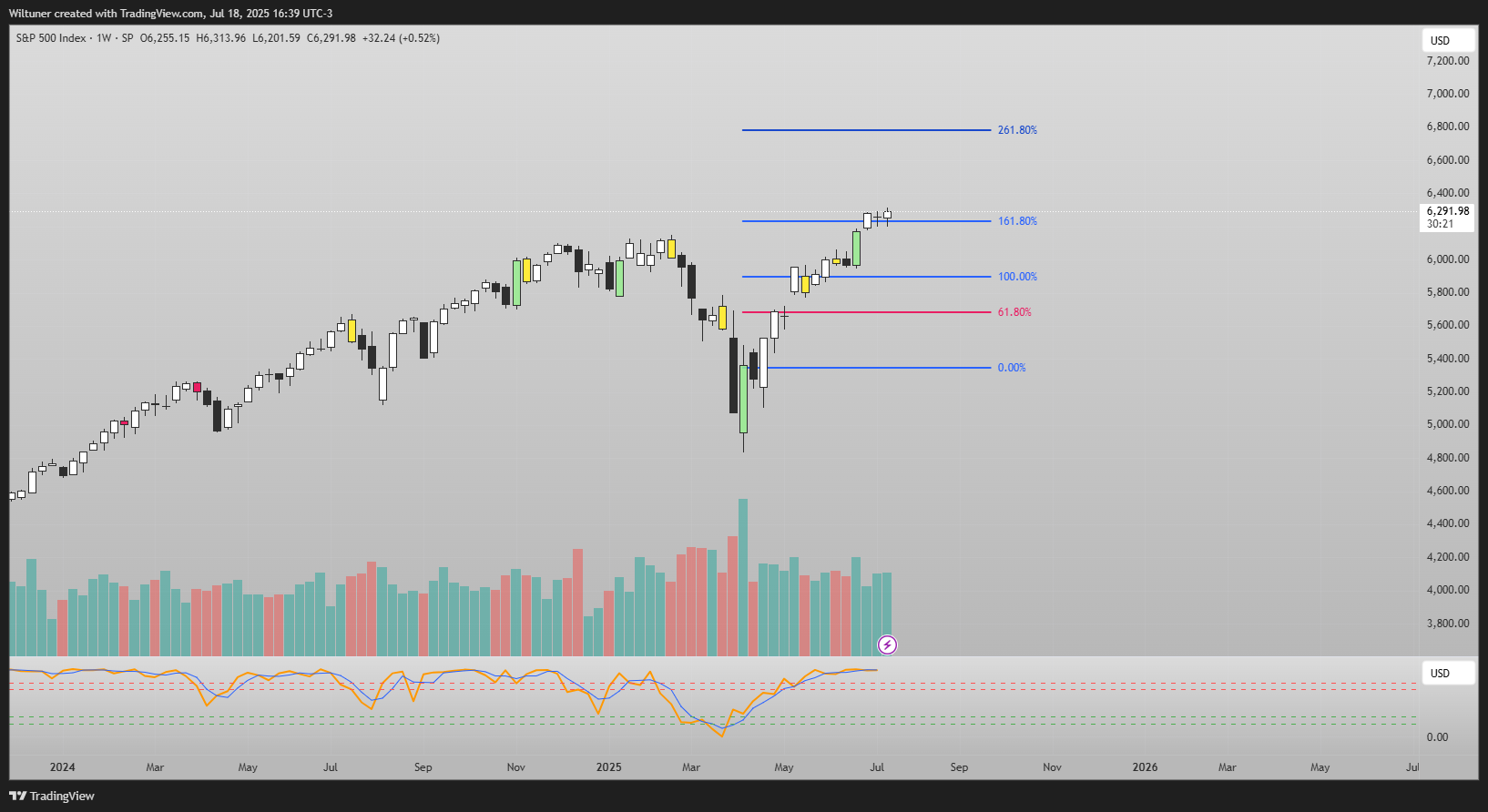

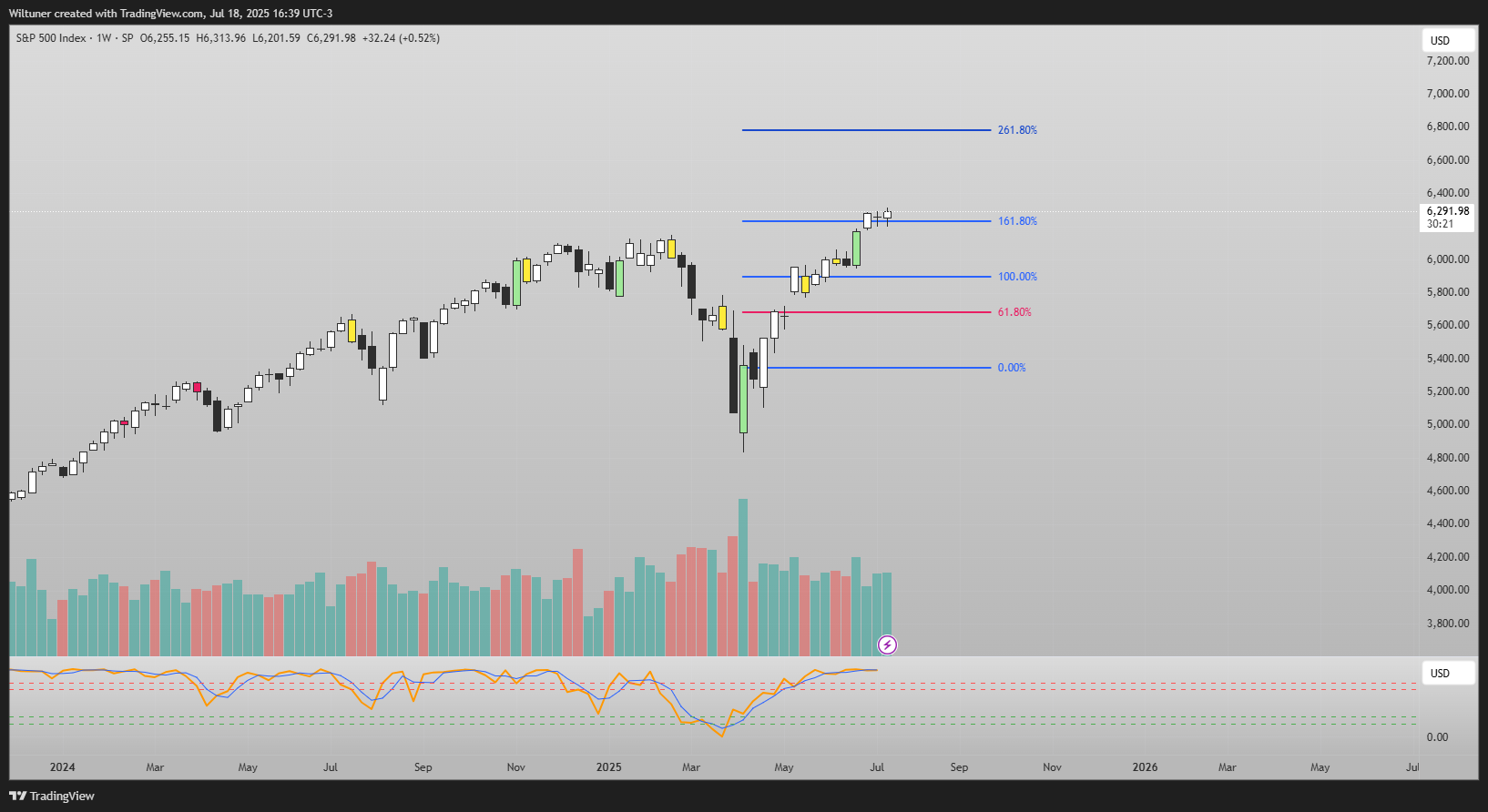

S&P 500 Index forum

And that's the weekend calling .. :) all done

TP1 1:9

TP2 1:11 Planned , hit a counter signal and closed 1:8

Took the short on a little bad entry just out side of structure but easy

TP3 1:3

Layers are great but a little work to manage the trades on intraday.

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational

🎯 Summary posts only. Full context via DM