US 500 - Rolling Future (Per 1.0) forum

🌀 Confidence Beats — But NDX Fades and Labour Cools

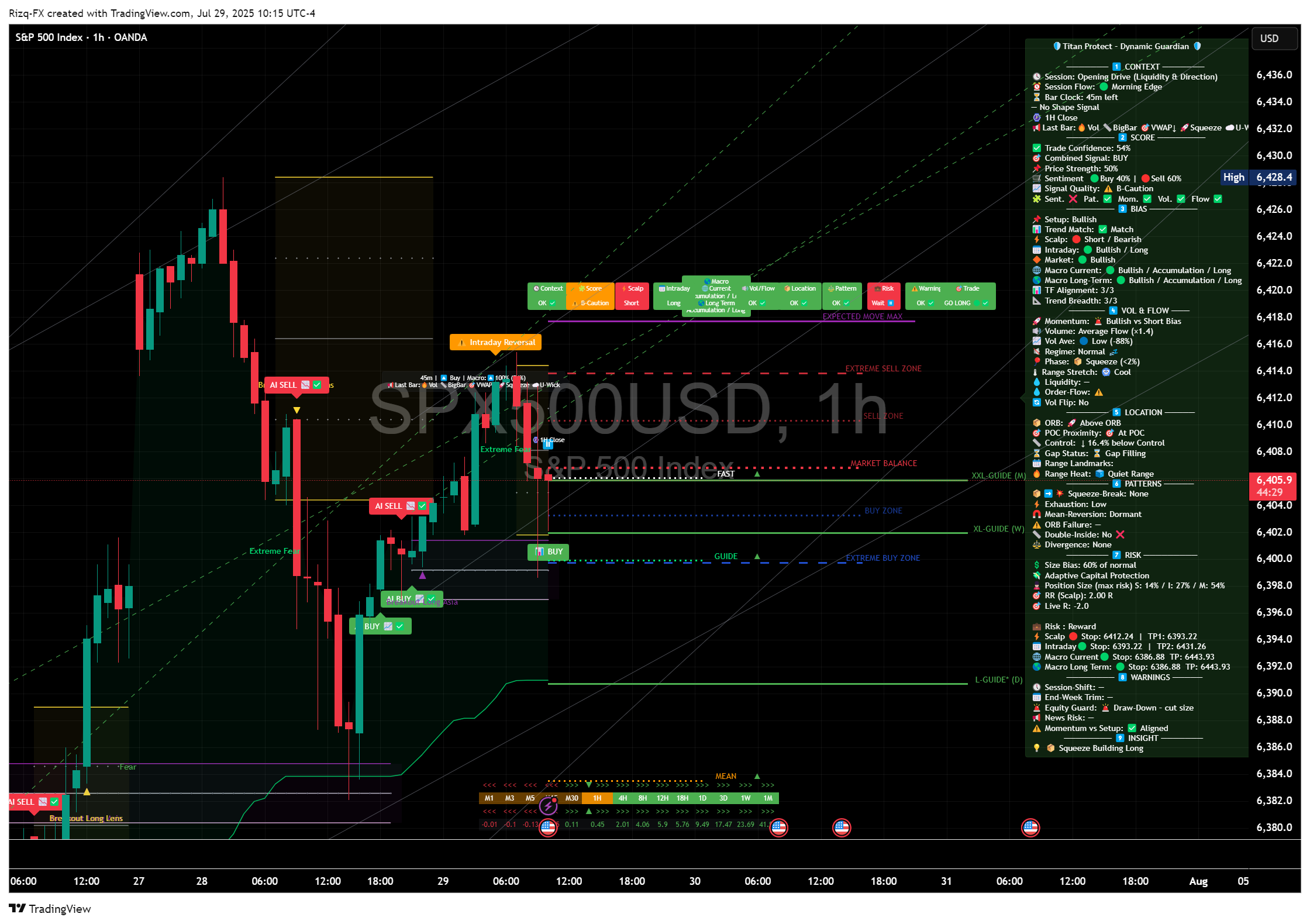

📆 Tuesday, July 29, 2025 | ⏰ 15:15 London / 10:15 NY

📦 Market Context: Sentiment lifted by confidence — but tech rejects and labour softens

📉 Data Recap:

• ✅ CB Consumer Confidence: 97.2 vs 95.8 est → surprise beat fuels retail tone

• ❌ JOLTs Job Openings: 7.437M vs 7.5M est → fewer jobs being posted

• ❌ Job Quits: 3.142M vs 3.21M est → worker confidence cooling

• ❌ House Price Index MoM: –0.2% vs –0.1% est → housing softens again

• ✅ Goods Trade Balance: –$85.99B vs –$98.4B est → better Q3 growth baseline

• ⚖️ Retail/Wholesale Inventories: Flat → no new demand impulse

🔍 Flow Notes:

• SPX: Still above breakout, but flow is narrowing fast

SPX: Still above breakout, but flow is narrowing fast

• NDX: Rejected hard at 23,500 → tech leadership fading again

NDX: Rejected hard at 23,500 → tech leadership fading again

• BTC: Stalled near 117K → macro not driving conviction

• Gold: Pulls back with DXY firming → safety bid evaporating

• USD: Quiet bid on trade strength and pre-FOMC positioning

🔍 Labour Signal Pairing:

• Fewer job openings + fewer quits = cautious economy

→ No panic — but no wage heat either → disinflation bias builds

→ Suggests Fed may stay patient unless Friday’s NFP surprises hot

🎯 Trade Ideas:

• 🟢 Long Bias: SPX — while above 6,375 and VIX stays below 15

• 🔴 Short Bias: NDX — rejection under 23,500 = clear weakness

• ⚖️ Neutral: BTC — no directional impulse into Fed risk

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

🎯 Summary posts only. Full context via DM.

⚠️ Educational content only. Not investment advice.

📉 Macro data reflects positioning as of July 29 (reported same day)

📆 Tuesday, July 29, 2025 | ⏰ 15:15 London / 10:15 NY

📦 Market Context: Sentiment lifted by confidence — but tech rejects and labour softens

📉 Data Recap:

• ✅ CB Consumer Confidence: 97.2 vs 95.8 est → surprise beat fuels retail tone

• ❌ JOLTs Job Openings: 7.437M vs 7.5M est → fewer jobs being posted

• ❌ Job Quits: 3.142M vs 3.21M est → worker confidence cooling

• ❌ House Price Index MoM: –0.2% vs –0.1% est → housing softens again

• ✅ Goods Trade Balance: –$85.99B vs –$98.4B est → better Q3 growth baseline

• ⚖️ Retail/Wholesale Inventories: Flat → no new demand impulse

🔍 Flow Notes:

•

•

• BTC: Stalled near 117K → macro not driving conviction

• Gold: Pulls back with DXY firming → safety bid evaporating

• USD: Quiet bid on trade strength and pre-FOMC positioning

🔍 Labour Signal Pairing:

• Fewer job openings + fewer quits = cautious economy

→ No panic — but no wage heat either → disinflation bias builds

→ Suggests Fed may stay patient unless Friday’s NFP surprises hot

🎯 Trade Ideas:

• 🟢 Long Bias: SPX — while above 6,375 and VIX stays below 15

• 🔴 Short Bias: NDX — rejection under 23,500 = clear weakness

• ⚖️ Neutral: BTC — no directional impulse into Fed risk

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

🎯 Summary posts only. Full context via DM.

⚠️ Educational content only. Not investment advice.

📉 Macro data reflects positioning as of July 29 (reported same day)

$bears suck !