Nasdaq’s All Time HighsLiquidity moves liquidity.

Expansion, Retracement, Reversal, Consolidation

Market is doing 1 of these 4

Expansion is determined by where liquidity sits and where it is going. Price delivery is upmost important when receiving bias and narrative

Seeing where price is coming from is just as importan

Related futures

ES Futures — Week Ahead Playbook (Aug 11–15)Macro Drivers to Watch

Tue Aug 12 @ 8:30 AM ET — CPI (July)

Key inflation print; expect sharp vol expansion in NY AM.

Wed Aug 13 @ 2:00 PM ET — FOMC Minutes

Insight into Fed’s July 29–30 meeting tone.

Fri Aug 15 @ 8:30 AM ET — PPI (July) + Retail Sales (July)

Two high-impact releases within minute

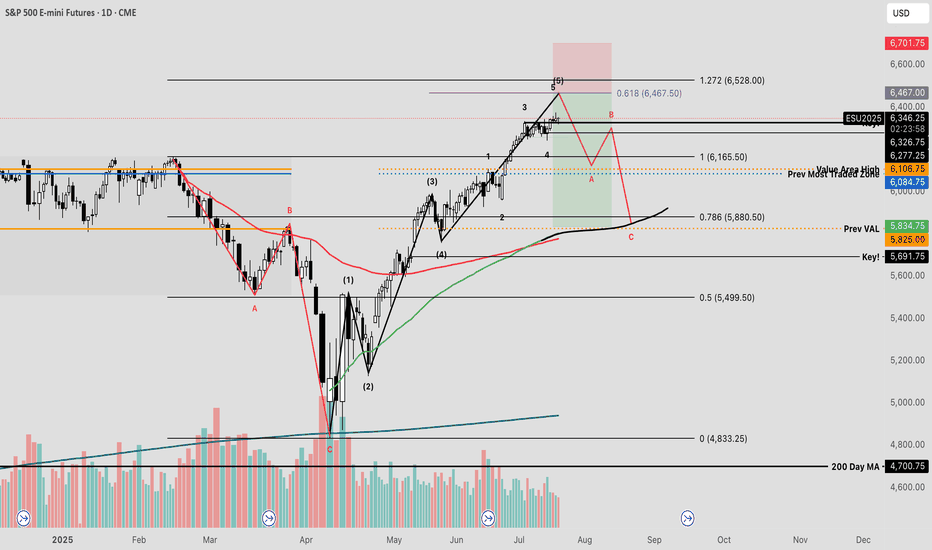

SPY The Final Countdown Since the April lows, equity markets have exhibited strong performance, with many stocks appreciating by nearly 100%—some even exceeding that threshold. Given the velocity of this rally, a corrective pullback may be imminent before the broader uptrend resumes.

The current reading on the Fear & Gree

Corrective Dip or New Downtrend on the S&P 500 Futures?🟣 1. Impulses vs. Corrections – The Classical View

When price trends, it doesn't move in a straight line. Instead, it alternates between directional movements called impulses and counter-directional pauses or retracements known as corrections. Most analysts define an impulse as a sharp, dominant m

Approachable Contracts for Trading Around Fed DecisionsCME Group E-Mini S&P Options ( CME_MINI:ES1! ) and Micro S&P Futures ( CME_MINI:MES1! ), #microfutures

On July 30th, the Federal Open Market Committee (FOMC) decided to keep the Fed Funds rate unchanged at the 4.25-4.50% target range. Investors now turn their focus on whether the Fed will cut rates

ES Rejection Setup: Volume Profile & Fair Value Gap StrategyOn ES, it’s nice to see a strong buying reaction at the price level of 6352.00.

There’s a significant volume cluster in this area, showing strong buyer accumulation. I believe buyers who entered here will defend their long positions. If the price returns to this level, strong buyers will likely pus

Why You’re Not Successful as a Trader(And What Nobody Tells You)A lot of people want to know how to succeed at trading. They jump into day trading thinking it’s super easy. Just click a button and make money, right? And in a way, it really is that simple because every trade has about a 50/50 chance of being right or wrong. But here is the thing most people do no

Nq & Es Key Levels & Daily Bias 08-08-2025Today’s bias is once again bullish, aiming for those all-time highs.

When the market opens at 09:30, I’d like to see price dip into discount zones or take out some lows first — that would set up a nice rally upward and a potential long opportunity.

If that doesn’t happen, I’ll stay on the sidelines

S&P 500 (ES1!): Bullish! Look For Valid Buy Setups!In this video, we will analyze the following FX market for the week of Aug 11 - 15h:

S&P 500 (ES1!)

The S&P 500 rose Friday to close the week strong on a busy week of tariff updates and good earnings.

There is no reason to consider selling.

Wait for pullbacks to FVGs for high probability buys.

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Micro E-mini S&P 500 Index Futures (Dec 2020) is Dec 18, 2020.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Micro E-mini S&P 500 Index Futures (Dec 2020) before Dec 18, 2020.