5 Ways To Enhance Your Trading Psychology (Tips)Welcome to mindset Monday, where I will share something trading psychology-related.

In this post, I will be breaking down 5 things that have helped my trading psychology over the years. Trading is not only a game of strategy, but there is a level of self-awareness involved as well. The 5 things that have helped me are basic brainwave science, limiting social media, diet, letting go, and having a trading ritual. Let’s discuss them further.

1. Your Brainwaves & Binaural Beats

Did you know? When you wake up your brain is in what’s called “Alpha” state? Believe it or not this is actually not ideal for trading. When your brain is in Alpha state, it is actually in a more relaxed mode, Alpha is typically a state someone is in when they meditate or are about to fall asleep. It takes the average person 30-60 minutes after they wake up to transition out of Alpha and into the “Beta” state. Beta waves are what your brain is in when it feels “on.” When you are doing homework, working out, or even at a work, your brain is in Beta. How does this relate to trading? Well, back when I was obsessed with charts (in a dangerous way) I would wake up and just hop on the chart and try to trade. I would literally hop out of bed and look at my laptop. I now allow myself one full hour to transition into Beta before I begin trading, this allows me to operate at full capacity and stay sharp and alert. I also use an app on my phone called binaural beats. The app will actually play Beta waves through headphones, and while your listening to it will help your brain switch into it faster. I recommend looking into binaural beats apps, a quick google search will explain more to you. In trading, it’s important to find as many ways as possible to stay mentally sharp. This is one I use.

2. Limit Social Media

I’ve seen it and I’m sure you have, the people on Instagram, Facebook, and other platforms flashing pictures of how many pips they are catching and how they are scaling accounts by 5000% in 8 days. That’s great and all, but this could potentially DESTROY you when you sit down and look at the charts. As humans, we are always comparing ourselves to other people, and when we see someone else doing better we either get down on ourselves, get inspired, or think that we need to do that too, or we aren’t performing up to par. Trading is unlike anything out there. You aren’t competing with anyone, it’s about you and the chart, your mind needs to be clear to tap into your zone. The issue with social media is people get googly-eyed at money and the lavish life but trading is not about that, it’s simply about building habits, when you take your mind off of your execution and systems and you start thinking you need to scale up quicker, you are going to be trading simply off emotion and probably make mistakes. Silencing my social media from flashy traders was one of the best decisions I have ever made.

3. Your Diet

What you put into your body can affect your mind greatly. If you eat more whole foods, and get some exercise regularly these actions lead to a good feeling. Your brain will release more serotonin, this will help increase your mood. When you feel good about yourself. You usually have more confidence, and when you have more confidence, that is going to come through in your trading and your life, you’ll feel more confident in your intuition and decisiveness, and as traders, all we do every day is make decisions!

4. Let Go

Let go of everything, let go of yesterday’s bad trade, let go of an argument you had with a loved one, try and let go of any stress you may feel. Meditate for 15 minutes if you need to. Beat the crap out of a pillow. Release that energy because if you don’t you may exert it onto the chart. Every trade is a brand new trade, the market doesn’t care about your problems, it will tick on with or without us. I have tried yelling at EURUSD when it stops me out, and I found that I never get a response from my computer screen. If you’re having a bad day, just step away and get a fresh start tomorrow.

5. Consistent Ritual

Man, I can’t emphasize this enough, when you have a strategy, the name of the game just becomes execution really. You need to train your brain/subconscious to simply repeat your strategy over and over. In my opinion, the best way to do this is to trade from the same location. If you trade at home, do it in the same spot every time. Do something that puts your brain into “trading mode,” for me, it is making a cup of tea. I wake up, eat food, and once that cup of tea gets made, I started thinking “it’s game time.” Did you know that Tom Brady takes a nap two hours before every game? This is an example of his ritual, yours can be anything you want, affirmations, visualizing, anything you feel you can do before sitting down that will trigger your “trader state of mind.”

I’m not a psychologist, but I hope this article gave you value, or maybe just gave you a break from reading posts about charts and setups. Just sharing my experiences.

Let’s Elevate,

Gio

P.S. Every week I share a forex outlook, educational content and trade ideas, right here on tradingview. Make sure to follow so you don’t miss them!

Eurusd-4

📚 The Beauty of Combining Technical & Fundamental Analysis 📚What is Fundamental Analysis?

Fundamental analysis is a way of looking at the forex market by analysing economic, social, and political forces that may affect currency prices. The idea behind this type of analysis is that if a country's current or future economic outlook is good, its currency should strengthen (Baby Pips - www.babypips.com)

What is Technical Analysis?

Technical analysis is the study of historical price action in order to identify patterns and determine probabilities of future movements in the market through the use of technical studies, indicators, and other analysis tools (Forex.com www.forex.com)

Technical analysts look for similar patterns that have formed in the past and will form trade ideas believing that price could possibly act the same way that it did before.

From the chart above, you can see how key fundamental news created incredible volatility in the market but the underlying technical analysis was still intact. From this, we can gather that although fundamental analysis is important, technical analysis is just as important.

See charts below to identify how we could have traded the key fundamental moments over the past few years.

See links below for more trade ideas and in-depth analysis!

📚 The Beauty of Combining Technical & Fundamental Analysis 📚 What is Fundamental Analysis?

Fundamental analysis is a way of looking at the forex market by analysing economic, social, and political forces that may affect currency prices. The idea behind this type of analysis is that if a country's current or future economic outlook is good, its currency should strengthen (Baby Pips - www.babypips.com)

What is Technical Analysis?

Technical analysis is the study of historical price action in order to identify patterns and determine probabilities of future movements in the market through the use of technical studies, indicators, and other analysis tools (Forex.com www.forex.com)

Technical analysts look for similar patterns that have formed in the past and will form trade ideas believing that price could possibly act the same way that it did before.

From the chart above, you can see how key fundamental news created incredible volatility in the market but the underlying technical analysis was still intact. From this, we can gather that although fundamental analysis is important, technical analysis is just as important.

See charts below to identify how we could have traded the key fundamental moments over the past few years.

See links below for more trade ideas and in-depth analysis!

Q-Stick IndicatorThe QStick can generate trade signals based on signal-line ( I prefer 50% of the first swing after trend reversal) or zero-line crossovers.

A descending QStick signals the price is closing lower than it opened, on average.

An increasing in QStick indicator signals the price is closing higher than it opened, on average.

WHY PIPS DON`T MATTER#ExplanationHey tradomaniacs,

ever since I`m in this business I see posts about "Profit in pips" and how important allegedly pips are.

I can tell you... this is non-sense unless you trade the same PAIR with exact the SAME Risk-Reward over and over again!

In this post, I want to clarify and show you that it is absolutley senseless to count the profit in pips as it says nothing about your actual profit!

NOTICE: THERE IS A BUG IN THIS POST SO OPEN THE SNAPSHOTS AND CLICK ON IT AGAIN!

So let`s have a look at the first chart and see what we got here...

In this scenario you see two trades with exact the same risk-reward-ratio of 5:25. This means you risk 1$ for 5,25$ or can win 5, 25x more than you can lose.

We assume here that we risk 1% per trade.

Scenario 1️⃣: 👉You win EUR/USD and lose USD/JPY

EUR/USD:

Risk: 1%

Profit in pips: 68 pips

Profit in %: 5,25

USD/JPY:

Risk: 1%

Loss in pips: -5 pips

Loss in %: -1%

Result in pips: 68 pips - 5 pips = 63 pips profit

Result in %: 5,25% - 1% = 4,25%

Scenario 2️⃣: 👉You lose EUR/USD and win USD/JPY

Risk: 1%

Loss in pips: 13 pips

Loss in %: -1%

USD/JPY:

Risk: 1%

Win in pips: +25 pips

Profit in %: +5,25%

Result in pips: 25 pips - 13 pips = 12 pips profit

Result in %: 5,25% - 1% = 4,25%

The real profit on your account is 4,25%, no matter which trade you`ve won and how many pips you`ve made! The pip-difference is 51 pips, but you still have these 4,25%, no matter which trade you win!

Why is that? Now look at USD and at JPY-Pairs.

A pip in USD, or MAJOR-PAIRS is always the fourth figure behind the komma. 👉 1,248(0)0

A pip in JPY, or JPY-PAIRS is always the second figure behind the komma. 👉 107,6(8)5

Let`s calculate the pip-difference from Entry to target for both pairs:

1️⃣ EUR/USD:

Take-Profit - Entry

1,2547 - 1,2479 = 0,0068 = 68 pips

2️⃣USD/JPY:

Take-Profit - Entry

107,935 -107,685 = 0,25 = 25 pips

Also notice that if you lose both trades that a -5 PIP loss and a -13 PIP loss are both the same LOSS of 1 % if you stick to a consistent risk! IT DOESN`T MATTER!

Okay, let`s say you trade the same pair with the fourth figure behind the comma as a pip, but you trade with different risk-rewards but a huge move you catch!

In this case you trade with a different risk-reward as you need a wider stop-loss due to volatility and you want to advoid to get stopped out!

You use the same strategy to follow the trend, but now we had news that pumped EUR/USD like hell!

Scenario 1️⃣: 👉You lose the first EUR/USD trade and win the second EUR/USD trade

EUR/USD #1:

Risk: 1%

Loss in pips: -13 pips

Loss in %: -1%

EUR/USD #2:

Risk: 1%

Win in pips: +140 pips

Win in %: 4%

Result in pips: 140 pips -13 pips = 127 pips profit

Result in %: 4% - 1% = 3% profit on your account

Scenario 2️⃣: 👉You win the first EUR/USD trade and lose the second EUR/USD trade

EUR/USD #1:

Risk: 1%

Win in pips: +68 pips

Win in %: 5,25

EUR/USD #2:

Risk: 1%

Loss in pips: -37 pips

Loss in %: -1%

Result in pips: 68 pips - 37 pips = 31 pips profit

Result in %: 5,25% - 1% = 4,25% profit on your account

Even though you`d make 127 pips in scenario 1, the real profit would be 1,25% less on your account!

ERGO: More pips = Less profit

So let`s head into a very extreme example of HOW pips don`t tell you a s**t about your profits! ;-D

In this example we compare a GOLD-TRADE with our recent EUR/USD-TRADE.

I don`t want to spamm this post with too many calculations so I try to keep it simple here.

Important to notice is that the PIPS for GOLD are represented by the second figure behind the comma.

In this scenario we buy Gold at 1.800$, or 1800,0(0) <- Cents

A dollar change in Gold , for example 1800 to 1801, is called a POINT.

A dollar change in Gold would be 100 Cents, or 100 pips!

So let`s say you buy gold with a risk-reward of 2:1, means you risk 1$ for 2$ or can win 2x more than you can lose.

In this case you would make 20 POINTS as the price moves from 1.800$ to 1.820$. In pips you would make 2.000 friggin pips but only 2% profit compared to your 68 pips in EURO /USD with 5,25% profit.

One last example:

In this scenario you win the EUR/USD trade and LOSE the GOLD-TRADE:

EUR/USD #1:

Risk: 1%

Win in pips: +68 pips

Win in %: 5,25

XAU /USD:

Risk: 1%

Loss in pips: -700 pips

Loss in %: -1%

Result in pips: +68 pips - 700 pips = -632 pips profit

Result in %: 5,25% - 1% = 4,25% profit on your account

You would lose -632 pips but make a real profit of 4,25% on your account!

So when do PIPS really matter? If you would trade the same PAIR with the same RISK-REWARD over and over again as you would always win and lose the same amount in %.

If you`d trade the same EUR/USD trade, PIPS would actually make sense to be counted. But who trades that way? Almost noone!

What does that mean for your positionsize in LOT?

They always VARY! Use a position-size-calculator to get your right position-size.

But thats a topic for another post... :-)

IF YOU WANT TO SEE MORE EDUCATIONAL CONTENT PLEASE LEAVE A LIKE AND A COMMENT.. especially when this helps you! :-)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

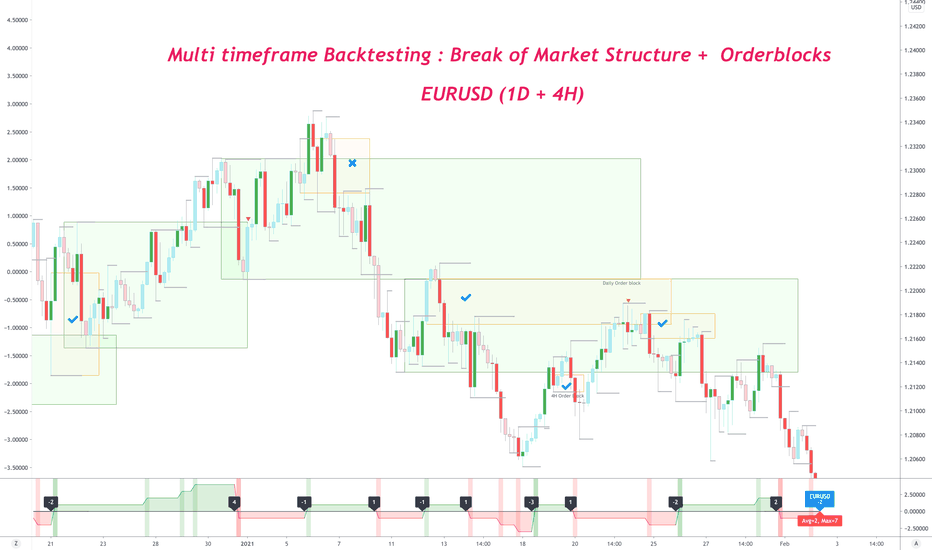

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

10 Awesome 'Hidden' Gems on TradingViewWelcome Traders!

In today's trading episode, you will learn and get to see some of the best 'hidden' gems on TradingView. A lot of you are new to TradingView and may not know some of these features. TradingView has a lot of really neat features so take time to click on different elements to see what they do.

Thank you @TradingView for creating such an amazing platform!

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

Price Oscillator StrategyThe Price Oscillator uses two moving averages.

✔ One shorter-period, and one longer-period.

✔ When 2 MAs cross each other the PO reads 0.

The Price Oscillator technical indicator can show overbought and oversold areas.

Strategy:

Only go long in an uptrend.

Only go short in a downtrend

Uptrend strategy: Look for an oversold situation to open a buy position. Close when get to overbought then close some more when crossing back to the zero line.

Downtrend strategy: Look for an overbought situation to open a sell position. Close when get to oversold then close some more when crossing back to the zero line.

EURUSD 1D MEAN REVERSION TRADING STRATEGYBest Mean Reversion Strategy:

Before we get to that point, first and foremost, let’s see what tools we need to use for this strategy.

The best mean reversion indicator that works 85% of the time is the RSI indicator.

So, you will need the RSI oscillator on your charts.

Now, there is one more important thing that needs to be done. The RSI settings must be changed from the default 14-period to 2-period RSI. So, we’re having not just any type of RSI, but a very fast RSI. Levels are 10 & 90.

The other technical indicators we’re going to deploy on the charts are:

10-period simple moving average.

200-period moving average.

Note* Another thing to keep in mind is the recommended time frame is the daily chart. Intraday charts won’t work because the fast-period RSI will generate a lot of false signals on lower time frames.

Now, let’s see how we can combine the 3 indicators into a profitable mean reversion strategy.

The first obvious question is when to buy and sell currency.

To answer this question the mean reversion trading strategy needs to satisfy 3 triggers:

The price needs to be above the 200-day EMA. This means that the overall price is in an uptrend so, we’re only going to look for buy signals in bull markets.

Second, we look for the price to below the 10-day SMA, which shows a deviation from its mean.

Last but not least, we look at the RSI to overshoot below 10, which signals that we’re in oversold territory.

Note* For sell signals use the same trading rules but in reverse.

Once all 3 conditions are satisfied we enter a trade at the open of the following day.

Once we’re in a trade we also need, we also need to know when to exit the market. This is where the 10-period simple moving average comes into play again. What we’re looking for is for the price to reverse back to the 10-period SMA strategy.

More often than not the price will overshoot to the upside and break above the 10-period SMA.

So, to fully capitalize on the entire move we use multiple take profit targets:

The first profit target is to cash half of the position once we touch the 10-period SMA.

The second portion of your position is left until we break and close above the 10-period SMA.

Based on our backtesting result, on average your trades should reach the second target within 1-3 days. The longer you keep your position open, the lower the chances of the trade to succeed. As a general rule, you should cash out of your entire position within the first 3 trading days.

Now, we have left out for last the most important part, which is managing risk.

When it comes to the protective stop loss we’re advising not to place a stop loss right away, but instead, use a time stop.

Let me explain…

Based on our backtesting results we have found that a lot of the times the market will do a false breakout below the previous day low (high) and hurt our position.

So, to avoid this scenario we have found a great trick to move around it.

Our rule is very simple:

If by the first half of the day our position shows a loss, we close that trade and call it a day.

This is a risky play but we have the edge on our side to play this kind of trick. After all, trading is a risky game and everyone needs to decide for themselves how to manage risk.

Final Words – Best Mean Reversion Strategy

In summary, the most alluring thing about mean reversion trading is the high win-loss ratio and the simplicity behind it. One thing to keep in mind is that the mean reversion strategy tends to perform poorly when the market is in a hard-mode trend. But that shouldn’t be much of a big deal since the market is ranging 75% of the time.

The key takeaways from the mean reversion trading strategy are as follow:

Mean reversion can be used with all asset classes (stocks, commodities, currencies or cryptocurrencies).

Range trading and overbought/oversold signals work the best with this method.

Adjust the RSI settings to a fast-period.

You can generate quick profits – short holding time periods.

A trading tip – use a time stop instead of a price stop.

Thank you for reading!

Mean Reversion Trading Strategy with a Sneaky Secret.

In this guide, you’ll learn a mean reversion trading strategy with some trading secrets that will assist you to limit the downside. The first part of the guide will highlight what is mean reversion trading, while in the second part we’ll reveal the mean reversion strategy and how you can fine-tune it to fit your personality.

If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box.

The mean reversion trading systems are more appealing to a lot of traders because it tends to have a higher win rate as opposed to the trend following strategies. Even when the markets are in well-established trends, mean reversion happens quite often.

So, there are more opportunities to profit from mean reversion trading.

Let’s kick the ball rolling and start with the basic by first explaining what is mean reversion in trading and then we’re going to reveal 5 trading principles that can be used with the mean reversion strategy.

Table of Contents

1 What is Mean Reversion Trading?

2 How Mean Reversion Trading Works?

3 Why the Mean Reversion Strategy Works?

4 Mean Reversion Trading Strategy

5 Final Words – Best Mean Reversion Strategy

What is Mean Reversion Trading?

Put it simply; mean reversion trading assumes that over time the prices of any asset (stock, commodity, FX currency or cryptocurrency) in time will revert back to the mean or average price.

In other words, reversion to the mean trading comes down to the old saying:

“What goes up must come down.”

The mean reversion theory is at the foundation of many trading strategies that involve buying and selling of those asset class prices that have deviated from their historical averages. The idea is that in the long-term prices will return back to their previous average prices and normal pattern.

Example of mean reversion trading strategies includes:

Reversals.

Pullback trading.

Retracement.

Range trading system.

Overbought and oversold strategies.

Our best mean reversion strategy is to trade those price ranges that occur after a severe price markup or markdown. In this case, reversion to the mean implies trading around the middle of the range as our average price.

In essence, mean reversion is playing around a central value be it the middle of the range, or a moving average, or however you wish to express it.

The reversion to mean trading system tends to produce a higher win rate in those instances where we can notice extreme changes in the price.

We can measure extreme price changes relative to the time frame used.

Obviously, there is also a probability that the price will not revert back to its mean. This can indicate that there is a real shift in the market sentiment and we’re in a new paradigm.

Now that we know what is mean reversion trading, let’s see how the mean reversion regression works.

How Mean Reversion Trading Works?

With mean reversion, we’re looking to trade against the heard.

A lot of the times when you’re doing mean reversion trading, you’ll be quick in-and-out of a trade. That’s why day trading mean reversion strategy works better.

There are other different ways to trade with the mean reversion strategy, including:

Price stretch from a simple moving average strategy.

A break outside the Bollinger Bands strategy and a return back to the mean.

A test of support and resistance strategy while the price is consolidating.

The linear regression is clearly slopping upwards and it’s acting as a magnet to the price. Each time the price deviates from the average price line it snaps back to it outlining the reversion to the mean concept.

The main advantages of the mean reversion strategy include:

Effective exit strategy – the take profit target is always the average price.

High win rate – the shorter the mean reversion time frame used the higher the win rate.

Good risk-adjusted returns.

All trading strategies have their own pros and cons.

The biggest flaw is that once you’re in a trade you’ll often see first a loss before you see a profit.

The main components of the mean reversion strategy should include:

1. Entry signal after the price has moved away from its average price. You can simply calculate how far away percentage-wise are from the mean or use an ATR strategy multiple declines or simply use a volume oscillator to gauge oversold/overbought readings.

2. Exit signal gives you a way out once you get into a trade.

3. Broad market timing.

Why the Mean Reversion Strategy Works?

Mean reversion is a key element part of how all financial markets work.

Mean reversion happens because the prices have a tendency to overshoot and undershoot their intrinsic value. These “price anomalies” happens because the impact of new information that hits the market takes time to be digested by the market.

The market participants will take some time to understand the new information as the information is filtered slowly. Additionally, it takes time for the market to establish a fair value.

Secondly, mean reversion trading also works because prices also move based on collective emotions.

What this means for traders is that the price tends to overshoot to the downside a bit more than they overshoot to the upside. This is true because fear tends to be a bigger emotion than greed.

Let’s put the puzzle pieces together and construct our reversion to the mean trading strategy.

How To Successfully Trade The RSI IndicatorWelcome Traders!

In today's trading episode, you will learn how the RSI indicator works, and how to spot divergence. Divergence is a great indication to tell you if a trend might be reversing.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

How To Successfully Trade The Stochastic IndicatorWelcome Traders!

In today's trading episode, you will learn how the Stochastic indicator works. I will also show you how to use the Stochastic indicator to spot divergence on the chart which is one of my favorite ways of using this indicator.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

How To Set Up Alerts In TradingViewWelcome Traders!

In today's trading episode, you will learn how to set up alerts using the TradingView alert system. Free accounts come with one alert but you can always upgrade to receive more.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

How To Understand And Trade With The MACDWelcome Traders!

In today's trading episode, you will learn what the MACD is and how to use it to find trade setups. No indicator can predict market moves perfectly, but this is a good indicator to have in your arsenal when you trade.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

How To Correctly Draw TrendlinesWelcome Traders!

In today's trading episode, you will learn how to correctly identify and draw ascending and descending trendlines. Knowing how to identify these lines can set you up for great trade opportunities as shown in this video.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

How To Correctly Draw Support And Resistance LinesWelcome Traders!

In today's trading episode, you will learn how to identify support and resistance levels on your chart. These are places where the price can do one of three things: hesitate, bounce, or breakout.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

How To Confirm An Uptrend Or DowntrendWelcome Traders!

In today's trading episode, you will learn how to identify a confirmed uptrend or downtrend. There are only two elements to define these chart patterns and that's what you'll learn about today.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

Pretty Good Oscillator Indicator

In a Downtrend:

Only sell

1. At the end of the overbought area

2. Add when crossing below 0 line

3. Add at the start of Oversold

In an Uptrend:

Only buy

1. At the end of the oversold area

2. Add when crossing above 0 line

3. Add at the start of overbought

Indicator Settings

Period 28

Overbought 2

Oversold -2

Your Capital is at Risk. This is only an educational video.

Pivot Point Strategy

A pivot point is a technical indicator to identify trends and reversals in any market.

Pivot points are calculated to determine critical levels in which the price could find its support and continues in the same direction or change from bullish to bearish, and vice-versa.

We can use Pivot points to find

entry,

stops,

and profit-taking by trying to determine the psychology of the market.

When we are above the pivot point the market is bullish.

In a bullish market if we cross a resistance level the uptrend will continue but if it bounces back we can expect a trend reversal.

When we are below the pivot point the market is bearish.

In a bearish market if we cross a support level the downtrend will continue but if it bounces back we can expect a trend reversal.

Volume Profile and Losing Trades (A Cool Trick Explained) 💪Hello guys,

trading it not just about taking winners. Losing trades are also part of the business and there is no point denying it. In my trading career, I took hundreds of losers (maybe even thousands) and I feel no shame in that.

Today, I would like to talk about a recent losing trade which I had on USD/JPY.

Let me first talk about the logic behind this trade – the reason why I took it.

The logic behind the trade

In the last week of 2020, there was a zone where heavy volumes got traded. It was at 103.53.

This was the Point Of Control (POC) of the whole week – this means the heaviest volumes throughout that week got traded there.

From this place, the price went sharply downwards which indicated that there were strong sellers present and that they entered most of their Short positions at that POC (103.53).

The idea behind my trade was to wait until the price reaches this Weekly POC again and enter a Short trade. I expected the sellers that entered their Shorts at the POC would defend this area and to push the price downwards from there again (this setup is called the “Volume Accumulation Setup“.

That didn’t happen tough…

How the trade went?

I went Short fro 103.53, but there was no selling reaction whatsoever and the price just shot past the level. I took a loss there.

After that it was time for me to shoot a Daily video for members of my trading course. In that video I talked about this losing trade and I said that if there was a pullback to the same level (103.53) it would be a nice place to open a Long position.

Why I said that?

Reversal Trade

There were two reasons why I wanted to take a Long from there.

The 1st reason was that there was a very strong, volume-based trading level (Weekly POC) breached. This is quite unusual, because such a strong level as Weekly POC should trigger a reaction!

The 2nd reason was that the price just shot through the Weekly POC without ANY sort of reaction. This is important, because it indicates that the Buyers were so strong and aggressive, that the Sellers didn’t stand a chance.

You usually discover the strength too late (after you had taken a Stop Loss) – like in this case, but you can still emerge a winner from this, if you switch sides and join the winning party.

The best way to do it is to wait for a pullback to the same level you entered your previous trade. Don’t chase the market. Wait for it to come to you.

Then enter a new trade, but this time in the opposite direction.

In this case, the first trade was a Short which failed, and the second trade was a Long (from the same level) after a pullback, which was a winner.

I call this a “Reversal Trade“. Those work best if a very strong level based on a Volume Profile setup fails, and when there is no reaction to it whatsoever. Those are two main conditions to remember.

I hope you guys found this helpful. Let me know what you think in the comments below.

Happy trading!

-Dale

🎓 EDU 4 of 20: A PROFESSIONAL TRADING APPROACH (FIST)Hi traders, wish you a happy and prosperous New Year.

In the last EDU post, we touched on the main factors that move currencies in the short, medium, and long run. Professional traders follow these influences to determine what currencies to buy and sell.

However, each trader has its own time horizon, so following long-term market determinants if you want to hold your trade for a few hours doesn’t make much sense. In fact, it’s counterproductive. Currencies can move in the opposite direction of their Purchasing Power Parity (PPP) rate, or Terms of Trade (ToT) for months and even years.

While these models work well to provide us with a possible market direction in the long-term, their short-term track-record is rather poor.

At CommaFX, we hold our trades mostly intraday or for a few days, and close them ahead of the Weekend (if a trade is still open on Friday.) This way, we can make more short-term trades and avoid the market risk of holding trades over the weekend. News that are releases over the weekend can have a significant impact on open trades after the markets open on Monday!

I am following the FIST approach, which is a global macro approach that allows us to take only high-probability trades. FIST stands for Fundamentals, Intermarket, Sentiment, and Technicals.

On the Fundamental side, I am following:

1. The current business cycle of a country through leading economic indicators such as housing starts, durable goods orders, and PMIs. Countries that are in the expansionary phase of the business cycle see their currencies strengthen, while countries that are in the recessionary phase usually see their currencies weaken over time.

2. Important news and themes: Such as Brexit, US stimulus, OPEC meetings, Central Bank commentaries...

3. Economic Indicators used by central banks to adjust their monetary policy: inflation rates, labor market indicators, economic growth.

On the Intermarket side, I am following the performance of other markets and asset classes that can have an impact on the FX market, such as:

1. Commodities: For commodity currencies like CAD (oil), INR (oil), AUD (copper, gold), NZD (dairy).

2. Stocks: The performance of the stock market can provide clues for future exchange rates (e.g. higher Nikkei 225 usually leads to JPY weakness).

3. Bonds and yields: Global capital chases the highest yield. When bond prices fall and yields rise in a country, the country’s currency will often strengthen.

If I see a strong divergence in the Intermarket (for example oil rises but the Canadian dollar falls, such as the case in the previous week), it gets our attention. I become bearish on the CAD from an Intermarket perspective.

On the Sentiment side, I am following risk appetite indicators and market sentiment as shown by the options and futures markets. What I pay attention to is:

1. The performance of risky assets vs safe-havens: stocks (risky), risk-currencies (AUD, NZD), oil (market optimism), metals (silver, copper) vs safe-havens such as gold, bonds, JPY and CHF. When risk sentiment is positive (risky assets are bought and safe-havens sold), I become bullish on stocks, AUD and NZD, and bearish on the JPY, CHF, and USD, for example.

2. Market positioning: I follow the positioning of fast money (hedge funds) and smart money as shown by the Commitment of Traders report. When the big guys become bullish on a currency and increase their bullish bias week over week, I become bullish as well.

3. Options put/call ratio: The put/call ratio shows how many put and call contracts are active for a currency. As the ratio rises (i.e. more puts than calls), this is usually a bearish sign for a currency, and vice-versa.

Finally, once I see a promising trading opportunity in the market after performing my Fundamental, Intermarket, and Sentiment analysis (matching strong vs weak currencies), it’s time to identify possible entry and exit points with the use of Technicals.

Bear in mind that I know what direction I want to trade (i.e. short USD/CAD) before even opening a price-chart! The chart is only used to find suitable levels for a selling position.

On the technical side, I focus on important retracement levels, volume profile, and price-action. I don’t trade breakouts, but wait for the market to come to my level (using LIMIT orders) to enter into a trade with an attractive reward-to-risk ratio.

This was a short introduction to how professional traders find trading candidates in the market. Unlike the usual retail trader who focuses only on charts, we know what we want to trade before even opening the chart!

A chart is the last thing I pay attention to, and my technical analysis takes me around 5 minutes to find where I want to enter into a trade. 90% of the time, I am only focused on fundamentals, intermarket, and sentiment.

If you found this post useful, please hit the “LIKE” button and follow. Also, I’ll try to respond to all questions you might have, just post them in the comment section below.

Stay tuned for the next part of our Educational Series! In total, there will be 20 posts that will CHANGE the way you trade and look at the markets – PROMISED!