Chart Patterns Cheat SheetHey guys!

Today we'll have a look at chart patterns - which ones are the most popular, what do they look like, and how you can leverage them in your own trading!

Chart patterns are technical analysis tools used to predict price movements based on chart formations. There are two main types of chart patterns - reversal patterns and continuation patterns . Reversal patterns suggest a shift in the prevailing trend, while continuation patterns suggest that the trend is likely to continue.

How to trade these chart patterns effectively using trendlines on Tradingview?

Draw the chart patterns you see on the cheat sheet.

Create alerts for your drawn trendlines. Set the alarms when the price crossing up/down of the trendline you draw.

Click on the "Alert" icon in the menu. This will bring up the alert creation window. You can select whatever conditions you want, I usually just use crossing up/down, and change the message to something I recognize.

Click "Create" to save the alert.

Setting alerts allows you to act quickly on the trading opportunities that the chart patterns indicate. This is a super-effective way to manage these chart patterns.

The Triangle pattern

It can be both a continuation and reversal pattern. It consists of three types of triangles:

Symmetrical Triangle

Ascending Triangle

Descending Triangle

Symmetrical Triangle

The symmetrical triangle is a classic sideways pattern where the market consolidates, creating lower highs and higher lows that look like a squeeze. Neither the bulls nor the bears have control over the current movement during the pattern.

Ascending Triangle

The ascending triangle pattern forms when the price creates a series of higher lows within a clear resistance level. This indicates that buyers are unable to break through the resistance, but selling pressure from bears is weakening with each attempt. The bulls may take control and drive a breakout.

Descending Triangle

The Descending Triangle is an inverse formation of the ascending triangle and is a bearish continuation pattern that typically forms in a downtrend. To identify this pattern, look for a clear support level followed by a series of lower highs. This indicates that buyers are unsuccessful in pushing the price higher and each attempt weakens, potentially leading to a bearish breakout.

Pennant Chart Pattern

A pennant pattern is a continuation pattern that forms when the price makes a significant move in either direction and then consolidates in a sideways movement.

Bullish Pennant Pattern

Bearish Pennant Pattern

Bullish Pennant Pattern

A bullish Pennant Pattern is where the price is likely to move in the same direction it was trading before entering the consolidation period. It forms after a sharp move higher, followed by a pennant, and then a continuation breakout. To trade this pattern, traders typically place a long order above the pennant and set a stop below the bottom of the pennant to avoid false breakouts.

Bearish Pennant Pattern

The Bearish Pennant Pattern is the inverse of the Bullish Pennant Pattern. It forms after a sharp move lower, followed by a pennant, and followed by a breakout to the downside, signaling a continuation of the overall downtrend. Traders often take advantage of bearish pennants by placing a short order at the bottom of the pennant and a stop loss above the pennant to limit their losses in case the price moves against them.

Wedge Chart Pattern

Wedge Patterns can be both continuations and reversals based on the market trend.

Rising Wedge Pattern

Falling Wedge Pattern

Rising Wedge Pattern

The Rising Wedge Pattern is identified by upward-sloping support and resistance levels in which the support level is steeper than the resistance level and creates a wedge. If the Rising Wedge Pattern forms during a downtrend, it is often used as a continuation. On the other hand, if it is formed during an uptrend, it could indicate a potential reversal. Traders typically place their entry orders when the price breaks out of the wedge formation.

Falling Wedge Pattern

The Falling Wedge Pattern is characterized by a downward-sloping resistance level and a steeper upward-sloping support level. This pattern is usually a continuation if it forms during an uptrend. And it could signal a possible reversal if it forms at the bottom of a downtrend.

Flag Pattern

The flag pattern is a continuation pattern and is useful for price action analysis.

Bullish Flag Pattern

Bearish Flag Pattern

Bullish Flag Pattern

The Bullish Flag Pattern is formed during a strong uptrend when the price makes a sharp move higher creating the pole, followed by a sideways consolidation which forms the flag. it can be formed by two rallies separated by a brief retracement period, with the first rally creating a sharp spike known as the flagpole.

Bearish Flag Pattern

The Bearish Flag Pattern is formed during a downtrend when the price pauses sideways to create the flag form after a sharp moving lower. Price often consolidates or rebounds slightly higher before continuing with the trend. The flagpole forms on an almost vertical panic price drop and is followed by a bounce that has parallel upper and lower trendlines to form the flag.

Channels

A channel chart pattern is a continuation and it consists of two parallel lines that act as zones of support and resistance.

Bullish Channel

Bearish Channel

Horizontal Channel

Bullish Channel

Bullish Channel is a continuation pattern with a positive slope. The previous uptrend will likely continue if prices break through the upper channel line. There is no theoretical price objective on this chart pattern, and the movement is bullish, which can continue as long as the bullish channel support line is not broken.

Bearish Channel

The Bearish Channel is a continuation pattern with a negative slope. The previous bearish trend will likely continue if prices break through the lower channel line. It's not recommended to go long when the price touches the lower band as the trend may continue moving along it. Corrections towards the upper band in a downward trend are usually weaker.

Horizontal Channel

Horizontal Channel forms when the price moves sideways or when it is in a consolidation phase. A line is said to be "valid" if the price line touches the support or resistance at least 3 times. The horizontal channel pattern is considered valid if the price touches the support line at least 3 times and the resistance line twice (or the support line at least twice and the resistance line 3 times).

That is the end of part one, hope you found it useful! - Don't forget to follow us for more

Flag

📊 Chart Pattern CheatsheetChart patterns are visual representations of a stock's price movement over time. These patterns can provide traders with information about the stock's trend, momentum, and potential future direction. Continuation and reversal patterns are two types of chart patterns that traders use to identify potential entry points. When considering entry points for both continuation and reversal patterns, traders often use a combination of technical indicators and price action analysis. They may use tools such as moving averages, oscillators, and trendlines to confirm a pattern's validity and identify potential entry points. Additionally, traders may set stop-loss orders to manage risk and limit potential losses.

🔹 Continuation patterns

Continuation patterns are chart patterns that suggest that the current trend will continue. They occur when the stock price consolidates in a certain range, showing a temporary pause in the trend. Some common continuation patterns include triangles, flags, and pennants. Traders may look to enter a long position when the stock price breaks out of the pattern, typically on higher than average trading volume.

🔹 Reversal patterns

Reversal patterns, on the other hand, suggest that the current trend is likely to reverse. These patterns occur when the stock price has reached a high or low point and is likely to move in the opposite direction. Some common reversal patterns include head and shoulders, double tops and bottoms, and the "V" pattern. Traders may look to enter a short position when the stock price breaks below a support level or the neckline of a pattern.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

#5 | Running Flag: The most popular pattern in today's chartsHello.

Please excuse my use of "respectful language."

The last idea has been marked as "not suggested". They said I used aggressive words!

I didn't know that TradingView was made for babies...

Anyway, I'm not a native speaker, so I don't know what the H!LL that means...

RESPECTFUL LANGUAGE:

Today's idea is about corrective waves.

The 2nd corrective pattern.

RUNNING FLAG.

I know the name may sound funny. That's what my RESPECTFUL teachers taught me.

They said 90% of the time, if you get this pattern, just expect the price to run away more than any other chart pattern.

I can tell you that's true. Most of my profits come from this RESPECTFUL pattern.

The running flag is also some kind of accumulation/distribution. It may come in 3 simple waves (ABC) like that one you see on the chart above, or 5 complex waves (ABCDE).

It has four RESPECTFUL conditions:

The whole pattern must be corrective. Of course...

Wave A must not break the low of the impulsive wave.

The B wave must break the high of the impulsive wave.

The C wave must not break the low of the A wave.

The central wave is often corrective, but it's not a required condition in today's charts. (B wave in the case of ABC, or C wave ABCDE)

The central wave is the key to understanding the correction. If you can correctly determine it, you will be able to say whether the correction is completed or not.

You should know that the structure of this pattern becomes confirmed and complete only if the price breaks the top of the impulsive wave.

Otherwise, you can call it "potential running flag".

You probably have questions. Feel free to ask.

I will explain more later.

Don't forget to follow us. Also click that like button to help this post stand up.

I MAY USE AGGRESSIVE WORDS IF YOU DON'T.

#2 | Understanding Wave Analysis TheoryIt's a simple concept.

Impulsive wave, corrective wave, impulsive wave, corrective wave...

You may think I'm here to talk about Elliot ... (if you know him)

No.

The problem with Elliott Wave Theory is...

IT'S TOOOOO OLD.

It has a lot of problems...

The markets of 1938 aren't the same as the markets of 2022.

I'll show you an updated version...

The biggest mistake beginners make when they trade the flag pattern is

FALSE ENTRY.

Have you ever traded a flag when it breaks the trend line, then it goes straight to hit your stop loss?

Absolutely yes, one reason for this is...

YOU DIDN'T UNDERSTAND THE STRUCTURE OF THE WAVES YOU WERE LOOKING AT.

99% of beginners do rely on stupid strategies that say:

IF THE PRICE BREAKS THE TREND LINE, JUST BUUUUUY.

Because of that, they get disappointed results...

WRONG ENTRY.

WRONG STOP LOSS.

WRONG TARGET.

EVERYTHING GOES WRONG.

I highly recommend you have a basic understanding of Dow Theory and Elliot Wave Theory .

They are the structure of this updated WA version.

That will make you able to understand the upcoming ideas and analysis where I will share with you details and my strategies to trade the regular-flag properly.

If I see likes, I'll post the 3rd idea about the different types of impulsive and corrective waves.

Make sure to follow us.

#1 | Trading's most essential price action patternThe flag pattern.

Most of you know it, but it seems that most of you don't know how to trade it properly...

Let's fix that!

I am sure you have seen this pattern many times before.

It was there 100 years ago, and it will stay here forever... (while markets exist)

Most technical analysts do know this as one of many harmonic patterns...

Yes!

But today... forget that.

We have a different approach.

We, as wave analysers, do call this a regular flag.

We look at this differently and we trade it differently.

I entered hundreds of trades based on this pattern.

By statistics, it has an average of a 75% winning rate. (if the entry conditions are respected)

To keep things simple, you can focus only on this pattern in your trading.

When you become good enough, you will see the consistent profits come in easily.

I'll be posting a lot more information about wave analysis and the flag pattern soon... (until we fix that)

Click that follow button to be notified.

Flag Limit SampleFL (Flag Limit) Sample in audusd 30min chart

What is the Flag Limit Forex Pattern?

The flag limit is the area where the price penetrates the SR flip, forms a narrow sideways price action with 1 or 2 candlesticks, and breaks the support or resistance undoubtedly.

It’s basically a continuation pattern aligned with support or resistance. It strengthens the support or resistance zone. In short, you need to find out Rally Base Rally (RBR) or Drop Base Drop (DBD) along with SR flip (Support or Resistance).

Mark the breakout candlestick along with SR flip with a rectangle, as a reference level of supply and demand. The highest Price of this base zone should be called the upper flag limit (UFL) and the lowest price of the base zone is called the Lower Flag limit (LFL). Wait for the price to return, and it’s time to open positions.

What is Flag pattern and how to trade with that?Flag Pattern (Bullish)

* One of the most common patterns of price trend continuation is the FLAG pattern. How to identify this pattern? How to use it in trading most effectively?I will cover it all through this post.

* The Flag pattern is a type of price pattern in bullish trends. This pattern consists of a strong increase (called a flagpole), followed by a countertrend with two levels of Resistance and Support (called flags). The price forms this pattern after a strong increase. It then breaks out of the Resistance and continues rising, marking the end of the pattern. This is a very common behavior of prices during an uptrend.

* After breaking out of the Resistance, the price can retest this new Support.

How to open an order :

Entry Point : Right after the candlestick breaks out of the Resistance.

Stop-Loss : At the bottom of the price channel (the lowest point of the support).

Target : At the price whose, from the entry point, the length is equal to the length of the flagpole.

* In the future, we will publish other patterns such as Triangle, head and shoulders, wedge and other educational materials 📚 . Please follow our page to be informed as soon as the materials are published.

Thank you all for supporting our activity with Likes 👍 and Comments ❤️

Low and Tight Flag Tutorial #GBPCAD $GBPCADTF 30 Mins.

This is an example of Bearish Flag . It happens very recently.

The consolidation is very tight.

Retracement is just less than 25%. Not so deep.

This is called as 'Low and Tight Flag'. If this is bullish flag, we called it as High and Tight Bullish Flag.

This pattern is where you can grow your account largely (with risk-calculated).

The size of TP is the size of Pole 1.

Your kind comment/ thumbs up/ a follow are appreciated in advance. :)

Triangles, Flags, Pennants.Chart patterns, are becoming one of my favorites points of view in the market.

Using this tools i become more aware of where i am in the market, the trend and where i can place correct entry's

Lets consider the difficulty of this structures. First i am not using individual lines in this chart, i am using tool bar channels. That means that the line above has to be the same as the line below, that been said. the patterns showed in this chart are just made for expert traders. Simple and clean.

We can force some structures, but when we use tool bar patterns its very hard to find structures that make sense in the market.

Thanks fo the support traders.

And keep rocking in the free world.

Treat trading like a business or you might not succeedHello everyone:

Today I will go over 6 main points on why you should treat trading like a business in order to succeed in this industry.

1. Business will have busy seasons and slow seasons. But overhead expenses will remain the same. So not every month can be profitable, same with trading.

-Some months you can have more wins, some months you will have more losses. It's what you do on average for the whole quarter/year.

2. Record your win/lose trades like any businesses that has bookkeeping to record their revenue and expenses

-This is for you to keep track of your progress, results and find areas to improve. You must record your profits/losses so you can identify your result.

Refusing to do so is like a business that does not record their expenses and wondering why they spend so much $

3. In trading, YOU are the Owner/Director/CEO. If you are not putting in the time and effort like a top executive of a business, then it's unlikely you will succeed.

-Top executives don't just work 8 hours a day, 5 days a week. They put in way more hours than that to keep the business running, operational, and profitable.

4. No business starts out as profitable, they are likely to be in the “red” until years later when they can recover the losses and then some.

-Most businesses start up with debts, borrow money and loans. Don't expect to pay off all those in one year.

In trading you will likely incur losses in the beginning of your trading journey. Understand its a process all must go through in order to come up to the top.

5. Each and every year, businesses review their entire operation. Identify the mistakes they make, find solutions to their problems, create plans, visions and goals.

-Identify your mistakes by journaling your trades. Find areas to improve, whether that is your entry, SL/TP, Risk management, trading psychology, mindset/emotion.

Acknowledge your mistakes, drop your ego, work on overcoming your mistakes.

6. 90% of small businesses fail within 3 years, acknowledge the odds are not in your favour, but continue to put in time and effort. NEVER GIVE UP

-90-95% traders fail in time. You don't often hear about the traders who lose, but you often hear about the social media “guru” and scammers doing so well.

Trading is not a get rich quick scheme, nor is it easy. You have to continue to put in time and effort to succeed.

IT doesn't come instant, and those who can not commit to such, will not be able to continue trading consistently and sustainably.

Most important is, if you fail, get right back up. NEVER GIVE UP in trading, and NEVER GIVE UP in life.

Any questions, comments and feedback welcome to let me know.

If you like more of these contents, like, subscribe/follow and comment for me to keep doing them. :)

Jojo

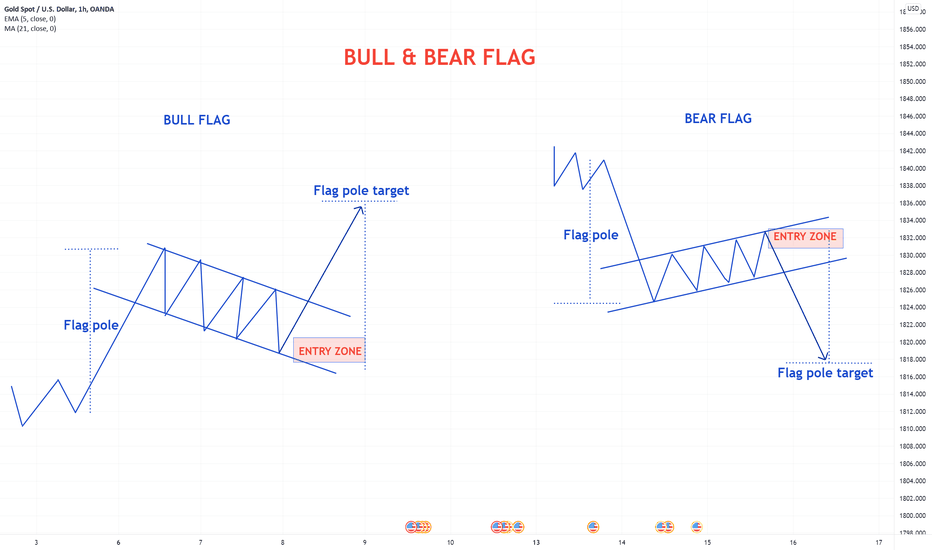

BULL & BEAR FLAG PATTERNSBULL FLAG

This pattern occurs in an uptrend to confirm further movement up. The continuation of the movement up can be measured by the size of the of pole.

BEAR FLAG

This pattern occurs in a downtrend to confirm further movement down. The continuation of the movement down can be measured by the size of the pole.

Please don't forget to like, comment and follow to support us,

GoldViewFx

XAUUSD TOP AUTHOR

FLAGS FORMATIONBearish Flags usually occur as markets fall from a base and pause in a downtrend. Bearish flags can be easily spotted as they make HH and HL within the flag area. A clear breakout downward gives us confirmation to trade these patterns as the price continues in the same direction of the trend. Flags are potential chart patterns

Trade: After higher high tops and higher low bottoms, prices will break out of the lower trend line. Wait for confirmation of breakdown with a reversal candlestick to go SHORT.

Target: Leg A in a Bearish flag should be used as your Leg B length which is used as the target.

Stop Loss: Place a stop-loss order above C the previous High.

When/How to move SL to BE and to profit in a running trade ?Hello everyone:

Today I want to discuss a topic in Risk Management, specifically on when and how to move your STOP LOSS to BREAKEVEN or in PROFIT when you have a running profit trade/position.

In an impulsive phase of the market, we want to make sure to protect our entry as well as secure profits.

In this example of EURUSD, I managed to get 2 entries in, and manage it to my best ability and secure profits

Trade close down for +7.9% profit

Original Trade Forecast and Analysis:

This is a topic that will have various answers across traders, as this is certainly up to each individual trader’s strategy, style, and management approach.

So understand there is no right or wrong, “holy grail” kind of decision.

It's up to you individually as a trader. I will share my management, and why I choose to go with these types of approaches, and you can certainly use them to your advantage to tweak/modify them to fit your strategy.

Few things to keep in minds are:

1. Moving the SL to BE or/and in profit is a way to protect your entry, as well as secure profit.

2. Sometimes moving the SL too early may “choke” the price, and you can get stopped out for BE or small profit. Then watch the price take off in your desired direction, which can create negative emotion.

3. Whereas sometimes if you don't move SL to BE or in profit, you can watch a trade that hits 3:1 RR or more, end up reversing down, passing your entry point and to your actual SL of -1%, which can also create negative emotion.

4. No perfect scenario or management when it comes to the aspect of trading, as every trade is unique, and different outcomes may happen, since the market itself is not perfect, and can do whatever it wants to do.

Now, I will explain my own management when it comes to moving SL to BE or/and in profit.

Certainly this is NOT the only way, nor it will be the best way, but over the years of backtesting & chartwork have given me reassurance on these types of management ways.

I will then show some real live examples on the trades that I closed down, and how I manage them as well.

CADJPY -

Original Trade Forecast and Analysis:

GBPJPY -

Original Trade Forecast and Analysis:

CHFJPY -

Original Trade Forecast and Analysis:

NASDAQ -

AUDNZD -

Original Trade Forecast and Analysis:

First, a general rule of thumb for me. IF the price has hit about 1:1 RR or so, and has broken past the previous recent lows,

I will move my SL to BE. There is no exception in this rule.

Again, I explained earlier that sometimes this will help you to protect your entry when price reverses, and sometimes it will choke the price.

In this case, I would rather take a BE first, and re-look for entry again in the same position, as long as the bias and the price action is still valid on both the higher time frame and lower time frame.

Second, once the entry is in some profit, say 2:1 or higher, I generally will move the SL up to about +0.5% profit or so.

Just want to secure a little profit while not choking the price entirely.

Third, once the entry is in 3:1 profit, then I will move my SL to +1% profit.

This is where I generally will decide whether I should take full profit here, or hold the trade for a mid-long term if the higher time frame has given me the bias.

Fourth, since the trade has already been in 3:1 profit or higher, generally we can expect a continuation correction to form now after the impulse phase.

If it's a smaller correction and price isn't reversing up sharply right away, I will move my SL to about +1.5% profit, set my alert above the continuation correction and observe the development of the correction.

This is generally a point where I can decide to hold the trade longer, or if it reverses up from the continuation correction, then exit the trade for profit.

Fifth, if we start to see a possible reversal development, then I will move down my SL to the recent swing highs/lows,

or just above the reversal correctional structure, and will let the trade tag me out for profit if it reverses.

Any questions, comments or feedback welcome to let me know :)

If you enjoy these contents, and the educational lessons are helpful, please press like, subscribe and follow for more.

Jojo

What is Bullish Flag Pattern?What is a Bullish Flag Pattern?

The bullish Flag pattern is usually found in assets with a strong uptrend. It is called a flag pattern because it resembles a flag and pole. Pole is the preceding uptrend where the flag represents the consolidation of the uptrend.

How does Bullish Flag Pattern?

The flag pattern resembles a parallelogram or rectangle marked by two parallel trendlines that tend to slope against the preceding trend.

Phase 1 : Preceding Uptrend

When there is an extreme demand in prices there is an uptrend. It continued as the demand increases.

Phase 2 : Flag

After the sharp uptrend when supply increases more then the demand prices move to the consolidation phase or flag phase. This acts as a small price channel.

Phase 3 : Uptrend Continuation

As the flag is a pause in an uptrend, as prices consolidate investors again start to show interest in the asset which eventually leads to heavy demand again which further leads to a breakout and uptrend continuation.

Role of Volume:

Volume plays a vital role in the completion of the Bullish Flag pattern. When in a preceding uptrend the volume is quite higher. In the flag phase, the volume starts to go down as investors are least interested to buy and sell that particular asset. And again on the breakout, the volume surges. Volume with Breakout gives a good indication of a successful uptrend.

Above Chart Explanation:

This is 4H chart of SOLUSDT We can see a good preceding uptrend with great volumes. Then after the uptrend, we enter the second phase the flag phase we can see perfect bounce and retracement from upper and lower trendlines or flag with diminishing volumes. And again a breakout with good volumes.

Here could be the two possible entries one at the bottom of the flag that gives us a very low-risk entry if it breaks the flag we exit.

And second entry can be at breakout, first, we have to confirm that the breakout is legit for that we can look at the volumes rising volumes to confirm that the breakout is legit.

Usually, we should target the length of the pole after the breakout.

Conclusion:

Bullish Flag is a continuation pattern it occurs quite often on charts and is one of the most reliable continuation patterns.

Comment your thoughts on Bullish Flag Pattern in the comment section below.

Disclaimer:

This is just an educational post never trade just any pattern. And please do your research before making any trades.

Happy Trading!

Filter opportunities if multiple setups are presenting entries

Risk Management: How to filter trading opportunities if multiple setups of the same currency pairs are presenting entries.

Hello everyone:

Today let’s take a look at how to filter trades if multiple opportunities shape up on the same currency pairs.

It's in our best interest to understand risk management. If there are trade setups shaping up for the JPY pairs for example, it's a good practice to choose the best ones to enter rather than most of them.

When the JPY gets strength or weakness, most of the JPY pairs will move together impulsively, so it's susaintable to filter out all the potential opportunities, and choose the best 1-2 pairs.

Taking multiple positions on different pairs of the same currency may potentially put your trading account at a greater risk.

Sure, on short term samples and examples, traders may find taking more positions can earn extra profits, but long term sustainability wise, it's not ideal to open up so many positions of the same currency.

When traders simultaneously take multiple losses, especially due to correlations, this usually “tilts” the traders, and all sorts of trading psychology effects happen.

They may go on to revenge trade, over trade and over leveraged to “win” back the losses they just took. Best to avoid such negative emotions.

When I am filtering out potential opportunities, few key areas I will focus on when I choose between multiple pairs:

Multi-Time Frame Analysis: Where is the price currently at, and is it in the beginning of the impulse phase on the HTF, or is it closer to the end ?

Risk:Reward: 3:1 RR or higher. Can I comfortably enter with proper Risk:Reward ? or is the price already approaching a previous swing lows/highs ? Which pairs may yield the best reward potentially ?

Price Action Development: Are we getting the confirmation price action structures/patterns on the lower time frames for entries ? Is there a better, more clear price development between the currency pairs ?

Compare the currency pairs with each other, and identify the best 1-2 pairs that fit all the above criteria. Then simply look to set your stop entry orders when applicable.

To wrap it up, understand you can always enter or scale in more positions, as the price continues to develop and in your bias favor. As long as our original positions’ SL are at BE or in profits.

This way you will never lose money from the original account, while potentially maximizing your profits.

Any questions, comments, or feedback welcome to let me know.

Below I will list out some of the other educational videos that tie in closely to what we talk about today:

Risk Management 101

Risk Management: 3 different entries on how to enter the impulsive phrase of price action

Risk Management: How to Enter and set SL and TP for an impulse move in the market

Multi-time frame analysis

Identify a correction in price action analysis

Continuation and Reversal Correction

Thank you :)

Top 10 Patterns (Flags) #5Example of a bullish flag on 1 hour GbpAud chart: Any time frame and can be bearish too.

These are almost similar to wedges in characteristics. The only significant difference between the two of them is the trend line. Trend lines in flags are said to be parallel and not converging like the wedges.

Flags can be both bullish or bearish, depending on the circumstances. Bullish flags can be found during an upward market trend with the trend lines running paralleled above and below the price action. To get the confirmation for the continuation of the trend, look for a breakout just above the flag.

Similarly, you look for bearish flags during downtrends. They will be easy to spot since they form an upward slope.

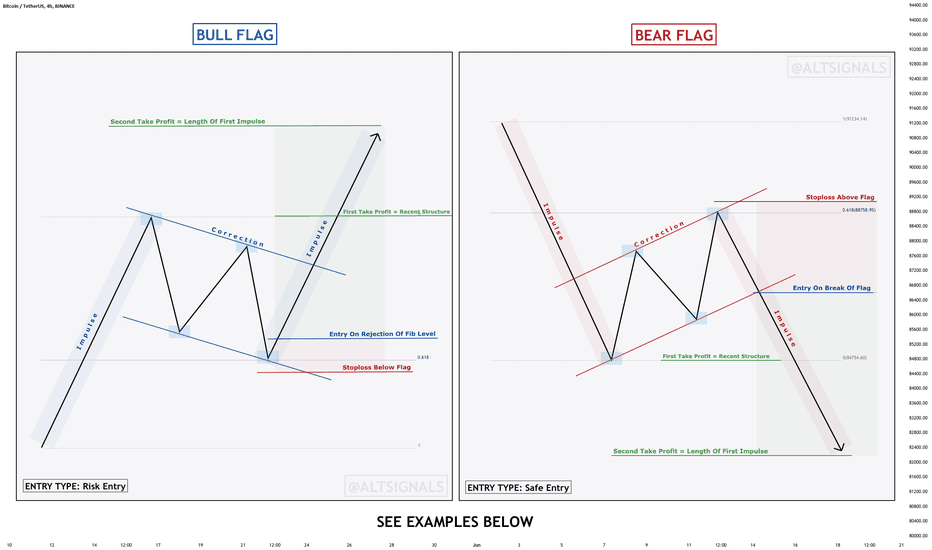

EDUCATION - Identifying & Trading Flag PatternsIn this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

EDUCATION - Identifying & Trading Flag Patterns In this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

Detail Look into Parallel Channel In Price Action Analysis

Hello everyone:

Let's take another detailed look into some parallel channels structures/patterns in price action analysis.

Recall my previous educational video on Ascending/descending channel correction, they are higher probability reversal price action structures/patterns.

Today I want to go over the horizontal parallel channel structures/patterns as well where they are more neutral,

more advanced to analyze and forecast the potential direction of the impulse phase following after.

Let's take a look into some of these horizontal parallel channel corrections, and break them down more.

In my opinion, the longer, deeper these types of parallel channels go, the stronger the next impulsive phase will be.

Although they can be tricky depending on whether they are continuation or reversal correction.

I will go over for examples in different markets to pinpoint some of these price action structures/patterns.

Below are some of the important topics that I mentioned in the video.

Reversal Ascending/Descending Channel

Risk Management: 3 different entries on how to enter the impulsive phrase of price action

Multi-time frame analysis

Identify a correction in price action analysis

Continuation and Reversal Correction

Any questions, comments, or feedback welcome to let me know thx :)

Jojo

FLAG PATTERNS & PSYCHOLOGY BEHIND BULL AND BEAR FLAG FORMATIONSHi everyone and Good morning. Welcoming you back (after 18-week break)

Thanks for your like and supports.

This is Part 3 of my Technical Analysis series of CHART PATTERNS

BULL AND BEAR FLAGS

Now, for those meeting the words BULLS and BEARS for the first time, these are terms used to describe the buying and selling action of traders

BULLS generally refer to the price action of buyers as they drive Stock PRICES UP, while BEARS refer to the selling action of sellers as they drive stock PRICES DOWN.

For starters, let’s define what a Flag pattern is:

A flag pattern is a TREND CONTINUATION PATTERN . It is named a flag pattern because its formation resembles a flag on a flagpole.

The pole is usually the result of an almost VERTICAL RISE IN PRICE, and the flag part results from a PERIOD OF CONSOLIDATION

When the price breaks out of the consolidation range, it triggers the next move higher.

Flag patterns can either be BULLISH or BEARISH.

Follow me closely, as We will now look at BULL and BEAR Flags in turn:

BULL FLAGS

Bullish flag formations are found in stocks with STRONG UPTRENDS.

They look something like (sketch 1 on chart)

As can be seen on the sketch 1 chart above, the pattern starts with a STRONG, ALMOST VERTICAL price spike, that eventually start losing steam forming an orderly pullback where the highs and lows are parallel to each other forming the FLAG in the form of a tilted rectangle.

The tilted rectangle (flag) usually breaks to the upside resulting in another powerful move higher, usually measuring the length of the prior flag pole (Let’s consider the sketch 2 chart)

Now let’s look at BEAR FLAGS :

The bear flag is an upside-down version of the bull flag. It has the same structure as the bull flag but inverted. looks like sketch 3

As can be seen above, the flagpole forms from an ALMOST VERTICAL price drop, which is followed by a period of consolidation, with parallel upper and lower trendlines forming the flag.

A break of the support structure of the flag, results in another move lower, with the same length as the prior pole.

Just as with any Chart pattern, there is usually psychology behind its formation.

Let us look at the

PSYCHOLOGY BEHIND BULL AND BEAR FLAG FORMATIONS:

On bull flags, the bears (short sellers) get blindsided due to complacency as bulls (buyers) charge ahead with a strong breakout causing bears (short sellers) to either panic and cover their ‘shorts’; or add to their ‘short’ positions.

Once the stock is in the consolidation stage, the bears (short sellers) regain some confidence and they add to their ‘short’ positions with the expectation of a price drop; only to get trapped again when the price break to the upside causing short sellers to cover their ‘Shorts’ thereby driving prices even higher

Since some short-sellers from the initial flagpole run up may still be trapped, the second breakout forming through the flag can be even more extreme in terms of the angle and severity of price move.

That is precisely the psychology behind BULL FLAGS; and that same psychology applies on BEAR FLAGS, just in reverse.

Now let’s consider the sketch 4 on how we can make money from bull and bear flags:

On a bull flag, you typically want to enter a Long trade on a breakout to the upside. Take profit target should be the same length as the prior flagpole. Stop loss should be placed just below the broken resistance line, which will now be acting as support.

I will leave it here for this week, that’s all I had in store for you. Follow me And JOIN me again next week as we will be talking about another Chart Pattern that works.

Until then, here is to Profitable trading!

How To Trail Stop Loss Effectively | Capture All day's ActionMaximise your Day Trading Profits 5X | Apply this trade management system to hold trades all day without much effort

In this video I'm going to share with you a trade management idea which would allow you to trade and hold the trade from the start to the end of the day trading session.

The Chart I'm using is US30 / DOW30. The Time frame for day trading would be the five minute chart.

The idea is to make entries on the 5 minute chart and then use a few swings to add on.

This can become part of your Trade Plan and you can apply to any time frame or symbol of your choice. It's a great way to maximise your profits using nothing but the data provided by the market itself.

Price Action is surely The King!!! I bow....