Geometry: Angles, Cycles, and SymmetryThe harmonics of two are as such:

1, 2, 4, 8, 16, 32, 64

Cycles are merely sequences;

sequences can be arithmetic, geometry, or some other variation ( harmonic for example is 1/n).

is a sequence. If we are looking at the idea of cycles in terms of the time duration between highs, lows, highs to lows, or lows to highs, we could measure out the duration of a high to high using that as the base one unit.

is also a sequence; this is a geometric sequence with the factor being two; likewise as the above scenario, we could take the first measurement, and use it as a base unit.

Explore the different sequences, and explore the relationships of price and time: time from high to high; time from low to low; time from high to high to low to low to high; price from high to high; price from high to low; price from low to low.

Some sequences to start off are

1,2,3,5,8,13,21; n = (n-1) + (n-2)

1,1.414, 1.73, 2, 2.23; n = sqrt(n)

.236,.382,.618,1,1.618,2.618; n = 1.618n

In-exhaustive book list

Law of Vibration - Tony Plummer

Michael Jenkins - Geometry of Stock Market Profits, Chart Reading for Professional Traders, Complete Stock Market Forecasting Course

Scott M. Carney - The Harmonic Trader, Harmonic Trading Volume I, Harmonic Trading Volume II, Harmonic Trading Volume III

H.M. Gartley - Profits in the Stock Market

Bill Wiliams - Trading Chaos, New Trading Dimensions, Trading Chaos 2nd Edition

J.M. Hurst - The Profit Magic of Stock Transaction Timing, Cyclic Analysis: A Dynamic Approach

Disclaimer: Not financial advice, no warranties of merchantability, profitability, or probabilities.

Economic Cycles

Geometry: SQRT(2,3,5)Geometric Angles are as such:

1x1

1x2

1x3

1x4

1x5

1x6

1x7

1x8

1x9

2x1

3x1

4x1

5x1

6x1

7x1

8x1

9x1

Anytime the point in price-time crosses the 45 degree axis, a change in trend takes place.

Recommended Reading:

Law of Vibration - Tony Plummer

Michael Jenkins - Geometry of Stock Market Profits, Chart Reading for Professional Traders, Complete Stock Market Forecasting Course

Disclaimer: Not financial advice, no warranties of merchantability, profitability, or probabilities.

Fractal example

its like extension of a simple base pattern spreadig by the rule of butterfly effects

with considering of crypto market atmosphere and 2 ex-waves "A" and "B", it would be easy to predict what's going to happen ...

zoom out to find out the orginal A ad B

you can read more about fractal and butterfly effect on my related tutorial

Trading Chaos Part 4 | Elliott WavesHello, everyone!

Today we are going to spot the most important and challenging part of Trading Chaos by Bill Williams(BW) – the Elliott waves. This analysis is the most efficient in combination with other techniques of Trading Chaos. Market always moves with the waves and BW developed the conception which eliminate the uncertainty of Elliott Waves. In this article we will consider every wave and explain how to spot their target areas.

First of all we need to understand the 5 “magic bullets” which kill the trend. They are:

Divergence with the Oscillator

Target zone

The squat bar at the one of three top bars

Fractal at the top

Momentum change

Today we are goin to consider only the target zone. Other tools we will reveal in the next articles about Trading Chaos.

How to spot Wave 1 start?

Research the last wave from the previous trend. This should be wave 5 or c. This last wave have the typical structure of waves with less scale. You can use the technique for Wave 5 end defining to spot when trend is finished.

How to spot Wave 1 end?

Search the 5-waves structure inside the Wave 1. You also should spot the 5-th wave end. Use the 5 “magic bullets” which usually kill the trend.

The Complex Relationship of Bitcoin and 10-year Yields: Part 2This is a strange and complex relationship. So let's delve right into it!

In my previous study of Bitcoin and US10YU, I mentioned that the "Crypto-market is reacting to the global market and appears to be predicting the future of the stock market by moving their funds in and out of the big crypto."

But this relationship is evolving! Now, let me explain:

My recent analysis of S&P500 indicates that the US market might be heading toward some degree of a corrective move in a near future. The uncertainty of this idea is extremely high but still worth the caution!

We are hearing similar ideas from other chartists, and now, both Bitcoin and US10Y may be pointing us in the same direction. Knowing the role of Bitcoin in the US economy, its recent price action could be a cause of concern and a hint about the future of S&P500 and Nasdaq.

If you read the article above, you know that Bitcoin is working as a hedging asset against inflation, market correction, or any sort of economic instability. In addition, its return is almost double of any other assets especially US bonds. So it makes sense to hop on the crypto train whenever there is fear in the air!

As you can see in this chart, US10Y first bottomed 2 weeks ahead of BTC's completion of its triple-bottom. It almost seemed like Bitcoin took a lead on predicting the recent economic uncertainties, and US10Y is catching up with some delay.

However, when they were both hitting their previous high, Bitcoin did not tip over until US10Y was on its way down. As if, as soon as the fear of inflation was lowered, Bitcoin had less value and the sell-off began.

These days, we are experiencing a volatile period in the US stock market due to a variety of reasons. And it's causing a lot of doubt and fear in the heart and mind of investors. But the recent unstabilizing factors (debt ceiling, delta variant, etc.) don't seem to be fading away any time soon. Therefore, by this notion, Bitcoin shall keep rising until the US10Y starts dropping while SPX gets on track to hit a new ATH. In that case, it makes sense that hedging assets will not stay in such high demand!

What are your thoughts?

Please share your ideas in the comment section below.

Weekly Market Maker Cycle (Go With It)Weekly Market Maker Cycle:

On a 1 hour or 4 hour chart, you should be able to find this weekly market maker cycle. If you know what Big Money/Smart Money is doing, trade with them.

The cycle starts on Monday and ends on Friday, MM (Market Maker) will mostly trap traders on Monday, everyone is back on screens and is expecting a highly productive week of trading. MM makes what we call a stop hunt, induce traders to take wrong direction. So MM will reverse price action against everyone.

This cycle has three stages:

1) We have accumulation where the market maker accumulates contracts.

2) Next we have manipulation, where the MM manipulates price against the traders that have been trapped on the contracts MM have accumulated.

3) Lastly we have the trend release, where the MM releases the intended trends after every stop loss has been hit.

The MM has three weekly templates that they follow, but they wont make this very obvious for everyone to see. Its there in front of your eyes its just that you don't pay full attentions to what is really happening on chart, instead you are being fed with useless indicators and zones. At times, MM may start trap on Friday, setting bait for traders to become victims next week. MM do that so on Monday, MM doesn't start on a empty slate, but with traders trapped from previous session or week. If you understand price action you can see this trap by the MM. Forex is a physiology game, which most realtor traders lose.

How to Identify Market Structure and Increase Your ProfitabilityHave you ever wondered, when is the best time to trade?

It all depends on what market structure is present at the current moment.

There are 3 different types of market structure:

1. Ranging

2. Trending

3. Indecisive

During a ranging market, prices can turn rapidly so taking profits quickly is crucial. Not optimal market conditions but can be traded if you don't get greedy.

During a trending market, prices can keep continuing in one direction and not look back. It's better to be more lenient on rolling your stops. Expect the trend to continue and trade accordingly. Once the trend ends, sit back and wait for a clear picture of the market.

During indecisive markets, you want to stay out! Don't touch. Avoid at all costs.

I appreciate you investing your time in your future.

Much Love

Dil

How To Trade With The Big Banks (Price Cycle Trade Setup)Elements To The Trade Set Up: Price Cycle Of Institutions.

1) Expansion= Order block/Zone

Is when price moves quickly from a level of equilibrium in other words when price breaks out of consolidation. This will leave an order block or zone behind.

2) Retracement= PA Fills In Any Imbalance

Is when price pulls back inside the recently created price range or close to breakout of expansion area. Look for imbalance to be filled on retracement.

3) Reversal= Seek To Pick UP Liquidity

Is when price moves in the opposite direction from the current market direction was moving in. (from up trend to a downtrend).

4) Consolidation= Equilibrium In PA

Is a period of ranging or sideways price action, before expansion in price action area.

One trading system to rule the allYesterday I made a video explaining an easy way to begin developing a trading strategy if you have had a hard time remaining profitable. This strategy works on all markets crypto stocks, forex very simple rules that all ways has a 10:1 Risk & Reward meaning you can lose 10 times in a row but that 1 time you are right will cover the 10 times you were wrong. If you like the video pls share it and leave a tip ✌🏾

Don't Miss the Stock Market Boom By Fearing the Crash.It is absolutely normal to worry about the next stock market crash. You probably have a portion of your life savings wrapped up in your retirement fund, which is tied to the success of the stock market.

Should You Fear The Next Crash?

Except for the perma-bears out there, no one loves a stock market crash. But the fact is Governments, Central Banks and Economists are getting better at responding to existential financial disasters.

The recovery from the Corona crash has been nothing short of impressive. This crash was the most violent and volatile of all crashes, yet has been handled very well. It had the potential to be as big as 2000 and 2008, yet the response curbed the brunt of the disaster.

How Long Until Stock Markets Recover From A Crash?

If we analyze the 6 major US stock market crashes of the last 100 years, we see that the average peak loss was 57%. Also, the average duration of the recovery is 9.8 years. This can be somewhat misleading, though. The 1929 crash was exceptional in its size and duration. Additionally, governments and central banks have realized that they can manage inflation and stimulate the economy to speed economic and stock market crash recovery.

Over the last 20 years, we have had 3 major crashes, with an average loss of 62%, but with an average recovery time of 7 years. the last 2 crashes lasted only 5 years and under 1 year.

The History Of Crashes

Year Loss Years Recovery

1929 -89% 23

1973 -46% 10

1987 -35% 2

2000 -83% 16

2008 -54% 5

2020 -38% 1

Average -57% 9.8

Will There Be Another Crash?

Yes, there will be another crash, probably due to a needed correction of the current boom we are in.

What Will Cause the Next Crash?

Historically speaking, my analysis shows that the most common causes of crashes are:

- Equity Bubbles (1929,1987,2000)

- Easy Access to Credit (1929,1987,2000)

- Poor Institutional Risk Management (1929,1987,2000,2008)

- Asset Bubbles (2008)

Right now we are experiencing an Equity Bubble, Asset Bubble (Property), and Easy Access to Credit. The Crypto Bubble is also a major risk.

When Will Be the Next Crash?

My in-depth business cycle analysis indicates a high probability of a correction in 2022. This also coincides with potential increases in interest rates to begin cooling off the current boom.

Don't Be Crippled By Fear.

The markets are booming, now is not the time to be crippled by fear. If you miss out on these gains in the good times, what do you have to look forward to in the bad times?

Crashes do not happen overnight, they usually take 2 to 3 years to fully hit bottom, so you will have time to react. Just enjoy the ride for now.

Bitcoin Wyckoff [Accumulation & Distribution] — ⚠️Possible 24000This trading method was developed by Richard Wyckoff in the early 1930s. It consists of a series of principles and strategies originally designed for traders and investors. Wyckoff devoted much of his life to studying market behaviour, and his work still influences much of modern technical analysis (TA).

Currently, the Wyckoff method is applied to all types of financial markets, although it was originally focused only on stocks, but I find it amazingly good on cryptocurrency market and Bitcoin

During the creation of his work, Wyckoff was inspired by the trading methods of other successful traders (especially Jesse L. Livermore). Today he is in the same respect as other key figures such as Charles H. Doe and Ralph N. Elliott.

Wyckoff's Three Laws

The law of supply and demand

The first law states that the value of assets begins to rise when demand exceeds supply, and accordingly falls in the opposite order. This is one of the most basic principles in the financial markets, which does not exclude Wyckoff in his works. We can represent the first law as three simple equations:

Demand > Supply = Price Increases

Demand < Supply = Price Falls

Demand = supply = no significant price change (low volatility)

In other words, Wyckoff's First Law assumes that the excess of demand over supply leads to higher prices, since there are more buyers than sellers. But in a situation where there are more sales than purchases, and supply exceeds demand, it indicates a further drop in value.

Many investors who use the Wyckoff method correlate price movement with bar volume as a way to better visualize the relationship between supply and demand. This often helps to predict the future movement of the market.

Personally I recommend use higher timeframes and indicators like ADL and Stochastic RSI.

The law of cause

The second law states that the differences between supply and demand are not coincidences. Instead, they reflect preparatory actions as a result of certain events. In Wyckoff's terminology, the accumulation period (cause) ultimately leads to an uptrend (effect). In turn, the distribution period (reason) provokes the development of a downtrend (consequence).

Wyckoff used a unique technique of plotting patterns on charts to assess the potential consequences for specific causes. In other words, he created methods for determining trading targets based on periods of accumulation and distribution. This allowed him to assess the likely expansion of the market trend after exiting the consolidation zone or trading range (TR).

The Law of the Connection of Efforts and Results

Wyckoff's Third Law states that changes in price are the result of total effort that is reflected in trading volume. In the case when the growth of the asset value corresponds to the high trading volume, there is a high probability that the trend will continue its movement. But if the volumes are too small at a high price, the growth will most likely stop and the trend may change its direction.

For example, let's imagine that the bitcoin market starts to consolidate with very high volume after a long bearish trend. High trading volumes indicate more demand, but sideways movement (low volatility) suggests little outcome. If a large number of bitcoins change hands and the price does not fall significantly, this may indicate that the downtrend may end and there will soon be a reversal.

To sum up, the Wyckoff Method allows investors to make smarter and more logical decisions without relying on their emotional state. His extensive work provides traders and investors with a range of tools to reduce risk and increase their chances of success. However, there is no single, reliable methodology when it comes to investment. You should always approach all trades with caution and take into account all potential risks, especially in the highly volatile cryptocurrency market.

Best regards

Artem Shevelev

Interesting Observation <> HINDUNILVR / NIFTY1st Chart: HINDUNILVR/ NIFTY

2nd Chart : NIFTY

HINDUNILVR/ NIFTY is almost a mirrorimage of NIFTY. I plotted various other stocks against NIFTY but cound't see any such pattern. One thing that can be derived is, whenever NIFTY goes down, HINDUNILVR usually maintains the level and in many cases it starts to move up. Example - recent fall of NIFTY.

Let me know what you think! Please do hit me with other interesting observations you saw in the market.

How to detect the active cycle length?This is a short tutorial on how to use the Detrended Rhythm Oscillator (DRO) to identify the current dominant cycle. The Detrended Rhythm Oscillator is an advanced Detrended Price Oscillator DPO which helps to spot the key market rhythm or beat for any symbol on any timeframe.

It automatically labels the length of current market high-high and low-low pivots which helps to see cycle harmonics and relations. The output should be used as input setting for almost all technical indicators which require and "length" settings for the calculation. Using this length setting based on the dominant market rhythm will help to ensure better accuracy to your indicators at turning points. The indicators get synced to the beat of the market.

The indicator is available as Public Open Source Script for your own usage:

Bullish and Bearish Trend | ForexbeeBullish Trend

Bullish trend refers to consecutive higher highs

and higher lows in the price of a currency pair in forex during a specific timeframe. it shows that there is strong buying pressure.

Bearish Trend

The formation of consecutive lower lows and lower highs in the price of a currency during a specific timeframe is called a bearish trend. It indicates strong selling pressure.

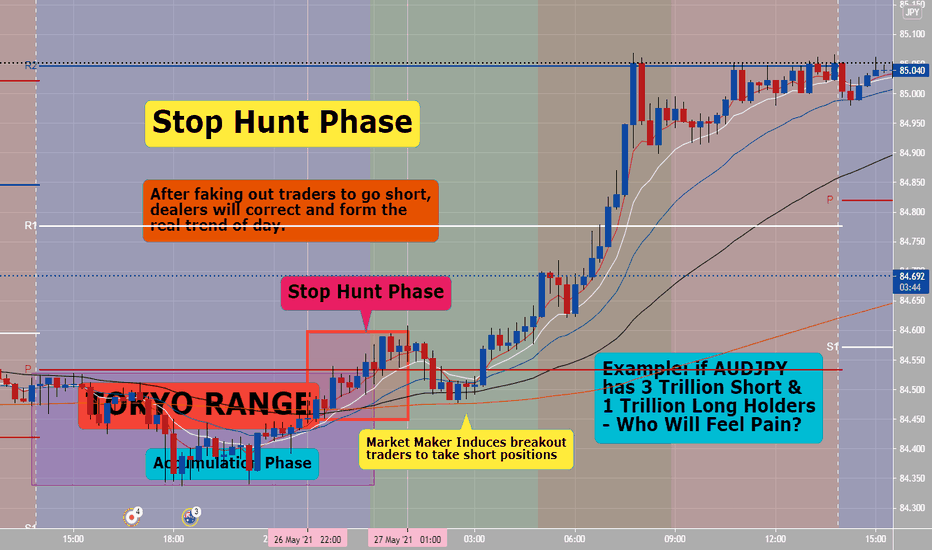

Market Cycle (Stop-Accumulation-Trend)On a 24 hour market cycle or longer time frames- these cycles happen all of the time. If you can figure out which phase current price action is in, you can make your trading easier and more profitable.

Remember: S.A.T. or Stop-Accumulation-Trend

Example of Today's sell trade from a breakout and return then going into trend for the day.

The Cycle Parts: Trend PhaseThen, what happens after they consolidate 60 minutes or so, they will start the trend run against their original move.

Trend Phase:

Once they set the high of the day off of the break, they'll start the channel, and run the trend down for 6-8 hours. If you're going the wrong way, it's a nightmare! It's slow, relentless, and it just keeps going, and going, and going. You think it's going to hold, and you start making up stuff in your head, and seeing things in the charts that aren't there. You start making up reasons to validate why you were wrong instead of understanding the true market structure. After the trend runs 6-8 hours it will go into the low of the day, and the same behavior is seen. They'll make an M at the high, a W at the low.

How you can profit from this market cycle?

Understanding this cycle gives you a major edge in your trading! Once you can identify it on the chart, taking trades is simple; second nature even.

Just initiate short positions once the high is set for the day, or long positions once the low is established. Your stop loss for short trades is placed just outside the dealers grasp, above the high, or for long trades, below the low. If you are correct in your assessment, your stop will rarely be triggered, because the dealer will not move the entire market just to grab your stop loss. You see, if he does, he will allow other traders to exit their trades. How many times have you told yourself that if price comes back on a bad trade you will simply click out? Market makers are aware of this, so they come near previous levels but don’t break them. This is added confirmation that you have obtained an excellent entry!

24 Hour Market Maker Cycle: Find this on all time frames- once you spot different phases - trading will become easier and stops and targets too.

The Cycle Parts: Stop Hunt PhaseLet's say they have 3 trillion dollar in short-holders, and 1 trillion dollars in long-sellers. Guess who's getting punished today? Short-holders. It's simple. It has nothing to do with the 1 hour, 4 hour, which way it's pointed, or which way it's going. It's where the dollar volume is built up that they can do the most damage, and collect the contracts. (See: Chart Example)

Stop Hunt Phase:

Sometime between 1 am EST and 4 am EST, they'll break out of the Asian range in 3 swipes. They'll quickly change the high of the day, settle in, and work it for 30-90 minutes. This is a two- pronged approach. The reason they use the number three is because we are stubborn. They hit it one time, and we think, "Oh, maybe it's not really going that way. It'll come right back." They hit it a second time, and we think "Oh, I'm missing it!" They hit it a third time and you finally get excited and give in that you were wrong, and switch your direction. Now, you've changed in the wrong direction, which is their first break-out of the Asian channel, to get you to recommit your money the other way.

What happens when they break out of the range is they trigger the stops of the weak short-sellers, the people that put their stops on the other side of the Asian range, people who put their stops 7 pips below the candle. That's all garbage...they hit them! They cancel out this volume, and get those traders to recommit their funds long. So, let's say half of the people come back. in, and the 3 trillion dollars has now become 3.5 trillion dollars long. What is the goal for the market makers, now? To get that money! How do they do it? There are a lot of people that trade the ABCD patterns (AB=CD), the Fibonacci extensions: when the market makers make their pullback, they make one more pass toward the high of the day. When they make this pass, people put pending orders right above the high. The job of the market makers is to go to the high, open the spread, trigger the pending orders, and validate all of the patterns that can be found in textbooks. When they fire those pending orders, all of those pattern traders are now stuck. They quickly pull off of the high of the day 25-50 pips, to trap the traders in that cycle, and hold them there.

The Cycle Parts: Accumulation PhaseFirst of all, let me ask you, "Have you ever heard of a market maker?" Others will tell you they don't exist in Forex market: that the Forex market is too big to be manipulated. Well, I'm here to tell you otherwise. There is a small elite group of traders that do in fact control how market will play out on any given day.

The beauty of what I am about to share with you boils down to this: These manipulations are visible on the chart to the trained eye. Once you see the behaviors and understand what they mean, you will be able to trade like a market maker!

Accumulation Phase:

At 5 pm EST, the high/low are reset. The price comes in,and the market makers make a quick push up, 15-25 pips. They make a quick pull back down, and then go sideways. They push it again 15-25 pips. Why would they do this? When they push up, you're a buyer, and they sell to you. When they push down, you're a seller, and they'll buy from you. They are accumulating contracts, and building up the volume.

Have you ever heard of 1 hour, 4 hour, daily, trade in the direction of the trend? Why doesn't trend following work? It's not about the trend, it's about the money. All the market makers do is wait for the money to build up during the accumulation phase, and see where the contracts are accumulated.

Apple Market Cycle TOP!!My point of view for what it's worth..

--------------------------------------------------

TA= on the H1, H4, D at lower BB just holding on.

MACD= BEAR, worse on the weekly, daily.

Stoch= BEAR COSSED on the daily, about to on the Weekly.

BIG GAP AT 90$ needs to be filled. test lower weekly BB.

Market Cycle top in distribution phase. plateau

Logistic curve top.

do your on FA if you really don't understand.

I'll give you :

7nm(A13) EOL

CHIP SHORTAGE!!!

market saturation

dividend increases ..

just need the silver sparrow( unknown fundamentals) to really kick it off, but it will not take much now.

Adam