WHY THE MEDIA SILENCE ? I'm going to publish & be dammed. Cool.Mon 17 Dec 2018 is one year since bitcoin peak 17 Dec 2017. Not a single media reporter or journalist appears to have referred to it in media yet. No analyst or analysis available yet. Is that good or bad news? Bullish or bearish. A good or bad time to buy?

Three simple charts showing what happened in previous years from high Dec 2013

Btc-e

Pattern test based on Bulkowski's Chart PatternsJust an idea, want to see if it'll be accurate at all.

Comes from this page: thepatternsite.com *

I used to use Bulkowski's site as a reference for chart patterns, I guess this could be a good test for his descending triangle calculation. I think he claims to base the percentages on statistical analysis of historical chart patterns. I never really use them myself, so this is just for fun.

* I am not Thomas Bulkowski

Exclusive Update, Bitcoin And Solving The Bart Move Puzzle As promised i would explain my view on why i assumed today's bear flag was NOT a Bart move.

There is more to is than just these 2 moves, the bigger picture also plays a part, but i won't get into those details because it would make things too complicated.

1: The spread between high and low

2: A drop and quick move above the previous high

3: Difference in buying volume

4: Bull flag and follow through, on the right a failed one

5: Similar move also similar volume

6: What is the difference here?

7: Left is a triangle shape, right is a bear flag shape

1: First of all, number 1 was the most obvious from the start. Don't mean it already said it would not be another Bart move, but it was an obvious difference, as i also mentioned in my

Bitcoin' analysis. On the left it's 150 points and on the right it's 70 points. The one on the left is enough to create liquidations or stops getting hit on a leveraged exchange like

Bitmex' which creates fuel to do what they want.

2: A second big clue is number 2, a quick drop and a big move up just as fast and went even above the high of the previous few candles.

3: The high buying volume on number 2, most probably even just bots who are programmed to buy within a certain price range. The high volume shows the order book was filled with

sell orders, so perfect opportunity to get a big amount of long positions in.

4: During this drop and bounce up, we can see a small bull flag on the left with follow through reaching the target of that bull flag. First though would be, hmmmm this is a bullish

sign. That is true as well, but look at the one on the right, what do you see? We see similar buying volume but no follow through in price? This i want you to answer yourself in the

comment section.

5: Explained at point 4

6: Here is where we continued to drop today and bounced up again at the Bart move on the left. This one is not easy to judge, there is a difference in volume here but not significant.

On the right it obviously just continued to drop while on the left there was support at that low.

7: The whole pattern on the left has the shape of a triangle while on the right it was simply a bear flag.

The orange part was an extra bonus, does not have much to do with the Bart pattern.

Now who ever these people are, if it's on entity or simply just several traders who use the similar bots, i don't know. But to make it easy, i always look at the market as if it's me against one big whale. Now the blue circles, you have to see those as if the bots are eating up all the sell orders on the way until a maximum level. Now if their bags or not filled up enough, they simply stop the price there with sell orders or simply just sell walls, unless the rest of the market pushes the price down. So they try to eat up all the sell orders as fast as they can before someone else does it and hit the break at a certain point. Just think of it in that way, makes it easier to comprehend/visualize.

Please don't forget to give a like if you appreciate this :)

Current Bitcoin analysis:

#bitcoin MACD to confirm nearest to low like last time maybeConstruction: Only used signal line in Histogram format. The last time confirmed low was shortly after price hit bottom the signal line dropped into the box (light blue) which is the gap between the last lower low in the signal line. Note that I've picked lower lows in the signal line which did not return above zero in between

NOTE: The low in this example of $166.5 was later beaten by $162 set 18 August of same year.

Gaps in the volume profileJust a example to show how gaps in the Volume Profile caused during fast falls or rises in price are filled at a later date.

The gap between 4200 down to 3800 during the drop on 24th November was filled just over 24 hours later.

The left window shows the volume profile prior to the drop and up to the bottom of the drop.

The right window shows the volume profile from the start of the rise back up to 4000.

I have displayed the volume profiles back to back to make it easier to visualise.

The range of the gap in the volume profile has been marked with a box extending across both sides.

There are some other boxes in the chart that mark previous volume areas from last year.

This was created on my working chart and I didn't want to spend the time hiding them or opening a new chart for this example.

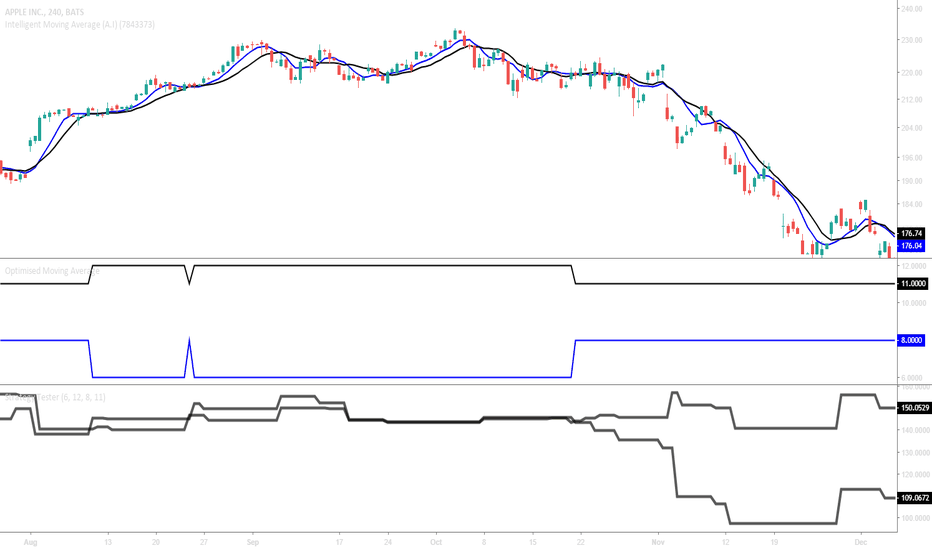

3 trading methods with my indicator. :)it's mainly for swing trading, i use the 3 day / 15 day / monthly charts with it and it works perfectly,

it works good for stocks and cryptocurrency.

you will use heiken ashi chart style and turn on the EMA DOTS indicator.

once the indicator is on you will hide the heiken ashi so you only see the dots.

when a green dot -0.57% -7.44% appears you buy, if a green dot -0.57% -7.44% appears after that green dot -0.57% -7.44% you hold your investment.

if a red dot appears you sell your position. easy as that.

the standard dots setting will be set to 10 - use this for any chart above 3 days

change the dots setting to 6 for 3day charts and below

shorter time frames will be choppy.

larger time frames will be smooth.

*Daytrading smaller timeframes is possible but not recommended.

#bitcoin bounce odds 3-1 or doubts about future dominance maybeLoads of predictions and time to try and make it simple maybe using roughly same principles as when bitcoin first hit $6000 low back in February 2018. I think if bitcoin goes lower then there may be serious doubts about its future dominance and likely institutional portfolio weighting going forward into 2019.

Bitcoin LOGISTIC CURVE LOGISTIC CURVE

The logistic curve describes the speed of information dissemination among people. This graph describes the distribution of information in an environment.

At first, a instrument is of little interest to anyone, investors are afraid of buying it, and its price fluctuates around r °. At this time, the initiated ("elite"), solely owning important information, begin to buy it, the price slightly grows. Then the information is shared with a small circle of insiders, individual purchases grow into active buying, the price of the instrument abruptly takes off. The general public is perplexed and can not understand what is the reason. At the third stage, news comes out and investors fearing not to have time to "jump into the last car" buy up this tool that the "elite" and "proxies" are happy to sell to them at the maximum price (with joy, because at that time the "elite" there is already new information that the "elite" has taken into account, a new logistic curve in another instrument begins, or in the same, but with another sign, sales begin). The third stage is completed, when the whole society is aware of what happened, discuss everywhere, in the metro , all who could have already made There is no one to sell.

Practice of application: the most important is to determine at what stage the price for the asset is now at which you paid attention and in relation to which you received some information. You can recognize and apply the Elliott waves .

The main thing is not to get into the crowd number at stage 3. If in all financial newspapers, on news sites, on TV there is a discussion of news / ideas - in fact, it is no longer news, this crowd of investors are bred, and this idea should not be used as its defining action (unless with another sign, directly opposite).

Examples in life and the stock market abound. On the classics the same was done with bitcoin last year

People do not change over time. Information and actions of the consonant received information people do the same actions.

The only thing that changes is the slope of the logistic curve - information dissemination rate

As a rule, 90% of bulls in high. And then the market unfolds and vice versa

If you are constantly being told the same thing, then everybody knows it already. It is necessary to look not at the news

If everyone around you screams the same thing, then you are in the upper zone

The task of stepping back from the noise

The main task is to be in the lower green zone. "When there's blood on the streets, buy property"

Bitcoin Oversold (RSI Lowest since 2015)Bitcoin’ RSI indicator has hit its lowest level since 2015.

Bitcoin’ is also oversold on the weekly time frame, this is a very strong signal.

You can see support levels on the chart, these are relevant now.

Lots of good can develop from here, it is good to have this drop. Bitcoin’ stalled since February, this is surely going to bring some action into the market. Action, is what we want.

TIME TO BUY BITCOIN’

Thanks a lot for reading.

Namaste.

P.S. This is no trade advice.

#bitcoin do these 10 indicators tell us something 2018 vs 2014Study of 200 MA updated to include a variety of indicators with default settings multiplied by 30 (30 days average in month). Maybe next bull run will work on a different multiple and those using 30 will be too late to catch it. Cannot predict outcomes, but can sure tell us something's odd/different about today.

Each chart has an extra indicator added to the live chart at the top of the thread and with the 200 MA removed. Each extra indicator has had default settings multiplied by 30 and some are in log format. Have also used zoom in feature on some to help make easier visual comparison.

#bitcoin vs Yuan predicted end 2013-14 bear market maybe. Top chart is USDDNY and below BTCUSD. Using Hollow Candles to Log Scale. Blue verticals correspond to months when both markets had red candles. Signal explained on chart. Can't predict todays outcome but Yuan had the same bad month at the start of this bear market as back in the 2013-14. They were the first actors in at both starts and they may be the first actors out again at the end maybe.