Bitcon On Track For 73.3K - Daily BreakdownBy now it's fairly obvious we've entered a bearish market. From a peak of 109k to now 82k this is hard to argue. We can view our earning moving average data with the red(10day), blue(20day), and yellow(50day) to see the candles are well below all levels. The most important level on the bearish confirmation is the 50 day EMA cross. This is known as a 'death cross'. When price crosses below the 50 day EMA price historically will continue to decline.

Our second major confirmation to enter short is by looking at lower Support zones for price. Looking at price to the left there are long periods from 73.3k to 87k where price action took off very rapidly with zero consolidation.(side ways market action). This means when price comes back down as it is there are zero support levels(as in the orange box) until 73.3k.

73.3k was previously a resistance level(where price did not go above) four times as in circled. These levels will now become a support zone for buying liquidity.

I do believe this bearish market will be much different than previous years. It will be a much more drawn out process with less typical overall volatility. This is due to the increase in the market cap is much higher than before. That being said the major confirmations based upon EMA data and zero support levels make this overall trend very clear.

Don't be stupid NEVER trade against the trend! Do not except price to snap to target over night either. This is a daily view on the overall direction of BTC and is not a short term trade. We should except price to decrease overall, but remember the market increase and decrease in 'waves'.

Community ideas

NASDAQ Supercycle — Welcome to the Age of Global DistributionOn the long-term chart of NASDAQ:NDX IG:NASDAQ , we are likely in Wave IV of the Supercycle, which appears to be unfolding as a running flat (rFL). The current decline may not be a mere correction, but a motive Wave C, potentially retesting the 2021 ATH zone (around 16,500–17,000) before a powerful new bullish wave begins.

Volume spikes at the top confirm the phase of global distribution, with institutional players gradually locking in profits and reducing exposure.

🧩 Base Scenario:

- We are in the final Wave C within the rFL structure.

- Once complete, a strong Wave V rally may follow.

- Key support zone: around the 2021 all-time high.

🧪 Alternative Scenario:

- This could be part of an extended Wave III of the Supercycle.

- Even so, a significant correction is expected in the near term before the next leg higher.

Structural Drivers for Long-Term NASDAQ Growth:

- 📉 Monetary policy easing from the Fed

- 💵 Fiat currency devaluation

- 🤖 Tech innovation boom — AI, biotech, semiconductors, Big Tech

- 🌍 Global digital transformation

- 🏦 Asset repricing amid structural macro shifts

📌 In conclusion, NASDAQ CME_MINI:NQ1! is entering a period of heightened volatility and capital redistribution — but its long-term upside potential remains intact.

Huge Buy for Gold XAUUSD (Trump announces tariffs of up to 25%)How Trump’s 25% Auto Tariffs Could Be a Huge Buy Signal for Gold

The proposed 25% tariffs on automobile imports to the U.S. by former President Donald Trump could have significant economic consequences, many of which could drive gold prices higher. Here’s why:

1. Trade War Fears and Market Uncertainty

A new wave of tariffs could escalate tensions with key trading partners, particularly the European Union, Japan, and South Korea, leading to retaliatory tariffs and a potential global trade war.

Uncertainty in global trade historically increases demand for gold as investors seek a safe haven from market volatility.

2. Higher Inflation and Rising Costs

Tariffs would increase the price of imported cars, leading to higher inflation in the U.S.

Rising inflation typically weakens consumer purchasing power and drives investors toward gold, a traditional inflation hedge.

3. Economic Slowdown and Risk of Recession

Automakers and suppliers may cut jobs or reduce production, impacting economic growth.

A slowing economy could trigger rate cuts from the Federal Reserve, which would lower bond yields and make gold even more attractive as a non-yielding asset.

4. Pressure on the U.S. Dollar

Trade conflicts can destabilize the U.S. dollar, especially if major economies reduce reliance on U.S. exports or retaliate with their own tariffs.

A weaker dollar increases the price of gold, as gold becomes cheaper for foreign investors.

5. Central Bank Demand and Gold Accumulation

If economic uncertainty rises, central banks may increase gold reserves, further boosting demand.

We’ve already seen major central banks accumulating gold at record levels, and new trade disruptions could accelerate this trend.

Conclusion: A Strong Bull Case for Gold

If Trump’s 25% auto tariffs take effect, they could trigger inflation, market volatility, and economic slowdown, all of which are bullish for gold. With central banks buying aggressively and rate cuts likely on the horizon, this could be a major buying opportunity for gold traders.

Would you buy gold in this scenario? Let me know in the comments! 🚀

The Truth About Trendlines: Are You Drawing Them Wrong?If your trendlines look like a toddler took a crayon to your chart, we need to talk. Or if you draw them so much that your chart looks like a spider web, we still need to talk.

Trendlines are one of the most abused, misinterpreted, and downright misused tools in technical analysis. Used correctly, they can give you a structured view of market direction, potential reversals, and areas of interest.

Used incorrectly? Well, they can be your fast lane to bad trades, broken accounts, and questioning your life choices.

So, are you drawing them wrong? Let’s find out.

📞 A Trendline Is Not Your Emotional Support Line

This is big because it happens virtually every day across the charts. When a trade is going south, it’s tempting to adjust your trendline just to make your setup look valid again. That’s not technical analysis—that’s denial. A proper trendline should connect clear pivot highs or lows, not be forcefully manipulated to fit a bias.

Traders do this all the time. Price action no longer respects their original line, so they just… move it. As if shifting the goalposts somehow changes reality. It doesn’t. If your trendline gets broken, respect the price action and get out, don’t adjust the line because you risk dragging your account deeper in losses.

🤝 Two Points Make a Line—But Three Make It Real

Here’s where most traders mess up. They draw a trendline the moment they see two points connecting. Sure, two points technically make a line, but two random highs or lows do not make a valid trend.

A legitimate trendline should be tested at least three times to confirm that price actually respects it. Until then, it’s just a hopeful hypothesis. But we gotta give it to the early spotters — yes, if you see two points, pop open a trade and it pans out nicely, then you’ve chomped down on the good grass before the other animals.

The more times price touches and respects the trendline, the stronger it is but the risk of it getting overcrowded increases. Anything less than three touches? You’re basically trading off a hunch with a potentially higher risk-reward ratio.

⚔️ Wicks, Bodies, or Both? The Great Debate

Should you draw trendlines through candle wicks or just use the bodies of the candlesticks ? If you’ve spent any time in trading communities, you’ve probably seen this debate get heated enough to break friendships.

Here’s the deal:

If you’re trading short-term price action, drawing trendlines using candle bodies makes sense because it reflects where most of the market agreed on price.

If you’re looking at major trends, wicks matter because they show extreme liquidity zones where prices actually reached before snapping back.

⛑️ Steep Trendlines Are a Disaster Waiting to Happen

If your trendline looks more like a vertical cliff than an actual slope, you might want to reconsider its validity. The steeper the trendline, the less reliable it is.

A proper trendline should represent a natural flow of zigging and zagging price action. If it’s moving up too aggressively, it’s usually unsustainable. That’s why parabolic runs tend to end with painful crashes—what goes up too fast typically comes down even faster.

If your trendline is forming an angle sharper than 45 degrees , be careful. Sustainable trends don’t need a rocket launch trajectory to prove their strength.

🌊 One Chart, One Trendline (or Two)—Not Ten

Some traders draw so many trendlines that their charts get lost under the weight of too many lines. If you need to squint to see price action through the mess of lines, you’re doing too much.

Here’s a golden rule in drawing trendlines: less is more. Trendlines should highlight key structures, not overwhelm you with information. If you find yourself drawing trendlines at every minor high and low, take a step back. A clean chart is a tradable chart and one or two trendlines are usually enough to help uncover price direction.

🚩 Breakouts Aren’t Always Breakouts

One of the biggest mistakes traders make is assuming that when the price breaks a trendline, it’s an instant reversal signal. It’s not.

Markets (or well-trained algos) love to fake out emotional traders. Just because price dips below your uptrend line doesn’t mean the trend is over—it could just be a temporary pullback or liquidity grab (stop-loss hunting?) before continuing in the original direction.

Always wait for confirmation. A proper breakout should come with:

Increased volume (to validate the move)

Retest of the broken trendline (flipping from support to resistance, or vice versa)

Clear follow-through (not just a single candle wick that breaks and snaps back)

The market loves tricking traders into premature entries or exits. Don’t fall for it—instead, use some technical backup like looking for a double top, a head and shoulders or some other popular chart pattern .

☝️ The Only Trendline That Matters? The One The Market Respects

At the end of the day, trendlines are just tools—guides to help you structure price action. They’re not magical indicators. They don’t necessarily predict the future. They simply help visualize market tendencies.

If price constantly breaks through your trendline and ignores it, guess what? It’s not a valid trendline. The best traders don’t force a narrative—they adjust their view based on what the price is actually doing.

So next time you find yourself drawing, adjusting, or forcing trendlines into existence, ask yourself: Am I analyzing the market, or just trying to make myself feel better? Because the market isn’t wrong—so better check your trendlines twice.

Now off to you—are you using trendlines in your charts and do you wait for the third point to connect before moving in? Share your experience in the comment section!

Be the Choosy trader on Gold!Price is dragging on dropping. being very indecisive. Looks like the entire market is waiting on News to help give it a push. I need to see price break out of value before I can get a read on a sold move. in the mean time this is sclaping conditions. You can hold trades. Have to cut them short quick with this price action. Since we have some USD news tomorrow that indicates that the market might be waiting for that before proceeding on any decisions. Patience is key!

NFLX & chilling until...Earnings. I have been bearish on this stock technically. Currently it is floating within the Bollinger Bands. Today (3/26) was pretty bearish on the market overall. I read that NFLX will be raising rates or creating alleged value within its ad tiers. I like commercials, so I'll keep watching them lol. Anyways... I just know that people will be affected by loss of jobs/income. NFLXing may not be top of mind for many. I also hear rumors of a stock split. That would be great. & if it happens, I'll still be looking for pullbacks. Will see how week and month close. Earnings 4/17.

***Side note... I remember when the original CD business launched during my college days. Oh how I wish that I was investor savy at the time. Sigh... Looking forward to earning some moolah on my trade ideas now.

AUDUSD triangle pattern suggests a big move is comingAUDUSD has been consolidating in a triangle pattern, suggesting a breakout is near—likely within weeks. A bullish breakout could target 0.6393, with potential for a 229-pip move. A bearish break is also possible but less clear. The setup offers strong risk-reward, with examples showing a 5.6x ratio.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

Tips for Corrections & Dips with TradeStation: TradingView ShowJoin us for an insightful TradingView live stream with David Russell, Head of Global Market Strategy, as we dive deep into the latest market developments, including potential crashes, corrections, and the upcoming Federal Reserve announcement. We'll cover it all, LIVE!

In today’s session, we’ll explore the critical factors shaping the market landscape and how you can leverage the TradingView platform to stay ahead. Plus, we’re excited to share a major update to our broker integration with TradeStation, which opens up new trading opportunities and provides expanded options for your portfolio strategy.

TradeStation, a fintech leader since 1982, has built a reputation for providing institutional-grade tools, personalized services, and competitive pricing to active traders and long-term investors alike. Known for their innovation and reliability, TradeStation remains a trusted partner in navigating volatile market conditions.

For the first time, we've expanded our integration with TradeStation to include equity options trading directly on TradingView. This new feature complements our recently launched options trading suite, featuring tools like the strategy builder, chain sheet, and volatility analysis, helping you make informed decisions, especially in light of potential market corrections.

This session is sponsored by TradeStation, whose vision is to provide the ultimate online trading platform for self-directed traders and investors across equities, equity index options, futures, and futures options markets. Equities, equity options, and commodity futures services are offered by TradeStation Securities Inc., member NYSE, FINRA, CME, and SIPC.

www.tradestation.com

www.tradestation.com

AMD stock up over 20% off the lows- outperform NVidia?AMD is still cheap relative to its growth and still way down from all time highs.

Seeking alpha analysts expect 25-30% annual growth in earnings yearly. The stock is still in the low 20s PE. Stock can double and still be a good business worth owning for the long term and let compounding earnings work.

Low rsi and bollinger bands gave us the signal to buy, we bought with leverage, now we are in the shares unlevered.

Target would be all time highs over the next 2-3 years.

Trading isn't Rocket Science!!! - BUY NAS100 All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

Tesla Is Retail Traders' Choice, JPMorgan Says. Are You Buying?Tesla NASDAQ:TSLA has endured a soul-crushing experience over the past three months or so. The stock is down 50% from the record high of $480 hit in December (more than $700 billion in market cap washed out). Even insiders have sold a big chunk of their holdings.

But over the past three weeks (12 trading days to be precise), investment bank JPMorgan NYSE:JPM says, retail traders just couldn't get enough of it.

Retail net buying activity in TSLA stock. Source: JPMorgan

They’ve consistently been buying the dip, and then the dip of the dip and then… you get it. Every new dip is seen as a buying opportunity to the daredevils among us who try to catch a falling knife.

In the latest issue of “Retail Radar” — JPMorgan’s weekly report revealing where the retail money is flowing — the banking giant traced a net $12.5 billion of retail cash poured into stocks or stock-related investments last week.

As much as $4.2 billion went into ETFs (diversification, nice), where a cocktail of ETFs with a broad selection of stocks took the lion’s share along with some gold ETFs . Still, the big chunk of the pie went into individual equities — $8.3 billion of cold hard cash was injected into the retail-trading darlings Tesla NASDAQ:TSLA , Nvidia NASDAQ:NVDA and other Mag 7 members.

🤿 Buying the Dip

Here’s what the bank said:

“Single stocks accounted for +$8.3B of the inflow. TSLA (+$3.2B, +3.5z) and NVDA (+$1.9B, +1.1z) collectively contributed more than half, and the rest of Mag 7 contributed another $1B. Notably, they have been buying TSLA for 12 consecutive days, adding $7.3B in total.”

The 3.5z and the 1.1z describe the standard deviation of the retail traders’ net flows compared to the 12-month average. (Keep reading, it gets even better.)

Did you hear that? Tesla dominated the charts. Day trading bros have kicked in a total of $7.3 billion into Elon Musk’s EV maker over the past 12 cash sessions. It even won some praise from JPMorgan analysts who said this endeavor represents “the highest magnitude among all past ‘buying streaks’ in over a decade.”

Here’s the best part:

“Retail investors returned as aggressive buyers on Wednesday, breaking the $2 billion threshold in the first half of the day (the 2nd time this year), and ending the day at $3.7 billion inflows (+7z),” JPMorgan noted (Wow, 7 standard deviations above the mean). “We observed their allocation into ETFs/single names are at 30/70% during a typical heavy buying day. Among single names, NVDA and TSLA led the inflows.”

JPMorgan also estimated that retail traders’ efforts to snatch the W this year are just bad.

“We estimate retail investors’ performance is down by 7% year to date (vs. -3.3% loss in S&P). Most of the drawdown came from March as they increased their holdings in Tech.”

Retail traders' performance, year to date. Source: JPMorgan

🤙 The YOLO Moment

Buying Tesla shares right now is the ultimate YOLO play. We’re only a week away before Tesla announces what’s shaping up to be the worst delivery figure in years. After a few cuts to delivery targets, considering Europe’s sales took a huge L earlier this year, analysts now predict first-quarter deliveries to land at an average of 418,000 vehicles.

Goldman Sachs NYSE:GS , for one, is bigly bearish on the number. It trimmed its target by 50,000 to 375,000 cars. If true, it would mean that Tesla’s business is shrinking by 3% compared with Q1 of 2024 when deliveries hit 387,000 units.

For the year, analysts expect sales to land anywhere between 1.9 million and 2.1 million. With looming competition in the global auto space , Tesla will need to work extra hard to meet these numbers. In 2024, Tesla rolled 1.8 million vehicles off the assembly line and into customers’ hands (down 1% from 2023).

👀 Are Retail Traders Buying the Dip?

What better place to gauge retail traders’ sentiment than the absolute best trading community out there? Let’s hear it from you — share your thoughts on Tesla! Have you been buying the dipping dip that just keeps carving out new lows? Or you’re a freshly minted Tesla bear after all the havoc and drama around Elon Musk? Off to you!

Bitcoin at $85K: Breakout or Breakdown?Bitcoin is currently trading at $85,000, holding steady despite a 4.4% drop in the broader cryptocurrency market over the past 24 hours. This dip reflects a cautious mood across risk assets, driven by uncertainty over upcoming US inflation data and potential Federal Reserve interest rate decisions. While altcoins are taking a bigger hit, Bitcoin’s price action has been choppy but resilient. For now, it’s in a consolidation phase, with traders watching for the next big move.

Broader Market Context

The recent decline in the crypto market mirrors a broader “risk-off” sentiment among investors, who are bracing for economic shifts that could impact global markets. Factors like US inflation reports and Fed policy updates are creating short-term uncertainty. As the leading cryptocurrency, Bitcoin often serves as a market indicator, its ability to hold key levels could signal stability, while a breakdown might deepen the downturn. Despite this, Bitcoin’s long-term outlook remains strong, supported by growing institutional adoption and a more favorable regulatory landscape.

Short-Term (1-Hour Chart):

Support: $84,000 (make-or-break), $82,000

Resistance: $86,500, $90,000

Indicators: RSI at 45 (neutral), MACD showing bearish momentum. A descending triangle is in play, breaking $86,500 with strong volume could push to $90,000, but a fall below $84,000 might test $82,000.

Long-Term (Weekly Chart):

Support: $80,000, $75,000

Resistance: $90,000, $100,000

The 200-day moving average is trending up, reinforcing a bullish long-term view, but $80,000 must hold for that to stay intact.

Potential Scenarios

Bullish Case: If Bitcoin holds $84,000 and breaks $86,500 with solid volume, expect a run to $90,000 short-term, with $100,000 in sight long-term.

Bearish Case: A break below $84,000 could see it slide to $82,000 or even $80,000.

Volume is the key, watch for a spike to confirm either direction.

Broader Context and Tips

Long-term, Bitcoin’s fundamentals look solid with growing institutional interest and a crypto-friendly climate. But short-term, watch out for volatility triggers like US inflation data or Fed moves. For traders, focus on $84,000 support and $86,500 resistance, these levels will dictate the next trend. Set tight stops (e.g., just below $84,000 for longs) and keep an eye on news. Long-term holders should view $80,000 as the critical floor for the bullish trend to continue.

Quick Simple ReturnsQSR baby! That's what that stands for to me. Anyway, it took a ton of searching, high and low to find this stock. The markets just haven't really turned from their bearish sentiment even after a strong day yesterday. I need to add some long delta to my portfolio and think this stock is just the one. Check out my market overview for why it has been so hard to find a bullish stock.

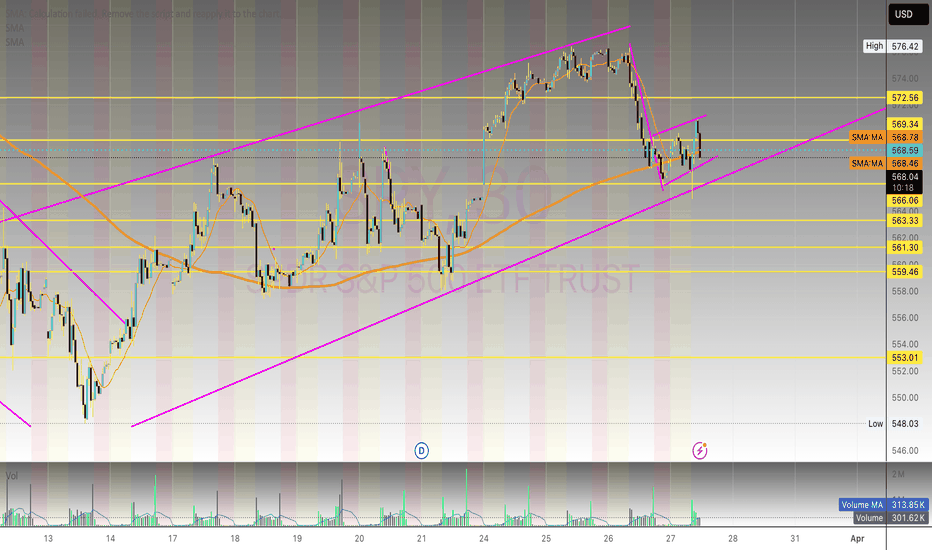

How to use ETFs instead of Indexes to know how to trade that dayMost Traders use the indexes to try to understand whether they should buy long or sell short. However, the ETFs impact the index components prices not the other way around. Most traders do not realize that they should be studying the ETF of an index rather than the index to determine how to trade the next day. Also ETF trading can be highly lucrative. Using the chart layouts that I have designed to trade Dark Pool activity, HFT and Hedge Fund activity and Sell Side activity helps you understand who is on control of price for the ETF and thus is created the value changes of the indexes.

When you study the ETF rather than the index, you will find you have far more information in the chart, indicators and price changes.

Gold Devours Stocks and Outshines Crypto with 40% Gains. Why So?Gold OANDA:XAUUSD has returned 40% in the past twelve months — that’s more than four times the S&P 500’s SP:SPX 9% increase.

Besides leaving stock bros with a sour taste in their mouths, gold is also serving a cold dish of revenge to the crypto heads who had for years been slamming it for lack of appeal. It crushed the $3,000 mark last week, pumping to the rarefied air of $3,005 per ounce.

The market’s digital gold — Bitcoin BITSTAMP:BTCUSD — is up 26% in the past year. Gold is certainly having a moment here with just about every star aligning for its upside swing. War tremors, inflation jitters, consumer uncertainty and lower interest rates have come together to make gold great again.

Catch the drift? Yes, we mean US tariffs. Trump’s tariff drama is perhaps the biggest driver right now for the shiny stuff. Anxiety over gold getting slapped with a tariff has sent traders, dealers and investors scrambling to get more of it.

The US President has floated some comments on gold but not to the point where he even remotely hints at imposing a tariff. Around the end of February, Trump said he suspects someone might’ve actually been stealing gold from Fort Knox. His remarks came after Elon Musk, designated as a “special government employee,” raised some alarming questions.

“Who is confirming that gold wasn’t stolen from Fort Knox? Maybe it’s there, maybe it’s not,” Musk wrote on X . “That gold is owned by the American public! We want to know if it’s still there.”

Trump chimed in and said in an interview they’re planning to visit Fort Knox soon. “We’re going to go into Fort Knox, the fabled Fort Knox, to make sure the gold is there. He added that “if the gold isn’t there, we’re going to be very upset.”

Fort Knox is the equivalent of Scrooge McDuck’s impenetrable fortress full of gold collectibles. Only that Fort Knox staff doesn't backstroke through the piles of coins (or do they?). The vault holds a total of 147.3 million ounces worth roughly $430 billion today. To those who’re asking why not sell it and pay off some debt — America has a staggering $36 trillion debt burden . Selling gold to pay it off wouldn’t even return a blip on the chart.

According to Treasury Secretary Scott Bessent (who’s also a hedge fund manager) the gold at Fort Knox is audited “every year” and “all the gold is present and accounted for.”

All American gold is stored in a number of vaults, which collectively add up to a total of 261.5 million ounces (8,100 tons), according to Federal Reserve balances. That’s around a $770 billion piece of a market that’s worth nearly $20 trillion.

So is the gold rush exaggerated and maybe a little overrated?

In practice, gold is a pet rock with an added flair. It doesn’t generate yield, produce earnings or pay any form of interest to those who hold it. But gold has a solid history of being the ultimate store of value.

Gold’s supply is more or less fixed as miners are only able to dig out about 1% to 2% a year at best. All the gold ever unearthed in the world is a little over 216,000 tons , according to the World Gold Council. One way to picture that is 64,200 Tesla Cybertrucks. Or, if we were to melt it all, it would be enough to form a cube that’s 25 yards (23 meters) on each side.

You be the judge now — do you think gold is overpriced? Or are you a gold bug who believes that $3,000 could be the start of a new mega cycle for the precious metal? Share your comments below!

Bitcoin can rebound from triangle pattern to 90K pointsHello traders, I want share with you my opinion about Bitcoin. Not long ago, the price was trading within a range, where it quickly entered the seller zone and remained near this area for quite some time. BTC attempted to rise but failed, and after nearly reaching the upper boundary of the range, it dropped sharply. The price broke through the 94000 level, exiting the range as well, and then fell to the support level, which aligned with the buyer zone. Shortly after, the price made a strong upward impulse toward the resistance level before starting a decline within a downward triangle. Inside this pattern, BTC initially made a correction, climbed back to the resistance line of the triangle, and then resumed its decline. Eventually, the price dropped to the 78900 support level, where it touched the triangle’s support line and then began to rise. At the moment, BTC continues to climb near this level, and I expect it to rebound from the support line of the triangle and break above the resistance, signaling an exit from the pattern. If this happens, I anticipate further growth, so my target is set at 90000 points. Please share this idea with your friends and click Boost 🚀

Volkswagen AG (VOW) – The Cheapest Military Stock in Europe? TP1: €150 – Short-term breakout

TP2: €180 – Mid-term resistance

TP3: €250 – Long-term revaluation target

Why Are We Bullish?

🔹 Defense Sector Entry?

-VW exploring military production, with CEO Oliver Blume confirming interest.

-Idle plants may be repurposed, potential Rheinmetall partnership in the works.

-Rearmament boom – Rheinmetall’s valuation already surpassed VW’s.

🔹 Financial & Growth Catalysts

-Q4 sales up 21%, 7.0% margin, 2025 revenue target +5%.

-€1B cost-cutting, strong EV & U.S. market expansion.

🔹 Bullish Technicals

-MACD Bullish Crossover + Green Histogram Bars confirm momentum.

-Bounced off long-term trendline support, signaling a strong reversal.

EURUSD - How Long Will The Bullish Gravy Train Last?German Chancellor-in-waiting Friedrich Merz announced he had secured the crucial backing of the Greens for a massive increase in state borrowing.

The deal will likely be approved by the outgoing parliament next week. It includes a 500 billion euro ($544.30 billion) fund for infrastructure and sweeping changes to borrowing rules.

Due to this, the dollar weakened against the euro but rose against the Swiss franc and the yen, underpinned by the likelihood the U.S. government will avert a shutdown over the weekend.

Will this weeks high impact events lead to the weakening of EURUSD?

Bull Trap Confirmed: HOOD's 8% Rally Faces ExhaustionHey Traders after the success of our last month trade on Tesla hitting all targets more than 35%+

With a Similar Trade setup I bring you today the NASDAQ:HOOD

Short opportunity on Hood

Based on Technical + Fundamental View

-Market structure

-Head and shoulder pattern

-Currently will be trading at supply zone which was a recent support and now an ideal place for a reversal to create the right shoulder of the bigger head and shoulder pattern - Daily time frame.

1. Declining User Growth and Transaction-Based Revenue

2. Regulatory and Legal Challenges

3. Rising Costs and Profitability Pressures

4. Intense Industry Competition

5. Macroeconomic and Market Volatility

Technical View

Head and shoulder pattern - Pretty visible. Right shoulder is yet to be formed, Which makes an ideal place to SELL with a great Risk Reward ratio.

Pro Tip

Wait for a bearish candle stick pattern to execute trades on end of the day keeping stop loss somewhere above the supply zone.

Target 1 - 35.52$

Target 2 - 30.81$

Target 3 - 26.26$

Stop Loss - 44.72$

Fundamental View

1. Declining User Growth and Transaction-Based Revenue

Robinhood’s revenue model relies heavily on Payment for Order Flow (PFOF), which makes it vulnerable to fluctuations in trading activity. After a pandemic-driven surge in 2020–2021, user growth stalled, with monthly active users dropping 34% YoY to 14 million by mid-2022. Transaction revenue fell 55% in Q2 2022, and while assets under custody grew to $140 billion by Q2 2024, the platform’s dependence on volatile crypto and meme-stock trading amplified revenue instability.

2. Regulatory and Legal Challenges

The SEC’s scrutiny of PFOF and proposed trading rule changes threaten Robinhood’s core revenue source. In 2022, New York regulators fined Robinhood’s crypto unit $30 million for anti-money laundering violations. Ongoing legal risks, including backlash from the 2021 GameStop trading restrictions, have further eroded institutional trust.

3. Rising Costs and Profitability Pressures

Operating expenses surged due to aggressive marketing, technology upgrades, and compliance investments. Despite workforce reductions (23% layoffs in 2022), profitability remains strained. The company’s shift toward diversified products like retirement accounts and credit cards has yet to offset these costs.

4. Intense Industry Competition

Traditional brokers like Fidelity and Charles Schwab adopted zero-commission trading, neutralizing Robinhood’s initial edge. Newer platforms like Webull and Public.com also captured younger investors with advanced features, while Robinhood’s limited product range (e.g., lack of wealth management services) hindered retention of high-net-worth clients.

5. Macroeconomic and Market Volatility

- Interest Rate Sensitivity: As a growth stock, HOOD declined amid rising rates in 2022–2023 and broader tech-sector sell-offs.

- Recent Market Turmoil: On March 10, 2025, HOOD dropped 18% alongside crypto-linked stocks like Coinbase due to Bitcoin’s price volatility and fears of inflationary tariffs under new U.S. policies.

- Retail Investor Pullback: Reduced discretionary investing and crypto crashes (e.g., Bitcoin’s 71% plunge in 2022) dampened trading activity.

NOT AN INVESTMENT ADVISE

AAPL and MSFT Reading Charts For Better Entries and ExitsOptions Trading Strategy Using Ichimoku Cloud, 200 SMA & Monthly Contracts

(Following Your 3 Trading Rules)

This strategy adapts the Ichimoku Cloud & 200 SMA trend-following method for trading monthly options contracts with a focus on high-probability setups. It leverages time decay (theta), trend strength, and proper timing to maximize gains while reducing risk.

🔹 Strategy Overview

We will trade monthly options contracts using:

Trend confirmation via Ichimoku Cloud & 200 SMA

Directional bias based on price positioning

Entry timing rules to avoid low-probability setups

Theta-friendly positioning (avoiding weeklies to reduce time decay risks)

📈 Trading Rules & Setup

(My 3 Golden Rules)

🚫 No trading on Mondays → Avoids choppy market structure from weekend gaps.

🚫 No trading on Fridays → Avoids gamma risk and weekend time decay.

⏳ No trades before the first 15-minute candle closes → Ensures market direction is established.

📊 Selecting the Right Option Contract

For monthly expiration contracts, select options that:

Expire within 30 to 60 days (avoid weekly contracts to minimize rapid time decay).

Are slightly in-the-money (ITM) or at-the-money (ATM) for higher delta (0.55–0.70).

Have open interest >1,000 and a tight bid-ask spread to ensure liquidity.

Example: If today is June 11, trade the July monthly contract (third Friday of the month).

📉 Bearish Put Play (Short Trade)

200 SMA Bias: Price is below the 200 SMA

Ichimoku Cloud Confirmation:

Price is below the cloud

Tenkan-sen is below Kijun-sen (bearish momentum)

Chikou Span is below price from 26 candles ago

Future cloud is red

Entry Trigger (After First 15 Min Candle):

Price pulls back into the Kijun-sen but rejects it

OR price breaks below the cloud after a weak consolidation

Enter PUT contract (monthly expiration)

Stop Loss & Take Profit:

SL: Above Kijun-sen or recent swing high

TP: First at the cloud’s lower edge, second at a key support level

Exit before Theta decay accelerates (last 14 days before expiry)

📈 Bullish Call Play (Long Trade)

200 SMA Bias: Price is above the 200 SMA

Ichimoku Cloud Confirmation:

Price is above the cloud

Tenkan-sen is above Kijun-sen (bullish momentum)

Chikou Span is above price from 26 candles ago

Future cloud is green

Entry Trigger (After First 15 Min Candle):

Price pulls back into the Kijun-sen but holds

OR price breaks out above the cloud

Enter CALL contract (monthly expiration)

Stop Loss & Take Profit:

SL: Below Kijun-sen or recent swing low

TP: First at the cloud’s upper edge, second at a key resistance level

📊 Trade Management & Adjustments

Rolling: If trade is profitable near expiry but not at the full target, roll to the next monthly contract.

Closing Early: If the trade is at 70-80% max profit, close early to avoid decay risk.

Cutting Losses: If price closes inside the Ichimoku Cloud, consider exiting early (trend loss warning).

🛠 Why This Works for Monthly Options?

✅ Avoids time decay risks of weekly options by trading monthly contracts.

✅ Uses strong trend confirmation from Ichimoku & 200 SMA.

✅ Only trades at high-probability times, avoiding choppy Monday & Friday moves.

✅ Allows scaling into strong trends rather than short-term noise.