Candlestick Analysis

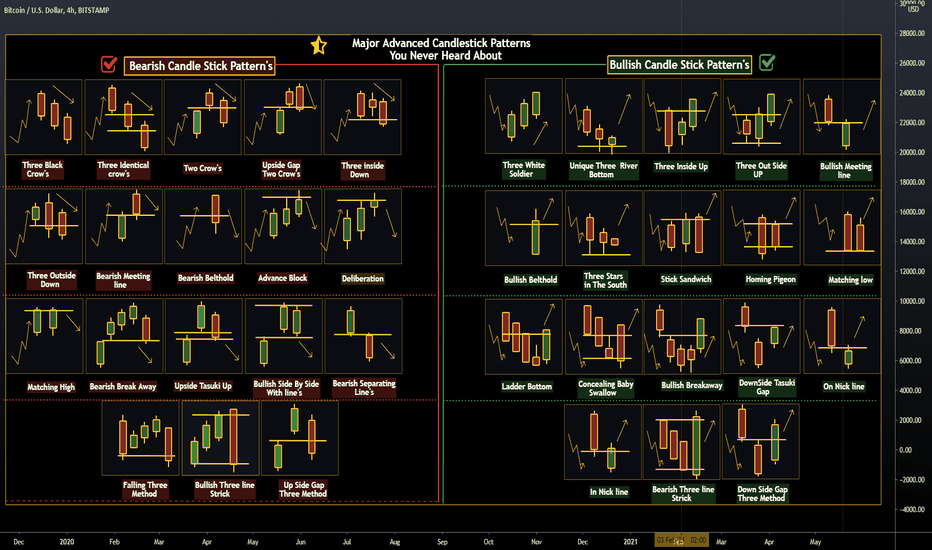

Major Advanced Candlestick Patterns You Never HeardCandlestick Definition

-----

What Is A Candlestick?

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price (black/red if the stock closed lower, white/green if the stock closed higher).

KEY TAKEAWAYS

Candlestick charts display the high, low, open, and closing prices of a security for a specific period.

Candlesticks originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States.

Candlesticks can be used by traders looking for chart patterns.

The candlestick's shadows show the day's high and low and how they compare to the open and close. A candlestick's shape varies based on the relationship between the day's high, low, opening and closing prices.

Candlesticks reflect the impact of investor sentiment on security prices and are used by technical analysts to determine when to enter and exit trades. Candlestick charting is based on a technique developed in Japan in the 1700s for tracking the price of rice. Candlesticks are a suitable technique for trading any liquid financial asset such as stocks, foreign exchange and futures .

Long white/green candlesticks indicate there is strong buying pressure; this typically indicates price is bullish . However, they should be looked at in the context of the market structure as opposed to individually. For example, a long white candle is likely to have more significance if it forms at a major price support level . Long black/red candlesticks indicate there is significant selling pressure. This suggests the price is bearish . A common bullish candlestick reversal pattern, referred to as a hammer , forms when price moves substantially lower after the open, then rallies to close near the high. The equivalent bearish candlestick is known as a hanging man . These candlesticks have a similar appearance to a square lollipop, and are often used by traders attempting to pick a top or bottom in a market.

Traders can use candlestick signals to analyze any and all periods of trading including daily or hourly cycles—even for minute-long cycles of the trading day.

Two-Day Candlestick Trading Patterns

There are many short-term trading strategies based upon candlestick patterns. The engulfing pattern suggests a potential trend reversal; the first candlestick has a small body that is completely engulfed by the second candlestick . It is referred to as a bullish engulfing pattern when it appears at the end of a downtrend, and a bearish engulfing pattern at the conclusion of an uptrend. The harami is a reversal pattern where the second candlestick is entirely contained within the first candlestick and is opposite in color. A related pattern, the harami cross has a second candlestick that is a doji ; when the open and close are effectively equal.

Three-Day Candlestick Trading Patterns

An evening star is a bearish reversal pattern where the first candlestick continues the uptrend. The second candlestick gaps up and has a narrow body. The third candlestick closes below the midpoint of the first candlestick . A morning star is a bullish reversal pattern where the first candlestick is long and black/red-bodied, followed by short candlestick that has gapped lower; it is completed by a long-bodied white/green candlestick that closes above the midpoint of the first candlestick .

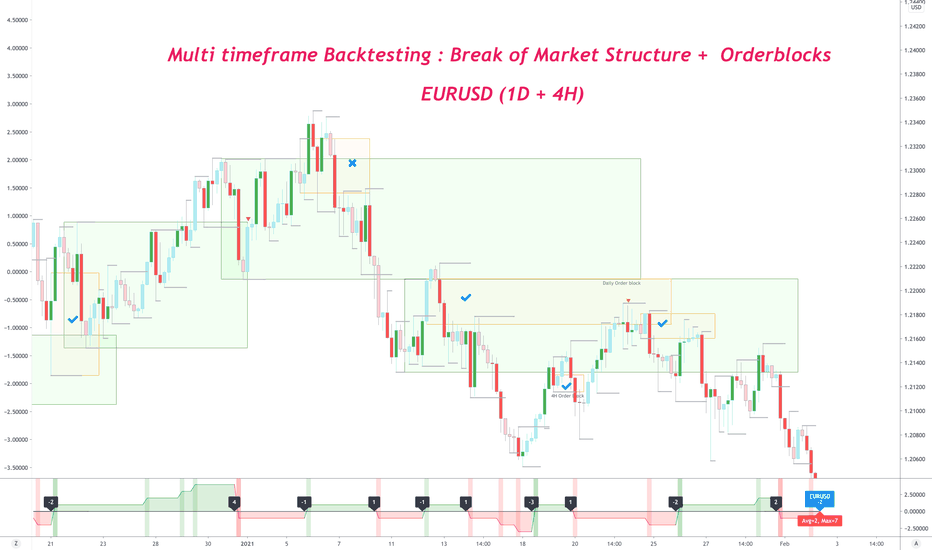

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

The "PIN BAR" Story Hi Pro Trader's .. Hope You Be Fine ♥

Today We Have Very Important Education Lesson .. THE PIN BAR STORY

The Pin Bar In Candle .. Came To Change The Pair Direction ..

we Have 3 Levels For It

Strong .. That's Came And Change Direction With High Move

Medium .. That's Came And Change Direction With Medium Move

Week .. That's Came And Change in Direction Will Happen

Start Trade Now With PIN BAR .. And Tell US Results

Be Safe -- Trade Safe

Bitcoin Traders Beware!, Buyers Will win this War(Short Squeeze)Like And Subscribe(😊 Thanks in advance)

Why do Support and Resistance hold but sometimes break forcefully? you may ask after bitcoin recent price actions.

I am sincerely more than happy😳 to welcome our new subscribers.

My analysis are always multi-timeframes, so please do expect a full week play out of my predictions.

as a result of my busy hectic schedules, I will be making only weekly analysis every weekends on what to expect from the market through out the new week before a new weekend.

I will do my best to try to constantly update the posts during the week, to keep you updated incase we have any sudden incoming changes in price action that could affect our results.

Thanks for your constant supports and understanding.

It is crazy to know that the bull(buyer) and the bear(seller) can be same trader at any point in time in the market, and sometimes even confused of what she/he should be doing, buying or selling.

To answer the above question, first I will start by explaining what Resistance and Support truly is in the most simplest way that I can, for the sake of new born traders reading along.

what then is Support And Resistance?

For Support;

The simplest definition I can gave you is that , a Support is simply an invincible form of form(🛏)made floor area on the chart where price somehow bounces off from, this invincible floor prevents price from going farther down

when falling from a higher price range as a result of coming in contact with an invincible barrier called resistance.

Ones price comes close to the support, here it manages to find a way to bounce back to the upside after being pushed down(sold off) by sellers in the market.

this support are build or formed by unusual huge number of buyers(when you have huge number of traders willing to buy at a particular price range on the chart) .

To better understand how a support works, I will like you to see this support built floor by the buyers as a form 🛌 floor because it is breakable and can be sliced to the worst piece with no remorse when the sellers are huge in numbers.

Here is my lil secret for trading supports (secret source😉):

*See support as an area on the chart and not a line because, it is likely price breaks the line only to find buyers below your line.

* Whenever price gets closer to support, start by focusing more on the candle formations even before it comes in contact with it. If any candlestick pierces the support with a full grown body, this will most likely mean that price could go down lower more if the next two to three candles doesn't give bulls(buyers) a bounce above the support area( the last swing low that was broken). It will likely seek the next support below for assistance of a bounce(price is looking for more buyers)

* If price gets to the support and starts to go side ways, then bounce strongly with strong reversal candle stick pattern, don't jump the gun yet, wait for price to come back to confirm by forming higher low on the support, to prove the buy power on the support, price always retest a support before taking off from it(if it finds large enough strong buyers, it will make a higher stronger bounce before it even touch the support on the retest, this therefore leads to a higher low as a result of too many traders watching that support and are racing each other on the buy zone , when more buyers see this they will also jump in because now they know that the support is likely to HOLD.

*The more a support is hit 🧐,the more lower the strength of the bounce grows, the more likely price will break below it. to trade, start by watching the candle sticks forming on the area of support. This simply means that, hitting the support countlessly times leads to it breaking because it is likely that soon one candle will break the support. too much sideways on support will lead to its break or pierce also.

* Support holds, but the can also sometimes easily break as well. When supports are broken they automatically turn to new resistance.this simply means that the buyers house is now having now owners(sellers), if you understand this particular tip, it easily explains why supports got broken in the first place because the buyers at home were to small in number to defend the house so sellers killed them all🤣(bull hunt) and took over the ownership of the support there by turning it into their now home(resistance),

*Horizontal support areas are the strongest while the slanting trendline buyers are weak and more prone to break easily.

What is Resistance ?

Resistance is simply an invincible Form🛌made barrier area where price comes in contact with then starts to drop, this invincible barrier prevents price from moving upward any further, next this barrier pushes price down(sometimes even after price successfully pushes above these barriers they some how manage to get the bulls tail and drag them back down, this is also know as fake out by price action traders. just like the buyers support, these resisitance areas built by sellers can be sliced to pieces if the buyers are huge in number and out number the sellers, the barrier will be 😱 destroyed 💸 with out remorse!

Here is my lil Resistance secret source😉:

here everything is just the opposite of my tip for support.

* when price starts to gets closer to the resistance, start focusing more on the candlestick formations even before it comes in contact. if any candlestick pierce the resistance with a full grown body(make sure the candle that follows doesn't close below the resistance, it will likely go down below more if the next two to three candles doesn't give bulls(buyers) a follow through, above the that resistance area that was broken. It is most likely, price will seek to retest that resistance if it succeed in breaking through the form barriers. buyers will allow price to comeback to the top of the barrier, here they will take time to reenforce and also make sure the barrier is turned into a new support( new home owners).

The current bitcoin price is in a buy support area. in my last analysis, the vertical support line was broken and price went below it to 28900 zone still within the horizontal support area, we saw price seeking stronger buyers zone on the support . I still remain bullish o! as I believe a short squeeze is coming, and can still see a strong bull bounce before the major retest of the last breakout of 12k resistance as a result of the weekly chart.

this new week coming we are likely seeing a reaction buy from the pullback. if buyers successfully holds the 32k support and get a bounce, their first target will be 37k resistance and if they succeed to break the edge at 39k of that barrier then 46k to 60k range will be their next target before a major big dump of over 40% drop will occur in my opinion.

USDJPY With Several Evidences For A Potential Bottom FormationHello traders!

Today we will talk about weekly USDJPY chart and we will show you many evidences for a potential bottom formation.

Well, for the begining let's talk about wave structures from Elliott Wave perspective. USDJPY is in a downtrend since March, but the wave structure is slow, choppy and overlapped which we see it as a complex corrective W-X-Y decline and we know that once corrections fully unfolds, we can expect a reversal.

The next very important evidence is an ending diagonal (wedge) pattern placed in third leg Y. The ending diagonal is a special type of wave that occurs in wave 5 of an impulse, or wave C/Y of a correction. This wave often occurs when the preceding move of the trend has gone too far, too fast and has run out of steam. An ending diagonal pattern is a type of pattern that can occur at the completion of a strong move. It reflects a “calming” of the market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave. Ending diagonals consist of five waves, labeled 1-2-3-4-5, where each wave subdivides into three legs. Waves 1 and 4 overlap in price, while wave 3 can not be the shortest amongst waves 1, 3 and 5.

The reason why they are so interesting is because they are indicating a reversal, usually a strong one.

The next interesting evidence is that we are already seeing bounce and recovery with quite big weekly candlestick, completely covered the previous one, called bullish engulfing candlestick formation which also suggests a bullish reversal from the lows.

If we also consider current break above strong weekly trendline, then with so many evidences, we can easily confirm a potential bottom and bullish reversal.

Trade well!

If you like what we do, then please like and share the idea!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

TOP 6 Candlestick PatternsHi,

I would like to share my TOP 6 candlestick patterns, you can also name your TOP 3 in the comment section.

Perfect scenario: identify the strong area, wait for the price coming inside of it, wait for a candlestick pattern which consists of at least two candles and it has to form in at least 1-hour timeframe (lower TF candlestick patterns are poor), wait for a pullback and GO.

Always wait for a small pullback after the candlestick pattern has formed, you will get a better price. It is so rear case that after candlestick pattern formation the price goes immediately into the shown direction.

MORNING STAR

The Morning Star is a bullish bottom reversal pattern. It warns of weakness in a downtrend that could potentially lead to a trend reversal, especially if it forms on a strong support level. The morning star consists of three candlesticks with the middle candlestick forming a star. The first candlestick in the morning star pattern must be a red candlestick with a relatively large real body. The second candlestick is the star, which has a short real body that is separated from the real body of the first candlestick. The star does not need to form below the low of the first candlestick and can exist within the lower shadow of that candlestick. The star is the first indication of weakness as it indicates that the sellers were not able to drive the price close much lower than the close of the previous period.

This weakness is confirmed by the third candlestick, which must be green in color and must close 50% above the body of the first candlestick.

EVENING STAR

The Evening Star is a bearish, top trend reversal pattern that warns of a potential reversal of an uptrend. It is the opposite of the Morning Star and, like the morning star, consists of three candlesticks, with the middle candlestick being a star. The first candlestick in the evening star must be green in color and must have a relatively large real body. The second candlestick is the star, which is a candlestick with a short real body that does not touch the real body of the preceding candlestick. The star can also form within the upper shadow of the first candlestick. The star is the first indication of weakness as it indicates that the buyers were unable to push the price up to close much higher than the close of the previous period. This weakness is confirmed by the candlestick that follows the star.

This candlestick must be a red candlestick and must close 50% above the body of the first candlestick.

BULLISH/BEARISH ENGULFING

The Engulfing candlestick pattern is a two-candle reversal pattern. A reversal pattern can be bearish or bullish, depending on whether it appears at the end of an uptrend (bearish engulfing) or a downtrend (bullish engulfing pattern). The first candle is a small body, followed by the second candle whose body completely engulfs the previous candle body and closes in the opposite direction of the trend.

BULLISH/BEARISH RAILWAY TRACKS

A bearish railway track pattern has the first candlestick bullish and the second candlestick bearish. That fact that there is a sudden change from bullish to bearish candlestick should be a good indication that there might be a bearish trend forming. If you see it inside of the determined strong area the more powerful it is!

Regards,

Vaido

XAUUSD 4H MACD CROSSOVER TRADING STRATEGYPrice was in an uptrend.

Price bounce off a previous resistance.

Price created a Bearish Engulfing Reversal Candle.

Entered trade at the close of above candle.

MACD crossover happened at the close of the candle also.

Stop Loss placed above reversal candle.

EXITED trade after consolidation made price go sideways.

Pro Candlestick Analysis Method! MUST KNOW FOR SUCCESS!!!Pro Backtest Method:

STUDY CANDLESTICK BEHAVIOUR

- You should know what type of

candle your ideal entries are taken

based on momentum/rejection.

- To help with in the moment decision

making before entry and avoiding

impulse entries try this;

1. Open Chart During your preferred

session and timeframe. Look to see if

market conditions are similar to your

strategies ideal conditions e.g. Creating

a LH and rejecting the level.

2. Watch how those Candles unfold and

record their behaviour and how they are

shaped at specific times through out. e.g.

30m candle, record its shape at 10min,

20min, 25min and the final 5mins

3. When Candle closes, record the outcome

and take a note as to whether this candle

is the sort of candle you would enter based

upon. Repeat this everyday or whenever the

conditions are right.

4. You will soon start to see patterns which lead

to specific candlestick close outcomes, then you

can confidently determine this in real time

and avoid entering on an impulse.

The Engulfing PatternThis is a candlestick pattern called the Engulfing pattern.

It bares its name from the fact that the second candle “Engulfs” the first.

It is bigger

This occurs when price, already in exhaustion, taps into an opposing liquidity zone.

Think a trampoline

You jump down into it

It goes down from that energy

And springs you back up with more energy than before

My teacher, along with other confirmations, doesn’t get into a trade until he sees this. It gives you certainty

How To Download Divergence+ I get a lot of private messages about divergence+, a divergence indicator that also gives insanely accurate buy and sell signals. It is so accurate the creator charges a monthly subscription for the indicator.

It cost $15 a month and for me personally, with the gains I have made... It is has already paid itself off for the remainder of my life and I am young!

Here are instructions on how to download

1. View my account [Myantman101}

2. View who I am following and click on Market Scriptors

3. Send them a private message requesting access to D+

4. Follow their instructions and use as desired

Hope this indicator helps everyone in their analysis/trading decision making

EDUCATION: Engulfing Candlestick PatternHello, dear subscribers!

The topic of this article is the Engulfing candlestick pattern. To be honest the candlestick patterns are almost useless if you use only this. But this is a great trend confirmation, so we will consider engulfing pattern with the Alligator Indicator which was described in one of the previous articles.

What is Engulfing Pattern?

The Engulfing Pattern can be bullish and bearish. The bullish one is the situation when the red candle is engulfed by the next green candle. It is not important if the candleweak was engulfed too or not. This is a subject for thought. Also it does not mean if the only one green candle or two consecutive candles absorbed the previous red candle.

The bearish Engulfing candlestick formation is exactly the opposite situation.

The Strategy

You can search by yourself the ehgulfing patterns on the chart and notice that it generate a lot of fake signals, it means that we should use the indicator for the trend definition. In our example we use the Alligator indicator to do it. As you already know the Alligator has two phases - the sleeping and feeding time. If the sleeping time is over the jaw, teeth and lips of the Alligator become wider. At this point we should find the Engulfing formation to confirm the new trend. You should enter a long position at the point which you can see on the chart.

Takuri: shadow down - trend reversal Takuri: shadow down - candles confirmed reversal

The main thing that everyone is interested in is, of course, what candles can confirm a market reversal.

One of the main candles immediately pointed out by the Japanese is the Takuri. The Americans called it a pin bar, where a pin is the shadow of a candle, which is longer than the body. Another name is "Hanging Man". A lot of names, the essence is the same. According to the Japanese, the color and the size of the body of such a candle is not very important. The main thing is the lower shadow, which is much longer than the body.

Such candles certainly reflect investor psychology. Here this long shadow is an indication that the bulls were significantly stronger than the bears during the candles. Of all the candles in existence, pinbar have the strongest signal. It should be interpreted using trends, channels, support/resistance and other candles, as well as confirmed.

Remember: Pinbars cannot be used as an independent signal.

If you can find a good confirmation for the pinbars, however, they can become the basis or addition to your trading strategy. As a result, quite a few systems are based on pinbars.

Push like if you think this is a useful idea!

Write your comments and questions here!

Thanks for your support!

My trading strategies : Trade against the trapped trader!STRAT 11 : Basic premise

As price continues in a trend, more and more traders keep piling into the same direction, hoping that the trend will continue and they will make money. However, at some point, the trend sharply reverses, breaking the market structure in opposite direction and trapping a whole bunch of retail traders in the direction of trend which just got reversed.

We create a zone which identifies these trapped traders and then patiently wait for them to exit, and trade with limit orders in the direction of their exit.

You can add additional confirmation signals from DXY's directions for the instruments which are highly correlated to DXY (EURUSD, USDCHF, etc)

PRICE ACTION WINNING TRADE – BULLISH RE-ENTRY STRATEGY Hi traders,

This is a 45-minute chart of the BTCUSD.

A bullish Pin Bar seen we took the trade.

after a bullish move price fell and hit stop-loss orders placed around the low of the Pin Bar (a common pattern stop level).

The market recovered quickly and offered a re-entry chance with a second bullish Pin Bar. We bought as price broke above its high.

After our entry, the market rose with a strong thrust.

I strongly recommend that you adopt this re-entry trading approach. It offers a trading technique that lowers trade frequency and increases probability of success.

Thank you.

Most Simple Way to find out Reversal Without Any IndicatorSo you've tried catching the bottom?

Trust me it's not worth catching em,

But what you can actually do is find an entry that is favorable to ur trade,

Here''s how best of best traders have been doing it since the early days.

Using candlestick patterns.

this one rule allows you & many other traders to find out the right entries,

1. DOJI Candles

if the candle with a long wick (as shown in the figure)

close above or below the close of the previous candle,

This is a good entry point to take an entry/position In the market.

P.s - This is not always true, but if you are counter-trading this is your best bet against the trend.

If you counter trade at the top or bottom after the closing of DOJI ,

you can have higher chances of winning & better reward for taking the risk.

What are your views on using DOJIS for trade confirmation?

Would love to know more about your Ideas,

Share your Ideas in comments below.

How To Trade EMA here i have set very good example on how you can trade EMA

it's common for every asset that it follow the price of EMA ( the moving average )

let's take example i set 7 ema on weekly chart so it's total 49 days moving average so if price make bounce above this ema on weekly something has been cooking in the asset . it's 49 days downtrend

same breakdown of EMA ( exponential moving average ) also shows upcoming correction in price on higher timeframe

so don't ignore moving average use this EMA with the triangle and other pattern and make your trading better

any asset always respect it moving average price if fall below major ema than it will take resistance if goes up than it will bounce when it touch EMA

Top down trading triad 09 NOV 2020 (reference)Visualization of 3 areas of chart analysis. Its makes it easier to break down the individual skill sets required to maximize success. This is just one way to break things down. You may break this down differently so this is just another way to view this if having issues.

Regardless of the indicators you use, looking at the market from these three angles may help you employ your preferred indicators more accurately. Breaking things down like this may also help your targeting.

Sources of education:

Richard Wyckoff

Tom Williams Volume spread analysis VSA/ Master the Markets

Pete Faders VSA*

Read the ticker dot com

Wyckoff analytics

Dee Nixon

Avoid buying into weakness/supply/resistance

Avoid selling into strength/demand/support

Avoid entry when price is in middle of a range (phase B)