💥 Bullish VS Bearish Candlesticks📍Bullish and bearish candlestick patterns are technical analysis tools used by traders to identify potential market trends and reversals. Bullish patterns indicate a potential rise in the price of an asset, while bearish patterns indicate a potential decline in price.

🔷 Bullish candlestick patterns include the dragonfly doji, hammer, tweezer bottom, morning star engulfing and three white soldiers. These patterns suggest that buying pressure is increasing and that there may be a potential for a trend reversal.

🔷 Bearish candlestick patterns include the gravestone doji, inverted hammer, tweezer top three black crows and more. These patterns suggest that selling pressure is increasing and that there may be a potential for a trend reversal.

🔷When using candlestick patterns for trading, it's important to look for confluence with other signals, such as trend lines, support and resistance levels, and other technical indicators. Combining multiple signals can provide a stronger indication of potential market movements and help traders make more informed trading decisions.

🔷It's also important to note that candlestick patterns should not be relied on as the sole indicator for trading decisions, as they are not always accurate and can produce false signals. Traders should always use a combination of technical analysis tools and fundamental analysis when making trading decisions. This is why its important to create and monitor your own strategy and backtest what works and what doesn't.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Candlestick Analysis

📊 The Doji Candle Pattern📍What is the Doji Candlestick Pattern?

The Doji Candlestick Pattern refers to a chart pattern consisting of a single candle. This pattern appears when the opening and closing prices of a candle are nearly the same or identical, resulting in a small-bodied candle with upper and lower wicks resembling a "+". Different variations of Doji patterns exist, with unique names like the Long-legged Doji, Gravestone Doji, Dragonfly Doji, and Doji star candlestick pattern. Regardless of the type, all Doji patterns provide traders with four critical data points: the open, close, high, and low prices for the given period. Doji patterns can occur on any timeframe and in any market, making them the foundation of many trading strategies

🔹Long-legged Doji

The Long-legged Doji pattern has an elongated upper and lower wick and a small body

The Long-legged Doji can be interpreted in several ways and works best when viewed in context with price action. It is a potential price reversal signal in a defined up or downtrend. If it occurs in a flat market, it suggests further consolidation.

🔹Dragonfly Doji

The Dragonfly Doji sets up when the candle’s open, close, and high is approximately the same. Visually, the Dragonfly looks like a “T,” as depicted in the image below. This formation suggests that heavy selling was present, but the market has rebounded. As a general rule, the Dragonfly is considered a reversal indicator. A retracement in price is expected when it occurs at the top of a bullish trend.

🔹Gravestone Doji

The Gravestone Doji pattern is the polar opposite of the Dragonfly; it appears as an inverted “T” and signals that heavy buying has given way to selling. The Gravestone Doji is a reversal chart pattern that signals downward or upward pressure may be on the way. The Gravestone suggests that a reversal is possible when observed within a defined uptrend. Within a downtrend, bullish price action may be forthcoming.

🔸Reversals

Doji candlesticks can be a great way to get in or out of the market in trending markets. The Gravestone and Dragonfly are ideal for reversal strategies as they indicate forthcoming upward and downward movements in price.

🔸Breakouts

One of the lowest-risk ways to utilize Dojis in the FX market is to trade breakouts. A breakout is a sudden directional move in price. Dojis often precede breakouts, as they are a signal of indecisiveness. As soon as the market makes up its mind, a significant move may be in the offing.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

🔎 A Look Inside The Candlestick Chart📍What Is a Candlestick?

The formation of the candle is essentially a plot of price over a period of time. For this reason, a one minute candle is a plot of the price fluctuation during a single minute of the trading day. The actual candle is just a visual record of that price action and all of the trading executions that occurred in one minute.

[b📍Who Discovered the Idea of Candlestick Patterns?

It is commonly believed that candlestick charts were invented by a Japanese rice futures trader from the 18th century. His name was Munehisa Honma.

Honma traded on the Dojima Rice Exchange of Osaka, considered to be the first formal futures exchange in history.

As the father of candlestick charting, Honma recognized the impact of human emotion on markets. Thus, he devised a system of charting that gave him an edge in understanding the ebb and flow of these emotions and their effect on rice future prices.

📉Bearish Candle

🔹 Open Price: A bearish candlestick forms when the opening price of a currency pair is higher than the closing price of the previous candlestick.

🔹 High and Low Price: During the candlestick's time frame, the price moves higher than the opening price and then declines to form a lower low than the previous candlestick.

🔹 Body: The body of the bearish candlestick is colored red and represents the difference between the opening and closing price. The longer the body of the candlestick, the stronger the bearish sentiment.

🔹 Upper Shadow: The upper shadow of the candlestick represents the highest price achieved during the candlestick's time frame. The longer the upper shadow, the greater the bearish pressure.

🔹 Lower Shadow: The lower shadow of the candlestick represents the lowest price achieved during the candlestick's time frame. The shorter the lower shadow, the stronger the bearish sentiment.

📈Bullish Candle

🔹 Open Price: A bullish candlestick forms when the opening price of a currency pair is lower than the closing price of the previous candlestick.

🔹 High and Low Price: During the candlestick's time frame, the price moves lower than the opening price and then rises to form a higher high than the previous candlestick.

🔹 Body: The body of the bullish candlestick is colored green and represents the difference between the opening and closing price. The longer the body of the candlestick, the stronger the bullish sentiment.

🔹 Upper Shadow: The upper shadow of the candlestick represents the highest price achieved during the candlestick's time frame. The shorter the upper shadow, the greater the bullish pressure.

🔹 Lower Shadow: The lower shadow of the candlestick represents the lowest price achieved during the candlestick's time frame. The longer the lower shadow, the greater the bullish sentiment.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Judas Swing (Bullish Example) Part 2The Judas swing term was named by ICT, he dubbed this swing concept and utilizes it upon the London Open. The idea is, the market maker will rally or sell price, normally just above or below the Asian session high or low (depending on institutional order flow bias) tricking buyers or sellers into the market to follow its direction. As the Judas swing high or low is formed, price is quickly reversed either taking out stops and or leaving traders out of the game.

The Judas swings happen on all time frames, but 1hr are the best for scalping or day trading- they happen a lot every week.

* Please check out your favorite forex pairs on 1 hour time frame- you will see that they four (4) hour candlestick set up happens at the same time over and over. Why not trade it? Just figure out the risk management around the ATR of pair you trade.

Noted on attached chart is:

Example of a bearish Judas Swing on Eur/Jpy 1 hour chart

and noted when you should not be trading RED x's and when you should be trading GREEN x's. Why? Because each day there are 12 hours of low liquidity and low volume and then there are 12 hours of high liquidity and high volume.

Make Forex trading as easy as you can- trade with big banks not against them and remember that both time and price are most important in Forex.

Good Luck,

Panda

Can you do a 50 pip box on this trade? 1:1 Risk Reward- is it worth it? It depends if you have a high win rate with 1:1 or you need trades to be higher.

What is an ICT Judas Swing?The Judas swing term was named by ICT, he dubbed this swing concept and utilizes it upon the London Open. The idea is, the market maker will rally or sell price, normally just above or below the Asian session high or low (depending on institutional order flow bias) tricking buyers or sellers into the market to follow its direction. As the Judas swing high or low is formed, price is quickly reversed either taking out stops and or leaving traders out of the game.

The Judas swings happen on all time frames, but 1hr are the best for scalping or day trading- they happen a lot every week.

* Please check out your favorite forex pairs on 1 hour time frame- you will see that they four (4) hour candlestick set up happens at the same time over and over. Why not trade it? Just figure out the risk management around the ATR of pair you trade.

Noted on attached chart is:

Example of a bearish Judas Swing on Eur/Jpy 1 hour chart

and noted when you should not be trading RED x's and when you should be trading GREEN x's. Why? Because each day there are 12 hours of low liquidity and low volume and then there are 12 hours of high liquidity and high volume.

Make Forex trading as easy as you can- trade with big banks not against them and remember that both time and price are most important in Forex.

Good Luck,

Panda

✔️Confluence Trading📍What is “confluence trading”?

“Confluence trading” is when you combine more than one trading technique or analysis to increase your odds of a winning trade.

You use multiple trading indicators that all give the same “reading”, as a way to confirm the validity of a potential buy or sell signal.

Confluence refers to any circumstance where you see multiple trade signals lining up on your charts and telling you to take a trade.

Here are some indicators, chart patterns and candlestick patterns you can use for confirmation of your trade.

🔹Indicators

Moving Average (MA)

Relative Strength Index (RSI)

Bollinger Bands

Fibonacci retracement

Stochastic Oscillator

MACD

Average Directional Index (ADX)

Ichimoku Kinko Hyo

Parabolic SAR

Williams %R

🔹Chart Patterns

Head and Shoulders

Double Top and Double Bottom

Triple Top and Triple Bottom

Flag and Pennant

Cup and Handle

Wedge

Rectangle

Symmetrical Triangle

Ascending Triangle

Descending Triangle

🔹Candlestick patterns

Doji

Hammer

Hanging Man

Shooting Star

Inverted Hammer

Bullish Engulfing Pattern

Bearish Engulfing Pattern

Piercing Pattern

Dark Cloud Cover

Morning Star and Evening Star

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

How to Trade With Relative Strength Index (RSI) Indicator

Hey traders,

Relative strength index is a classic technical indicator.

It is frequently applied to spot a market reversal.

RSI divergence is considered to be a quite reliable signal of a coming trend violation and change.

Though newbie traders think that the application of the divergence is quite complicated, in practice, you can easily identify it with the following tips:

💠First of all, let's start with the settings.

For the input, we will take 7/close.

For the levels, we will take 80/20.

Then about the preconditions:

1️⃣ Firstly, the market must trade in a trend ( bullish or bearish )

with a sequence of lower lows / lower highs ( bearish trend ) or higher highs / higher lows ( bullish trend ).

2️⃣ Secondly, RSI must reach the overbought/oversold condition (80/20 levels) with one of the higher highs/higher lows.

3️⃣ Thirdly, with a consequent market higher high / lower low, RSI must show the lower high / higher low instead.

➡️ Once all these conditions are met, you spotted RSI Divergence.

A strong counter-trend movement will be expected.

Also, I should say something about a time frame selection.

Personally, I prefer to apply it on a daily time frame, however, I know that scalpers apply divergence on intraday time frames as well.

❗️Remember, that it is preferable to trade the divergence in a combination with some price action pattern or some other reversal signal.

Let me know, traders, what do you want to learn in the next educational post?

Resistance level identification and application

Near the previous high, or when approaching it, or when reaching the psychological ceiling of the market or a position protected by bearish positions, the price may encounter resistance and pull back.

The depth of the pullback is determined by its strength. However, once it finds support after the pullback, there is a possibility of continued upward movement. If the resistance level is broken, the price may further increase or even experience a rapid surge.

Next update will cover the identification and application of continuation patterns in uptrends. Thank you for your attention!

FX:EURUSD FXOPEN:XAUUSD BINANCE:BTCUSDT FX:GBPUSD BITSTAMP:ETHUSD

Learn How Support Becomes Resistance

Support and resistance levels are important points in time where the forces of supply and demand meet. These support and resistance levels are seen by technical analysts as crucial when determining market psychology and supply and demand.

Support is the level at which demand is strong enough to stop the asset from falling any further.

Resistance is the level at which supply is strong enough to stop the asset from moving higher.

The psychology behind support and resistance.

First let’s assume there are buyers who’ve been buying a stock close to a support area. Let’s say that support level is $50. They buy some stock at $50 and now it moves up and away from that level to $55. The buyers want to buy more stock at $50, but not $55. They decide if the price moves back down to $50, they will buy more. They’re creating demand at the $50 level.

Let’s take another group of investors. They were thinking about buying the stock at $50 but never did before. Now the stock is at $55 and they regret not buying it. If it gets to $50 again, they will not make the same mistake and they will buy the stock. This creates potential demand.

The third group bought the stock below $50; let’s say they bought it at $40. When the stock got to $50, they sold their stock, only to watch it go to $55. Now they want to buy it back at the same price they sold it, $50. They’ve changed their sentiment from sellers to buyers. This creates more demand.

A key concept of technical analysis is that when a resistance or support level is broken, its role is reversed. If the price falls below a support level, that level will become resistance. If the price rises above a resistance level, it will often become support. As the price moves past a level of support or resistance, it is thought that supply and demand has shifted, causing the breached level to reverse its role.

Thanks for reading bro, you are the best☺️

Like, comment and subscribe to boost your trading!

Dear followers, let me know, what topic interests you for new educational posts?

Market Reversal & Candlestick Pattern | Spot & Trade It Like Pro

Candlestick patterns are frequently applied for the identification of early trend reversal signs.

Here are the three most common reversal formations that you may encounter trading different markets:

1️⃣ - Equal inside bar formation

Once the price reaches some important pivot point quite often it tends to form a weak candle with a long rejection wick (long in comparison to the buddy of the candle).

In case if the consequent candle's body has the same range, we call that the equal inside bar.

It can be treated as the reversal formation ONLY with additional confirmation.

Without an additional trigger, chances will be high that the market will start a sideways movement instead.

2️⃣ - Engulfing candle

Once the price reaches some important pivot point quite often it tends to form a weak candle with a long rejection wick (long in comparison to the buddy of the candle).

In case if the consequent candle's body engulfs (has a bigger range) the previous candle, we call that the engulfing candle.

By itself, it is a quite strong reversal signal and can be applied as a trigger for opening a trading position.

3️⃣ - Engulfing candle (2X)

Sometimes, the engulfing candle engulfs not only the previous candle but also one more preceding one.

We also can call such a candle a high momentum candle.

It is considered to be the strongest reversal formation (among these 3) and can be applied as a signal for a trade entry.

❗️Remember that candlestick patterns work only on strong pivots /structure levels. Being formed on random levels, the performance of these formations is relatively low.

Let me know, traders, what do you want to learn in the next educational post?

Price Action Candlesticks Cheatsheet — The Best Patterns!These different price action patterns are great for various situations. They can be identified at a Lower time frame or Higher timeframe, pick a chart and start looking at the candles!

If you identify any of these in a chart you are looking at today, feel free to share them below.

Here is a little more about bullish and bearish candlesticks:

Bullish and bearish candlesticks represent opposite market sentiments in technical analysis.

They are used to identify the buying and selling pressure in a financial market, and help traders to predict the direction of price movement.

A bullish candlestick is represented by a green or white candlestick that has a long body and a short wick or no wick. A long green or white body indicates that the closing price of the asset is higher than the opening price. It signifies that buyers are in control and that there is bullish sentiment in the market.

The longer the body of the candle, the more significant the bullish sentiment.

On the other hand, a bearish candlestick is represented by a red or black candlestick that has a long body and a short wick or no wick.

A long red or black body indicates that the closing price of the asset is lower than the opening price. It signifies that sellers are in control and that there is bearish sentiment in the market.

The longer the body of the candle, the more significant the bearish sentiment.

Traders use bullish and bearish candlesticks to identify trend reversals, support and resistance levels, and to confirm other technical indicators.

When a bullish candlestick pattern appears after a series of bearish candlesticks, it may indicate a potential reversal of the trend.

Conversely, when a bearish candlestick pattern appears after a series of bullish candlesticks, it may indicate a potential reversal of the trend. No single candlestick should be used to make trading decisions, and traders should always consider other technical indicators and fundamental analysis before making any trading decisions.

Learn Engulfing Candlestick Pattern

☑️WHAT IS A BULLISH ENGULFING CANDLE?

The bullish engulfing candle appears at the bottom of a downtrend and indicates a surge in buying pressure. The bullish engulfing pattern often triggers a reversal in trend as more buyers enter the market to drive prices up further. The pattern involves two candles with the second candle completely engulfing the body of the previous red candle.

☑️HOW TO SPOT A BULLISH ENGULFING PATTERN AND WHAT DOES IT MEAN?

▪️Characteristics of a bullish engulfing pattern:

• Strong green candle that ‘engulfs’ the prior red candle body (disregard the wicks)

• Occurs at the bottom of a downward trend

• Stronger signals are provided when the red candle is a doji, or when subsequent candles close above the high of the bullish candle.

▪️What does it tell traders?

• Trend reversal to the upside (bullish reversal)

• Selling pressure losing momentum at this key level.

▪️Advantages of trading with the bullish engulfing candle:

• Easy to identify

• Attractive entry levels can be obtained after receiving confirmation of the bullish reversal.

☑️KNOW THE DIFFERENCE BETWEEN A BULLISH AND A BEARISH ENGULFING PATTERN

Engulfing patterns can be bullish and bearish. The bearish engulfing pattern is essentially the opposite of the bullish engulfing pattern discussed above. Instead of appearing in a downtrend, it appears at the top of an uptrend and presents traders with a signal to go short. It is characterized by a green candle being engulfed by a larger red candle.

☑️CONCLUSION

A Bullish Engulfing Candle becomes an excellent tool for the trader, once he masters how to use it properly!

❤️Please, support our work with like & comment!❤️

What do you want to learn in the next post?

📊 Candlestick CheatsheetCandlestick charts are commonly used in trading to analyze market trends and make trading decisions. Candlesticks can be categorized as bullish or bearish, depending on whether the price has increased or decreased over a given period.

It is important to note that while candlestick patterns can be useful in predicting market movements, they should not be used in isolation, and other indicators and analysis should also be considered. It is also important to have a clear understanding of the market and its underlying fundamentals before making any trading decisions.

🔹 Rails

The rails pattern is a two-candlestick pattern that typically occurs during a downtrend. The first candle is a long red candle, followed by a long green candle that opens below the previous day's close but closes above it, creating a rail-like pattern.

🔹 Three White Soldiers

The three white soldiers pattern is a bullish pattern that consists of three consecutive long green candles with small or no wicks. It typically occurs after a downtrend and suggests a reversal in the market's direction.

🔹 Three Black Crows

The three black crows pattern is a bearish pattern that consists of three consecutive long red candles with small or no wicks. It typically occurs after an uptrend and suggests a reversal in the market's direction.

🔹 Mat Hold

The mat hold pattern is a five-candlestick pattern that occurs during a bullish trend. It consists of a long green candle, followed by three small candles with lower highs and higher lows, and ending with another long green candle.

🔹 Pinbar

The pinbar pattern is a single candlestick pattern that has a long tail or wick and a small body. The tail should be at least two times the length of the body. The pattern suggests a reversal in the market's direction.

🔹 Engulfing

The engulfing pattern is a two-candlestick pattern that occurs when the second candle's body completely engulfs the previous candle's body. A bullish engulfing pattern occurs during a downtrend and suggests a reversal in the market's direction, while a bearish engulfing pattern occurs during an uptrend and suggests a reversal in the market's direction.

🔹 Morning Star

The morning star pattern is a three-candlestick pattern that typically occurs after a downtrend. It consists of a long red candle, a small candle, and a long green candle, with the small candle gapping down from the previous day's close. The pattern suggests a reversal in the market's direction.

🔹 Evening Star

The evening star pattern is the opposite of the morning star pattern and typically occurs after an uptrend. It consists of a long green candle, a small candle, and a long red candle, with the small candle gapping up from the previous day's close. The pattern suggests a reversal in the market's direction.

👤 @algobuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

What is Gap in Trading | Ultimate Guide

Gaps are important parts of the financial market, especially in stocks and currencies. They happen when an asset opens at a significantly lower or higher price than where it closed at.

Gap is a situation where a currency or any other asset opens sharply lower or higher than where it closed the previous day. Such a gap happens when there is a major event or news when the markets are closed.

It usually represents an area where there is no trading taking place.

There are three main scenarios that happen after a gap in the market forms.

First, an asset price can continue moving in the direction of the gap. For example, when a bullish gap forms, an asset’s price can continue with that trend.

Second, a gap can be filled within a few days or months.

Finally, a gap can be followed by a long period of consolidation as traders focus on the next major moves. In all these, it is always good to focus on the asset’s volume.

The most common strategy of gap trading is when you decide to enter a trade in the opposite direction of the gap. In this case, you will be betting that the asset will reverse after forming a gap. Ideally, one way of doing this is to check the trends of volume after the gap happens.

Still, the risk of doing this is that the asset will either consolidate or resume the gap trend.

✅LIKE AND COMMENT MY IDEAS✅

Please, like this post and subscribe to our tradingview page!👍

The Three Black Crows PatternThe Three Black Crows or as otherwise known Three Soldiers are a formation of price continuation showing how the bears are taking control over the bulls to reverse the trend as we can see here.

Price comes down buyers try to push it back up only to be reversed by sellers overpowering them so it falls back down the buyers try again but realise the bear is the almighty and with that last attempt they withdraw from the market causing a big sell off with a strong downward movement when just the bears remain

key points:

- last attempt of the bulls

- price goes up and bears push price down every time

- bears in control after a long uptrend shows prelude to sell

TECHNICAL ANALYSIS is the new KING ok here me out.

i'll go straight to point

this message is for the newbies (oldies gonna hate)

what is pure Minimalist Technical Analysis Trader ( MTAT : i just made this up)

-it is when u leave out all so-called indicators and focus on the chart

-some of these indis are: MACD, RSI, ATR, STOCHT....

-it's when u leave out the FUNDAMENTAL analysis and focus on the chart pattern

- i'm talking here about financial news and garbage flash news

- didn't u sometimes realize that a news come out, but the dollar act contrary to the news it-self?

HOW TO APPLY this MTAT ?

let's be practical, but first u need to watch so many charts until ur eyes pops out (it's a prerequisite).

1- always pick a 4h-time frame chart

2- always brush ur teeth before bed time

3- always look for a bullish pair to trade (this is essential for the plan to succeed)

4- after identifying the bullish pair, start looking for SUpport & Resistance...but never make the chart too complicated, u really need like 2-4 lines drawn only

5- after u draw the S&R lines, look for retracements (the pair is going down slightly)

6- use the FIBONACCI drawing tool and draw from the lowest to highest point (before the retracement)

7- it's best to focus on the 61.8% line

8- look for a confirmation candle:

a- a red Bar, which the low point of it touched (crossed) the 61.8% Fib line

b- followed by a green bar which closed ABOVE THE fib 61.8% line

c- place ur buy trade when the green candle closes

9- how to set your target:

a- use the (-61.8% or -100%) FIb levels

or

b- use the Resistance line u drawn previously

now the question is, do u really need MACD or RSI or STOCH?

of course NO, if you google it, u'll know that these reflects previous price actions? so why use it for FUTURE price actions?

what to do when big news are coming out?

IT WILL ACT ACCORDINGLY THE PREVIOUSLY SET CHART PATTERN...this will never fail you

DO YOU PLACE STOP ORDERS?

NEVER, never put pre-set stop orders,

you should be active on ur screen and wait for the price to fall to the price u set as a stoploss, AND CLOSE TRADE MANUALLY

WHY?, because when we have big news, we have volatility the pair will go up and down so hard to close all stoploss orders

then it will continue to obey the technical chart pattern as a fukn slave!

let's practice:

use the FIB Ret tool:

identify the red and green candle:

place your buy order:

et voila....

#STOP_BEING_POOR

Learn to Read the Strength of the Candlestick | Trading Educati

What it is?

Candlestick rejection strategy is a pure price action swing trading strategy. It makes use of the concept of price rejection or candlestick rejection patterns to invalidate counter-trend momentum for a trade continuation.

By applying such candlestick rejection strategy onto swing trading, it allows trades to capture spots at which market prices are at rest during retracements before rejoining back the existing dominant trend.

How to use?

Some trade recommendation for such candlestick rejection strategy is to use it as a candlestick rejection pattern on counter-trend moves. This means that we pick candlestick rejection pattern only for the sake of searching for breakout continuation with the dominant trend at counter trend waves.Entry can be made after the breakout occurs at the high or low of The Mother Bar and stop loss order can be placed at the opposing breakout side's high or low.

Further trade help can also be incorporated to help increase the trade's probability of success. For instance, it can be used together with other technical tools such as dynamic moving averages and Fibonacci retracement tool. Some may even want to consolidate other trading strategies to further increase trade’s probability of success.

✅LIKE AND COMMENT MY IDEAS✅

Please, like this post and subscribe to our tradingview page!👍

A THOUGHT EXPERIENCE ON ENTRIESIf you follow your trading plan and then get stopped most of the time ending in loses versus gains and you see the current price still go to the tp you originally thought of, then maybe it is an issue of entry.

Note. If you make good gains and you profit, this advise may not be for you.

Okay here it goes. Put your entry where your stop loss used to be and then use atr to determine your stop loss and take profit.

Start with 1 to 1 win ratio and work your way to more as you adapt this system.

Weird? I know. Test it out and see the difference.

Basics

Trending markets.

D1 and 4h agree.

1h time frame

1. News first to see if you ought to trade

2. No news, check the charts for entry. You see that nice shooting star. Meaning sell. Check the floor and ceiling so you know if chances of your tp is good.

3. Put sell limit order on top of the morning star.

4. Stop loss the atr or average true range

5. The same as your stop loss.

The reverse for buy.

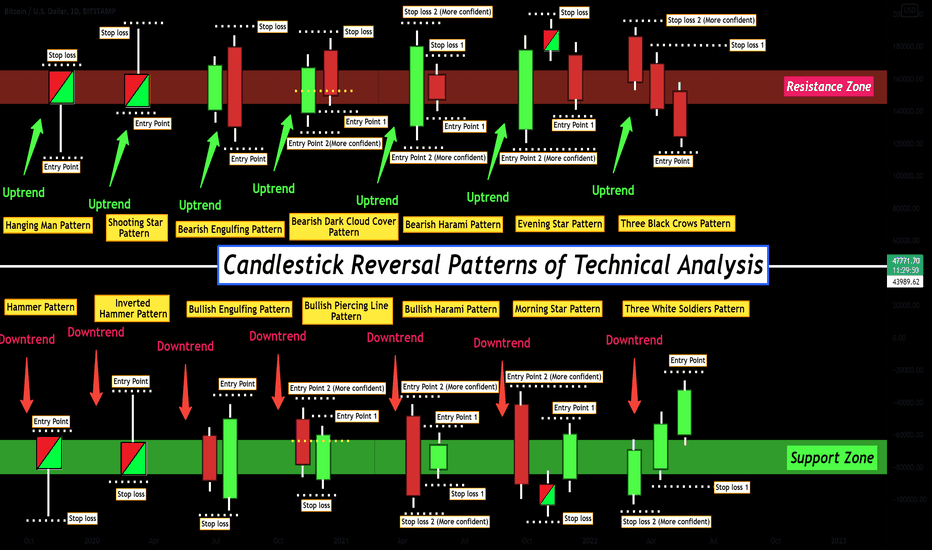

Candlestick Reversal Patterns of Technical Analysis !!!👨🏫 In this post, I tried to show you the most important Candlestick Reversal Patterns of Technical Analysis with Entry points & Stop loss points . you can use these patterns for Triggers of your traders at any timeframe ⏰ (These patterns are more valid at higher timeframes).

Please do not forget the ✅ 'like' ✅ button 🙏😊 & Share it with your friends, Thanks, and Trade safe.

What Is A Candlestick ❗️❓

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and

daily momentum for hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price

(black/red if the stock closed lower, white/green if the stock closed higher).

Bullish Pattern 🌅:

🟢 Hammer Pattern : A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. This pattern forms a hammer-shaped candlestick, in which the lower shadow is at least twice the size of the real body. The body of the candlestick represents the difference between the open and closing prices, while the shadow shows the high and low prices for the period.

🟢 Inverted Hammer Pattern : The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signaling a potential bullish reversal. The inverted hammer pattern gets its name from its shape – it looks like an upside-down hammer. To identify an inverted hammer candle, look out for a long upper wick, a short lower wick, and a small body.

🟢 Bullish Engulfing Pattern : A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the previous day's close. It can be identified when a small black candlestick, showing a bearish trend, is followed the next day by a large white candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day’s candlestick. A bullish engulfing pattern may be contrasted with a bearish engulfing pattern.

🟢 Bullish Piercing Line Pattern : A piercing pattern is a two-day, candlestick price pattern that marks a potential short-term reversal from a downward trend to an upward trend. The pattern includes the first day opening near the high and closing near the low with an average or larger-sized trading range. It also includes a gap down after the first day where the second day begins trading, opening near the low and closing near the high. The close should also be a candlestick that covers at least half of the upward length of the previous day's red candlestick body.

🟢 Bullish Harami Pattern : The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle. The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

🟢 Morning Star Pattern : A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A morning star forms following a downward trend and it indicates the start of an upward climb. It is a sign of a reversal in the previous price trend. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring using additional indicators.

🟢 Three White Soldiers Pattern : Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. The pattern consists of three consecutive long-bodied candlesticks that open within the previous candle's real body and a close that exceeds the previous candle's high. These candlesticks should not have very long shadows and ideally open within the real body of the preceding candle in the pattern.

Bearish Patterns 🌄:

🔴 Hanging Man Pattern : The hanging man is a type of candlestick pattern. Candlesticks display the high, low, opening, and closing prices for a security for a specific time frame. Candlesticks reflect the impact of investors' emotions on security prices and are used by some technical traders to determine when to enter and exit trades. The term "hanging man" refers to the candle's shape and what the appearance of this pattern infers. The hanging man represents a potential reversal in an uptrend. While selling an asset solely based on a hanging man pattern is a risky proposition, many believe it's a key piece of evidence that market sentiment is beginning to turn. The strength in the uptrend is no longer there.

🔴 Shooting Star Pattern : A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. It appears after an uptrend. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day near the open again. For a candlestick to be considered a shooting star, the formation must appear during a price advance. Also, the distance between the highest price of the day and the opening price must be more than twice as large as the shooting star's body. There should be little to no shadow below the real body.

🔴 Bearish Engulfing Pattern : A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up (up candle).

🔴 Bearish Dark Cloud Cover Pattern : Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle (typically black or red) opens above the close of the prior up candle (typically white or green), and then closes below the midpoint of the up candle. The pattern is significant as it shows a shift in the momentum from the upside to the downside. The pattern is created by an up candle followed by a down candle. Traders look for the price to continue lower on the next (third) candle. This is called confirmation.

🔴 Bearish Harami Pattern : A bearish harami is a two-bar Japanese candlestick pattern that suggests prices may soon reverse to the downside. The pattern consists of a long white candle followed by a small black candle. The opening and closing prices of the second candle must be contained within the body of the first candle. An uptrend precedes the formation of a bearish harami.

🔴 Evening Star Pattern : An evening star is a stock-price chart pattern used by technical analysts to detect when a trend is about to reverse. It is a bearish candlestick pattern consisting of three candles: a large white candlestick, a small-bodied candle, and a red candle. Evening star patterns are associated with the top of a price uptrend, signifying that the uptrend is nearing its end. The opposite of the evening star is the morning star pattern, which is viewed as a bullish indicator.

🔴 Three Black Crows Pattern : Three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Candlestick charts show the day's opening, high, low, and closing prices for a particular security. For stocks moving higher, the candlestick is white or green. When moving lower, they are black or red. The black crow pattern consists of three consecutive long-bodied candlesticks that have opened within the real body of the previous candle and closed lower than the previous candle. Often, traders use this indicator in conjunction with other technical indicators or chart patterns as confirmation of a reversal.

All Four ICT Killzones plus times on one chartJust wanted to put all four ICT Kill Zones to see:

All are 2 hours in length, except London open kill zone which is 3 hours in length.

AUDCAD 15 minute chart today worked out great related, all four kill zones could have made profits for a traders if done right, which Time & Price.

I do not trade AC during London Kill Zone related to both sides not being in session- Sydney would have just closed & NY has not opened yet.

The chart is just visually showing you exact time - all times or kill zones are NY session times ( you would need to translate them to your time- or like me I just put my charts on NY times (lower right), why? because you hopefully know the time it is, where you live... lol

Wish you best,

Keep forex trading as simple as you can, so you can enjoy life and keep in balance of body, mind & soul.

London Kill Zone Close (ICT concept) 4 of 4London Kill Zone Close (ICT concept) 4 of 4

Hours are from 10am to 12pm New York Time/EST

1) London session is closing, so one more pump or dump mostly happens before liquidity and volume to end of session gets lower

2) Trade majors with USD pairs

3) Look for 10-20 pips on a short scalp during this time

4) Don't be greedy- get your little piece of pip pie and then turn off computer and get some fresh air. Balance is key to life- not staying indoors always.

5) Look at what that pair has been doing for last few days or week and see or visualize what this LKZC wants to do- get on short trade train.

6) Do your homework with all of these Kill Zones noted in this series, take notes, practice what you would do in live trading if you see certain setups.

With you best in trading and life-

Stay Safe Always

New York Open Kill Zone (ICT concept) 3-4New York Open Kill Zone (ICT concept) 3 of 4

Times are from 7 am to 9 am New York Times/EST

1) You see a lot of both liquidity and volume with overlapping sessions of both London & New York

2) Better to use only majors or pairs with USD in them, like: EU, AU, UJ, GU, UC & NU

3) Nothing happens always in Forex, but one or more of the noted pairs above will have a setup to trade during this time, to give you 20-30 pips.

4) New York Open Kill Zone will do either two things during the session: Either be a continuation from London and go same way and/or be a reversal

in direction and make a low for the day.

5) During this NYOKZ- a lot of economic news releases happen which will either pump or dump a USD pair, so be cautious around news times.

6) Noted on chart is EU 15 mn chart, which you could have set up a 12 to 20 pip sell trade or scalp during this time period.

7) Look at bigger picture then noted 15 mn chart, higher TFs give you marco perspective so you do not get tunnel vision when trading on 15mn or 5mn Tfs.

You need to be able to read structure, price action, support and resistance areas, round numbers- Always remember time and price of day.

Stay safe, wish you best in Forex & Life.

Always on every trade control Risk and Reward by using only 1% to 2% of your account maximum per trade- related to a sound strategy and/or plan.