Even Gold Is Subject To Manipulation and ControlAll the hu ha hu ha of the Gold Bugs calling that Gold is a sound money and nothing can manipulate the Gold price. Gold is subject to supply and demand.

The word manipulation has been abused by people so many times. They think that manipulation comes in the form that someone is trying to manipulate the price of an asset "SHORT TERM". Nope, short term manipulation can't work and will never be work.

Manipulation that I have been referring to including in all my past ideas are "LONG TERM MANIPULATION".

You need to understand that the dynamics of markets are moves by its participants. Therefore, the much easier way to manipulate a market is by doing that PSYCHOLOGICALLY.

That's why bubbles ALWAYS exist, because it is the job of the manipulator to push the price of an asset BEYOND people BELIEFS and IMAGINATION in order to LURE THEM into it.

If everyone is rational and behaves rationally, bubble WILL NOT EXIST.

That's the reasons why there are so many dumb people and the number of people who understand financial literacy are awful. Because the system is designed in that way. It always about the Elite making money and RIPPING OFF the dumb people.

So, the only way for you to win this battle is to THINK and BEHAVE like the Elite, NOT LIKE THE DUMB PEOPLE OR MONEY.

You need to bring you conscious and awareness AWAY FROM MAINSTREAM and from the CONVENTIONAL WISDOM.

Remember, the CROWD and MAJORITTY always wrong. That's who market works.

Gold is an interesting case study. Its an example of how assets work and how capital flow works.

Gold has never been going up forever. In fact, from 1980 to 2000, Gold SEVERELY underperformed the stock market.

Even now, Gold started to go back up and start to fight back with stocks market.

But can Gold outperform stocks? It depends, it depends on what the elites want to do.

The tricky part here is that most retailers are NOT in stocks. So, the Elites can't simply drop and crash the market, because everyone has sold out.

Its a tricky situation.

And that's why I like to think in terms of whales and all these market manipulators, because they do exist and they do have strategic and comprehensive plan.

As long as you keep thinking that you can beat the market, then you are doomed, You need to remove all the noises in your mind and start to think and behave like the elites/whales.

Commodities

Trading MindsetWELCOME TO WORLD OF TRADING

Hi everyone, what I am about to talk right now is concerned with trading psychology. Everything that I am about to say right now is also a crucial aspect of my psychology and mindset that is fueling me to write this for you guys. Hence, we can deduce one thing from this. Psychology is the most important factor in deciding your future as trader. I will be honest upfront with you guys. So you’ve been introduced to the world of trading by your friend, family or anyone that doesn’t matter, so you’ve been told how the guy next door is making thousands of dollars with just few hours of work while you out there hustling yourself to exhaustion and making just about to survive your month doesn’t seen fair right? And exactly this guy has results to show for it to make you believe how if he can do it anyone can. Or you’ve seen couple of stories, Instagram post, Facebook post promising exponential gains in a few hours. With that said I want to address 2 main problems associated with trading which I believe are significantly important to understand before you step out there or if you’re already out there and struggling.

1) Holy grail in trading (a way or a method that will promise you returns on daily basis)

Holy grail in trading what is it and does it exist? To answer this question, I want you to ask yourself a question first: why you are trading and what do u want to achieve from it

Now that you’ve asked yourself that kindly note if the answer to these questions is (firstly: I want to accumulate wealth as soon as possible and drive a luxurious car next month. Secondly: I only want to find a way in trading that works 100% and gives me return on my investment daily)

If these are you believes I am afraid to say you have work to do on yourself not on your system of approach of trading.

Financial markets are a world of chaos there are millions of possibilities out there every day

(imagine you just focus on 1 possibility consistently every day, where will that take you in the next coming years think about it)

There are successful traders out there, trading and making living out it (the so-called narrative only 5% of people can make money in the markets) where’s the difference? The difference lies not on support was breached, trend line was broken or respected but on their mentality and mind set these people very well understand how market moves and work but be cautious they will never follow the market: no one in world has the intellect and memory to remember each and every tick movement of the market these people are focused on themselves and their performance in the market. They know exactly when to trade and when to stop trading. The approach of such people is not irregular but systematic and disciplined.

To sum it up financial world is a world of chaos with billions of possibilities (FOCUS ON THE ONE THAT MAKES SENSE TO YOU AND COINCIDES WITH YOUR PERSONALITY AND ROUTINE) anyone can trade Weather your doctor or an engineer or just a high school student provided you are consistent, disciplined and motivated (YES UNDERSTANDING OF MARKET MOVEMENT IS VERY CRITICAL BUT YOU DON’T HAVE TO FOLLOW AND TRADE EVERY MOVE).

2) More importantly your Mind set (psychology)

Now if you remember I asked you 2 question in the beginning 1st paragraph. If you focus on the fundamentals of that question, they are based on you and your way thinking (NOT ON YOUR METHOD OF TRADING LIKE I STRESSED EARLIER THERE ARE BILLIONS OF WAY OF MAKING MONEY IN THE MARKET STICK TO SOMETHING U BELIEVE IN ) I myself have been trading for almost 1 year am I a millionaire? No, I am not (and I say it proudly) I too was introduced in a conventional way just like many of you are. But trading (IS NOT A GET RICH QUICK SCHEME) (THIS NEEDS TO BE OUT THERE)

but rather a skill set and unregulated chaotic state of mind that needs correction and discipline of execution which will I guarantee you results which brings me to my final and most important point

YOU ARE THE MOST IMPORTANT PART OF YOUR TRADING JOURNEY Focus on yourself (yes u do need to understand the dynamics of market and its movement but alone with that I’m sorry to say you can’t achieve what u hope to achieve

Let’s do some simple math’s in term of percentage shall we to give you an idea what I’m talking about

Account size USD % return on investment USD ROI Account size X10 USD % return Usd ROI

1000 2 20 10,000 2 200

10000 2 200 100,000 2 2000

100000 2 2000 1,000,000 2 20,000

Don’t exhaust yourself trying to get rich fast as possible that won’t work at least not in the long run focus on getting solid return percentages first weekly, monthly, yearly consistently and get a job to build yourself step by step don’t rush the process and always believe in yourself

give me a like if you agree

OBSERVING CRUDE OIL IN A 1 MINUTE PERSPECTIVE (Visual Only)Someone brought this to my attention in oil chat and decided to have a look myself and you really do get to see so many tradeable scalping opportunities.

Never bothered to look at oil this way before, but this is very insightful to me, thought I ought to share.

If you are a pattern trader, then you really ought to start analyzing market this way in my opinion.

Highlight for this idea goes to @mikkel-j ... Now get pattern spotting guys.

BELOW IS A TEST CHART IN 1 MIN TO FOLLOW AND SEE IF PATTERN PLAYS OUT.

Three Percent Trades: Educational PostThis is an example of how we calculate range movements on a breakout. It comes down to simple math to calculate a measured move.

We simply take the high and subtract it from the low of the range. Then you add the high plus the difference to get your measured move.

If the trade moves in your favor you will want to add to your winners as it trends higher. You should add to your position on future breakouts of consolidation, and on any sign of weakness we sell half our shares to lock in profits and play with house money.

Following this will help protect your hard earned capital and allow you to let your winners run.

EW Analysis: OIL + EURUSD + BTCUSD In Positive Correlation?!Hello traders!

Today we will talk about correlations in different markets!

Correlations are very important to recognize the direction. There are positive and negative correlations, but what we currently see in the FX market (EURUSD), Commodity market (Crude oil) and Cryptocurrency market (BTCUSD) is that they are in tight positive correlation! So, if we respect what market is doing and considering Elliott Wave bullish setups, then we can expect a bullish continuation for the next few weeks soon!

As you can see, Crude oil has clear five waves up and three waves of correction back to very important 50%-61,8% Fibonacci retracement, which means that it's already formed a bullish setup and it may easily continue higher in the upcoming sessions!

EURUSD is still forming the final wave (c) of a correction that can retest 50%-61,8% Fibonacci retracement and 1.1000 support level at the beginning of the next week, from where we can expect to follow Crude oil within an uptrend!

And looking at BTCUSD, just like EURUSD, it can be ready for a decline into wave (c) to a complete a three-wave corrective setback, where 50%-61,% Fibonacci retracement and 10000 level can be tested before an uptrend resumes together with Crude oil and EURUSD.

That being said, there are no tick by tick correlations, but from our experience, they always somehow get caught in the end.

However, there's nothing confirmed yet, but if Crude oil stays above wave (c), and if in the meantime EURUSD and BTCUSD bounced from projected support levels in an impulsive manner, then we can easily confirm a bullish continuation!

Be humble and trade smart!!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

How to Become a Better Trader - Top Books for Reading!I got a request asking about interesting books which can teach how to trade properly. Now I would like to share with you my list- the best Authors and Books from my point of view. I read these books, and I should say they gave me priceless knowledge and experience. I saved a lot of time and became a better trader very quickly. The same I wish you!

Don't forget that you always have a choice:

- Make your own mistakes, do your own research, and study trading by yourself

- Read books and get knowledge, experience from them. This way allows you to move much faster!

Knowledge is one of the most part of profitable trading!

Recommended Books and Authors:

Jack D. Schwager

“Getting Started in Technical Analysis”

“Market Wizards, Updated: Interviews With Top Traders”

“The New Market Wizards: Conversations with America’s Top Traders”

“Stock Market Wizards: Interviews with America’s Top Stock Traders”

Alexander Elder

“The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade Management”

“Entries & Exits: Visits to 16 Trading Rooms”

Curtis Faith

“Way of the Turtle: The Secret Methods that Turned Ordinary People into Legendary Traders”

Steve Nison

“Japanese Candlestick Charting Techniques, Second Edition”

“Beyond Candlesticks: New Japanese Charting Techniques Revealed”

Kathy Lien

“Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Moves”

“Millionaire Traders: How Everyday People Are Beating Wall Street at Its Own Game”

Brett N. Steenbarger

“The Psychology of Trading: Tools and Techniques for Minding the Markets”

“The Daily Trading Coach: 101 Lessons for Becoming Your Own Trading Psychologist”

P.S. I hope I won't be banned for this list. Also, if you read interesting books which are not in this list, please share them in comments.

Gold plan before NFP ( not recommend to trade)Gold rebounce at my TL

it show hope of bullish still alive.

This only my idea . It is so Risk .

I am not recommend to trade.

I only use this for my trade plan.

This idea must prepare high drawdrown.

and everthing can occure in #NFP

PS: for whom ask me about direction in my opinion.

GOLD: A lower buy opportunity that may arise on the long term.Gold has been on a very aggressive rise since it broke the 1,380 long term 1W Resistance. Recently it made contact with the Higher High trend line of its 1M Channel Up (RSI = 73.372, MACD = 46.760, Highs/Lows = 196.7521). Undoubtedly we have entered a new long term multi year Bull Cycle but that doesn't mean that the uptrend won't be without lows. Long term traders should look for pull backs to take advantage of as dip-buying opportunities. In order to identify those we looked into the early 1W candles of the past Bull Cycle in 2000.

There are quite a few similarities of the 2000 Bull Cycle start with the current one. In the 2000s, the bear market bottom gave rise to a Golden Cross on 1W. That sustained the uptrend within the Channel Up until a new Higher High. Following that Higher High, Gold made a pull back to touch the 1W MA50 where it found support and on the next rise broke the Channel Up essentially starting the parabolic rise all the way to the 2011 All Time Highs.

Similarly the former bear market has made its bottom in late 2015 and the Higher High that followed built up the 1M Channel Up. Following a Golden Cross, the market consolidated for 2 years (unlike the early 2000) and recently broke the 1,380 Resistance to make a Higher High. If the 2000 model is followed then we may be looking for a 1W MA50 test by the end of year - beginning of 2020, which should be an optimal long term buy opportunity for a break above the Channel Up at $1,700.

Investing in Gold should be a priority for every fund, long term investor for at least the next 5 years. We will be updating our thesis on Gold with shorter term opportunities regularly.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

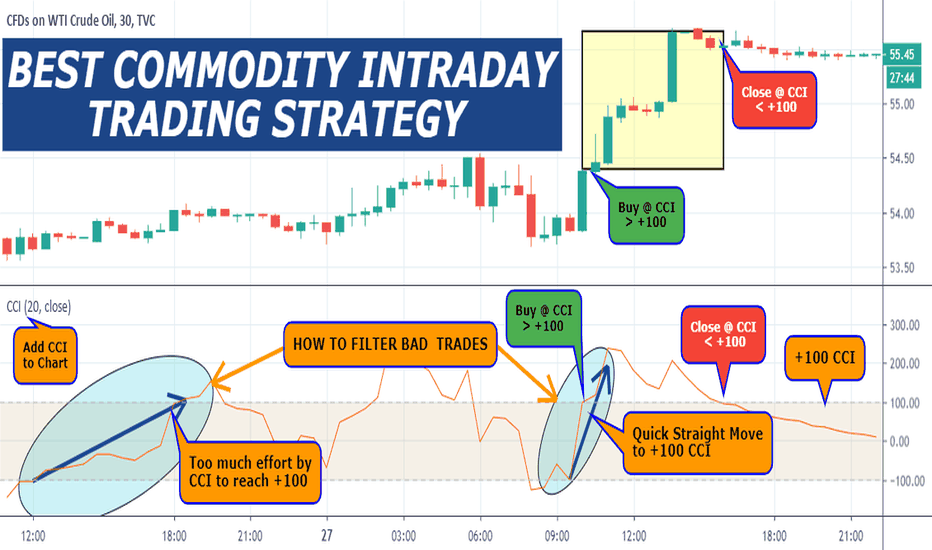

BEST COMMODITY INTRADAY TRADING STRATEGY Before we outline the best commodity intraday trading strategy, it’s important to understand that trading commodities are different from trading Forex or stocks. Every financial asset has its own set of unique characteristics. The commodity market has its own behavior, that’s why some strategies are more suitable than others to generate profits from commodity trading.

We’re going to reveal some of the most well-kept commodity trading secrets only known by successful commodity traders.

Let’s now see what commodity trading strategy you can use to buy and sell products in the commodity market.

Here is the link to "Best Commodity Intraday Trading Strategy" pdf.

tradingstrategyguides.com

BITCOIN VS GOLDI am seeing divergence in GOLD and BTC. BTC seller pressure and GOLD buying...people are "unsure" in the economy as to what is happening, they don't even want to think about elections, brexit stuff is still happening, JPY yen is getting stronger and BTC has corrected almost 50% this year..Asia holds most of BTC so as it climbs so does Yen alongside trade wars with the US. Lots of movement happening. Trump fuds dollar "too strong" as though it weakens and we keep pushing upward to try to make a new high before the value actually falls here later on....Play it safe everyone ^_^

Yellow Line is Gold...I like seeing when both gold and btc line up and move together...I will expect GOLD to fall and BTC to rise after 2021 opposite of each other for awhile. I want to see both move in the same direction again here in a few months probably closer to Christmas time.

Gold chart is high..dont buy high lol...just know it has been rising as BTC has been correcting. That is all this idea is for observing. Thanks everyone!

Bearish flag analysis on XAUUSD (gold)From the chart, there has been an increase in gold in a close-knit candlestick pattern, with it increasing value.

This has caused a bearish flag to arise.

This is recognised due to:

1. quick increase to reach the basis of the flag.

2. once it was reached began forming an upwards flag shape with close-knit candlestick high/ low closes.

3. once the flag lines (orange) got closer together, there is an expected bear break out due to it being a rising flag.

4. This is also backed due to the reduced volume once the flag is reaching a close.

5. as it can be seen, the break out downwards should see the price of gold to begin to slowly fall.

However, this is not the case lately due to today's actions by the Dow in response to Trump's tweets about China.

Nonetheless, if such didn't occur this should see the XAUUSD to fall lower to reach 2nd support, leading to either consolidation or a bounce off support to bring the price of gold back up. If this did not occur gold prices will be in a downtrend.

Due to Trumps recent tweets and fears of a recession due to the inverted bond yields, this may see gold prices to continue to rise upwards breaching resistance and being able to surge past $1580.

This is an example of a bearish flag and can be used to analysis all other shares, crypto's and commodities, if probable analysis is completed.

Mirror levels, How it can save you years and thounthends of USD.Today I want to share with 1 one type of key levels and also explain why it's so profitable for you to use it. This knowledge will save you years in trading and thousands of dollars.

For a start lat`s discuss some fundamental rules in trading:

1. We trade probabilities. It means it's impossible to say with 100% accuracy current signal will close with profit or not but it's possible to say that if we open 100 entries we will close 50% ... 60% or 70% entries in profit.

2. You don't need to hunt for 100% accuracy. That's one of the most common mistakes of freshers because if you will learn what is Risk / Reward you will understand how really you can make money in trading. You can be profitable even if you have 30% — 40% of profit deals if you take enough risk/reward.

Example of risk-reward. Just imagine that you have a risk per 1 position $100 and you always set potential profit (Risk/Reward (R/R)) 1 to 4 (in 4 times bigger) $400.

If you will get 3 losses and 1 positive entry you still will be in profit. Calculations: -$100 -$100 -$100 + $400 = +$100. It is only 25% accuracy.

3. You always need to use the same risk per 1 position only in that case your mathematical expectancy will work. I will write more about it in the future posts if this idea will get more than 100 like.

When we trade key levels we get:

- Accurate entries.

- Low predictable risk.

- Potential profit is in many times bigger than a risk.

Mirror level is: Support become Resistant or Resistance become Support .

How you can find a mirror level? Drow key level and wait when the price will break it. Below I will show you how I do it. Key levels better to build on:

- Trend change points

- Many daily candles bounced from one level.

It will be the most powerful levels which accumulate a lot of volumes.

Examples:

EUR/USD:

Gold:

SP 500:

OIL :

BTC/USD:

You can see that this system works on all markets.

P.S. It is only a first part about mirror levels. I will write more about: how it`s better to find levels on a chart, meanig of it and how big players accumulate volume using such type of key points if this post will reach 100 like.

P.P.S. Write in comments about what questions you have about Mirror levels.

How to open accurate entries with key support resistance levelsIn this Education posit I want to share with you how to pic best places on a chart. Where to open entries with potential profit in 5...10 times bigger than a risk.

I recommend to use Historical levels or Breakpoint of the trend:

- Most of the retail traders set stop Losses below or above such key levels.

- Stop Losses of retail traders is a Fuel for Big Players.

- You Have low and predictable risk if you open entry after the false breakout of a key level.

How to find such levels on a chart?

- Price bounced from it and started a new trend.

- An instrument made deep pullback from that point.

What can make entry more accurate?

Price sharply came to such level. Moved 2 or 3 Average daily move.

UK OIL Example. 01 Aug 2019 oil rate drop-down 400 pips. It's more than 2,5 average daily move. after a false breakout price bounced up 300 pips. Risk in that entry was 30 pips. Potential profit in 10 times bigger.

Examples:

1. US 2000 Index

Price bounced from the breaking point 1454,6.

2. UK 100 Index

3. Dax

4. EUR/GBP

5. US OIL www.tradingview.com

If u trade such level u can take in 5...10... bigger than you risk.

P.S. Write your thoughts about this strategy.

P.P.S. After 100 like I will write another educational post about my trading strategy and how you can use it.

How much value has the dollar lost since 1971?Against the Swiss Franc which is also a fiat shitcoin, the USD fell 84% from 1971 to 2011 (40 years).

Just by looking at how much it fell compared to Gold from 1975 to 2011, the USD lost 94% of its value. (1/XAUUSD = USDXAU)

The same and worse holds for most fiat shitcoins right now.

As for Bitcoin and USD, Bitcoin came into life when the USD restarted its uptrend after having lost a lot of its value against most other fiat currencies. There isn't a significant correlation we can spot between the two, even though over the last 2 years there seems to be more of a negative correlation.

Even if the US gets stronger against other fiat currencies, most central banks are going to print so much that even if the Dollar gets stronger, Gold and Bitcoin could keep appreciating against the dollar and other fiat currencies.

A Renko Strategy for Trading - Part 9This is intended more as educational material on a strategy for using renko charts. To begin with, I'll be using USOil in the examples but will include other markets as I continue through the series. The material is not intended to prescribe or recommend actual trades as the decision to place trades is the responsibility of each individual who trades as they assume all risks for their own positions and accounts.

Chart setup :

(Part 1)

Double Exponential Moving Average (DEMA) 12 black line

Double Exponential Moving Average (DEMA) 20 red line

Parabolic SAR (PSAR) 0.09/0.09/.23 blue circles

Simple Moving Average (SA) 20 blue line

(Part 2)

Stochastics 5, 3, 3 with boundaries 80/20 dark blue/light blue

Stochastics 50, 3, 3 with boundaries 55/45 red

Overlay these two on one indicator. Refer to 'Part 2' as to how to do this

(Part 3)

True Strength Indicator (TSI) 14/4/4 dark blue/ red

Directional Movement Indicator DMI 14/14 ADX-dark green, +DI-dark blue, -DI-red

Renko Chart Settings

Crude Oil (TVC:USOil): renko/traditional/blksize .05/.10/.25

Natural Gas (ngas): renko/traditional/blksize .005/.010/.025

Soybeans/Wheat/Corn (soybnusd/wheatusd/cornusd): can use the ngas setup

S&P 500 (spx500usd): renko/traditional/blksize 2.5/5.0/12.5

Euros (EURUSD): renko/traditional/blksize .0005/.0010/.0025

SUPPORT AND RESISTANCE A major mistake traders make is to assume that in order to be profitable you need to use so many tools and it's in fact the opposite.

Let's start off with basic support resistance. We know the market moves up, down and side ways. But it never moves straight up or down. As it moves up or down it will meet levels of support and resistance. It's important you understand where these levels are on which ever pairs you trade.

SUPPORT - you will meet points of support mainly in a downtrend. As pointed out above, you can see there are more points of support than resistance. So remember support will appear below price, below the candlesticks. see it as the floor of the chart.

RESISTANCE - You will meet points of resistance mainly in an uptrend, support is the 'roof' it will appear above price. Price meets head on with resistance levels.

Previous support/resistance turning into future resistance/support - Previous support can turn into future resistance, this is where price will break through this support in a downtrend and the come back and retest this level ( as shown in the chart above) . This previous support is now resistance. This also applies the other way around.

Support and resistance levels are points within the market where price will pivot. There are also levels in the market where price will gain momentum before continuing a move.

You always want to plot these levels on the higher time frames as the levels on the higher time frames will hold more significance. i.e. support on the daily time frame will hold a lot significance than support on the 1hr time frame.

Hit that follow button for more stuff to come..

A Renko Strategy for Trading - Part 8This is intended more as educational material on a strategy for using renko charts. To begin with, I'll be using USOil in the examples but will include other markets as I continue through the series. The material is not intended to prescribe or recommend actual trades as the decision to place trades is the responsibility of each individual who trades as they assume all risks for their own positions and accounts.

www.investopedia.com

Chart setup :

(Part 1)

Double Exponential Moving Average (DEMA) 12 black line

Double Exponential Moving Average (DEMA) 20 red line

Parabolic SAR (PSAR) 0.09/0.09/.23 blue circles

Simple Moving Average (SA) 20 blue line

(Part 2)

Stochastics 5, 3, 3 with boundaries 80/20 dark blue/light blue

Stochastics 50, 3, 3 with boundaries 55/45 red

Overlay these two on one indicator. Refer to 'Part 2' as to how to do this

(Part 3)

True Strength Indicator (TSI) 14/4/4 dark blue/ red

Directional Movement Indicator DMI 14/14 ADX-dark green, +DI-dark blue, -DI-red

Renko Chart Settings

Crude Oil (TVC:USOil): renko/traditional/blksize .05/.10/.25

Natural Gas (ngas): renko/traditional/blksize .005/.010/.025

Soybeans/Wheat/Corn (soybnusd/wheatusd/cornusd): can use the ngas setup

S&P 500 (spx500usd): renko/traditional/blksize 2.5/5.0/12.5

Euros (EURUSD): renko/traditional/blksize .0005/.0010/.0025

BTC EDU post - 100 followers THANK YOU!TL;DR - Go back in history from 1928 to today and research A.i. design / Banking / Market psychology cycles / the 1987 crash / - We are living in a butterfly effect wave caused by your world leaders when gold lost the greenback and it was no longer backed by the green anymore. If you are young in the markets you will want to read this. If you are over the age of 30 you most likely understand a lot of this...

This is a story I decided to type up for my followers. Thank you very much for being so support even by liking and following. If you are young it is important for you to really read this....

----------------------------

The year was 1999 and I was just 10 years old. At this time I didn't care much about the markets or money unless I wanted some candy or a new bike. One thing that did catch my attention was the panic and scare of something that was called the "Y2k Bug" where everyone thought all computers were going to reset to 0 and destroy lots of information data and loss of funds throughout accounts in global tech businesses. Luckily for me, I was a kid fascinated by technology and told my parents to not even worry that the problem was going to be resolved and most likely the news was just wanting to scare everyone. Because I was huge into conspiracy as a kid it actually took into my favor....See...I grew up liking conspiracies, aliens, etc etc...and with only less than 500 million people in the world on the internet pre-2000 I had quite an advantage as a child having access to information at my fingertips through my 56k modem. I did whatever any kid addicted to his favorite toys would do and started to learn for over 10 years about the growth of technology and A.i. Back then the dark web existed with less than 1 million people in it....did you know that?? So here is the point of me telling you this...a portion of the public was scared out of the market before it peaked and this made many people think we had just had a price correction once the market started to dump. Well most were wrong and the market kept dumping just like bitcoin did in 2018...the hype of the internet boom was over and real world use had started to take place..the market was slow...it took 4 years to crash 70% and 16 years to bloom golden apple trees for people who DIDNT GIVE UP AND FOLLOWED WHERE THE INTERNET WAS TAKING US INTO THE FUTURE!!!!!

I am here to tell you we have just started playing with this technology on a larger scale.....and we are going through a very similar cycle but there are new pieces at play. Those pieces are defined into 3 simple words...

Artificial. Intelligent. Design.

Do you know that 50% of bitcoin holders today were not in BTC in 2016 or 2017? The majority of people who came into this market have been entering since the mini bubble of 2018. Why do I say mini? Because the Dot com bubble hit over 5-7 Trillion dollars before it truly crashed. Some have claimed as much as 10 Trillion in certain locations of the world. ..What I call bubble in crypto is simply a "test run" of how the people of this world will take to this technology. In 2016 Btc was between 500-800 dollars. If the block chain leaders of today have already got their prosperity and now are recycling price to grow it realistically...we can very well see prices as low as $1,000 because I feel most of the large capital investors who are holding their initial amount they got in with have reset that same amount at around the 1K marker so they break even on the investment that has also paid for itself for a future to grow with. Think about it....Charles Hoskinson (ADA), Vitalik Buterin (ETH), Dan Larimer (EOS), Charlie Lee (LTC), ...ALL OF THEM STARTED NEW PROJECTS TO ADVANCE THE TECHNOLOGY AND MAKE IT BACKWARDS COMPATIBLE WITH BTC!!!!

So if all of them own some bitcoin still...are bullish on it...building networks to connect to it...AND developing better protocols AROUND IT LIKE A FKN SOLAR SYSTEM>>!>!>!> WHAT DOES THIS TELL YOU???!?!

They have to obey the rules of the leaders of the world and our government on what they decide....so they are placing their chess pieces accordingly so even if bitcoin fails.. the grand architectural design of the new systems will be in harmony on a new system that can simply "snip snip" other networks out if need be. Personally...I don't see it going anywhere near 1,000 again but I do not exclude all options...I see it slowing down a lot and stabilizing with realistic price growth based off real world use-case by the banks, governments, corp leaders, etc etc...and for you conspiracy fans...the shadow government which is where I personally think BTC came from ;)

Personally I believe price will hit 1900 - 3300 zone again and we will have 3 falling valleys with a fake out descending triangle just like GOLD looked like when the greenback was no longer supporting it...it dipped below then slowly kept going up and up and never stopped climbing for over 20 years..if bitcoin is like the gold of the internet then you better get it now while supply is cheap because a million dollars today isn't much in the large scheme of things. It will become "heavy" in data...it will be "heavy" in the cost to carry it and pricey to exchange it so it can stay controlled by few with very little common folks being able to have "1 whole bitcoin."

It will be like how people chase 1 million dollars today...they might very well be trying to chase 1 full bitcoin in the year 2040....

ARE YOU SEEING WHAT IS HAPPENING??

These block chain leaders are playing it safe...if bitcoin fails to stay around and becomes history..it will be a piece of history worth holding because it was THIS digital asset that started the global change for the next 80 years...a plan that has been set since the stock market crash of 1987...the year I was born...what a time to bust out the baby guns and enter this chaotic world huh??

It takes 10 years to remold technology but its about to re-define the next 80...and you already see how fast technology grows....

The people who lost everything.....

their pensions....their homes...their savings.....these people are the ones who have stood up to make a new design "fair" and so the world leaders have heard them because WE stopped giving a shit about their banks and loans and started using their own system against them. When you make millions of peoples lives hell and 90% of them are mentally poor...eventually they will go into survival mode and do whatever it takes to survive. You can't piss off a world of people and expect nothing will happen from the outcome when you suppress them to try and fix your own mess : / (the market crash couldn't be stopped so they have had to try and come up with a new design since then...)

I am about to wrap this up and I apologies this is so long but I felt compelled to share after reviewing some old stuff today.....

So think about this....

22% of student loans fall into default...1/5th.. For many, the payments are proving unmanageable. By 2023, nearly 40 percent of borrowers are expected to default on their student loans.

Over the past 20 years we had the economy stabbed by a "recession" and even I felt it at age 17 working 2 jobs....

(look at the market cycle crashes from 1982 to now....Funny patterns will begin to show and tell you the story...how ..and why.....)

The kids who grew up and graduated between 2000-2007 is the generation who has had to feel the PAIN of our parents struggle to survive an economic turbulence caused by our very own governments of the world because THEY DIDN'T KNOW WHAT TO DO SO THEY PROTECTED THEMSELVES WITH NEW OVER-LAPPING LAWS, NEW LOANS, AND GREEDY WAYS...I don't blame them...I would have protected my family and self as well......I blame the lack of communication between the people and the movers and shakers..I fault the education system for not having the integrity to make it a point to TEACH the importance of money and how it really effects our world in trade and to survive from birth to death....the education system historically was designed to create industrial manufacturing workers...don't believe me...look it up...you will be mind blown how the system went from "teaching to supply workers to grow the world" to "teaching to make people careers and jobs"

I am not saying that the education system was developed to make new world order slaves or some crap...I am saying that over the years ..lots of information has been manipulated and left out to teach as a necessity for living life.

Money. Education. The way knowledge moves....

All of it is about to change and how it will effect you will be up to you.

The 1987 crash not only scared us...but it scared them as well......they knew something had to change when they couldn't control the market from crashing...this is when the white paper of distributed ledger protocols started to come into shape. Yes that is right...there was a protocol design just like bitcoin prior to the age of bitcoin post-2000.. Google it..you will find it...

-------------------------------------

Let me take you back some in time and what I learned as a kid and why I am so focused in the world of artificial intelligent design and why this is important to pay attention to not only as a new investment vehicle but as a whole new cycle is in our markets . It will begin starting now and begin transitioning in 2020. Most of us in our middle/young adult years will see how quickly these next 20 years grow and change and Im sure it will make all of us feel very old since some of us got to play with a nintendo and some in this realm and who could be reading this have had the pleasure of playing pac-man on an Atari....

I want you to really think big here. If you were a world leader planning for 100 years of growth for your family legacy and the families of the world for a stable growing world thats in chaos..what would you do??? You would plant the seeds today for your kids tomorrow and you would begin a rough draft of a new era before you started to write the final draft......

If you are 24 years of age or older and reading this you know damn well we have no pension plan for us. You know damn well there is no PLAN for us to retire...we have to make our own plan. I feel as time goes on the middle class is becoming more "spread" apart in order to truly have multiple ladders of wealth to play from...in a sense creating a human liquidity source of workers no matter what the outcome is in life on one side of the world or the other....so we always have a working class and a leading class. If you make the financial road longer...it will take longer for families to generate wealth without innovation...machines are 20% or more of what physical labor used to do...think about that...use your brain or work for pennies will become the next thing. We will always need engineers but you need to see how the job force changes. Some jobs will fall forever and become history and replaced by robots. Some jobs today already are at that point.

It will take hundreds of years to become wealthy enough to be a leader of the world in 100 years time...mark my words...this is the only time in our world in our time at our age (if you are around my age) that will be able to have an opportunity to be on the wealthier side of the fence by simply planting your little cryptocurrency seeds across the new designed web 3.0

NOW for this to make sense you need to be taken back to the year 2000....

Take back to the year 2000

The Nasdaq index peaked early March on the 10th of the year 2000 and nearly double over the prior year. Right at the market’s peak, several of the leading high-tech companies, such as Dell and Cisco placed huge sell orders on their stocks, sparking panic selling among investors. Within a few weeks, the stock market lost 10% of its value. As investment capital began to dry up, so did the lifeblood of cash-strapped dotcom companies. Dotcom companies that had reached market capitalization in the hundreds of millions of dollars became worthless within a matter of months. By the end of 2001, a majority of publicly traded dotcom companies folded, and trillions of dollars of investment capital evaporated.

Fastforward to today in 2019....

What has the stock market done since 2001 - 2019?

What have our fiat currencies turned into? Toilet paper??? They are all becoming weaker and have been printed as such! A NOTE IS ALL YOU HOLD WHEN YOU HOLD PAPER MONEY. YOUR NOTE IS BECOMING WEAKER IN ITS VALUE EVERY PASSING YEAR UNTIL THEY STOP PRINTING MONEY!

What has interest rates done? WHY?

The housing market? PFFFTTT Dont get me started....

Im 31 years old and I will be damned if I let some old ballsacks in congress try to design my future without me being apart of it or me breathing down their neck through our weapon.....

The internet of things....the internet of value...

Data is the new oil... will you begin to mine oil today? Or purchase it for retail price later?

My best advice for everyone in this realm is to learn your history...truly understand what block chain technology is and DLT...truly compare the protocols and don't just read to forums and reddit posts. DO YOUR DUE DILIGENCE! Your world leaders and these leaders in crypto today are just like the leaders who survived the dot com bubble.......

Be patient...be smart...dont chase losses...and invest what makes you HAPPY in life...for that is what truly brings you wealth. As they say..do what you love and the money truly can come abundantly when you realize that money is just a tool....do not let it control your life. Turn it into your bitch and make money work for you. Your opportunity is here...take it with a grain of salt and make yourself valuable in many avenues in life..not just crypto portfolio value...build value through multiple avenues. Keep the faucets dripping and you will always have a supply of money to go to.

Supply the demand.

Thats it for now. Way too long as it is! If you read this thank you for reading my story...please tell me your thoughts as I wrote this pretty scatter brained and jumped around a bit but I tried to hit some topics that are related to why our financial economy is in rambles right now..I will make a video in the future with a very good explanation of this. Overall you can find plenty of topics on the internet about the things I have said here. DYOR and you will be surprised what you will find if you keep digging deep enough....