Trend Analysis

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

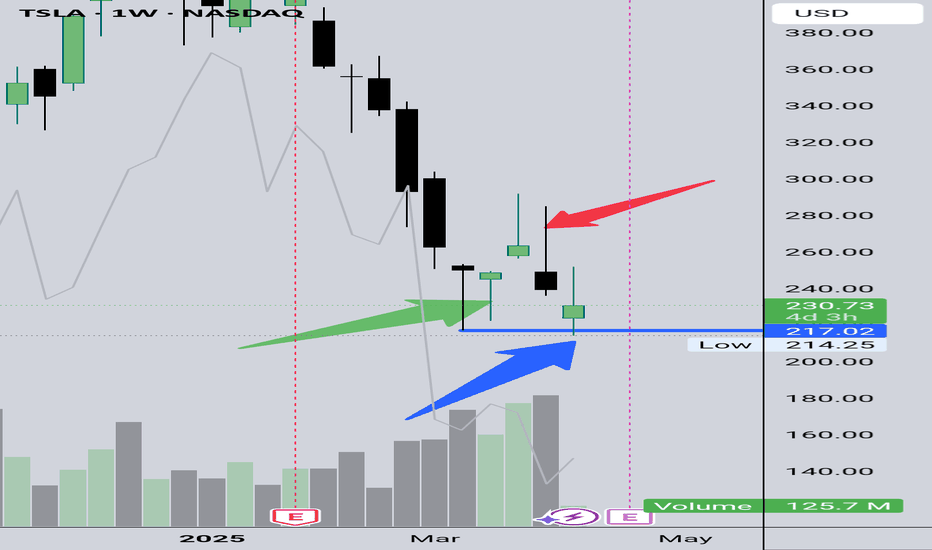

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

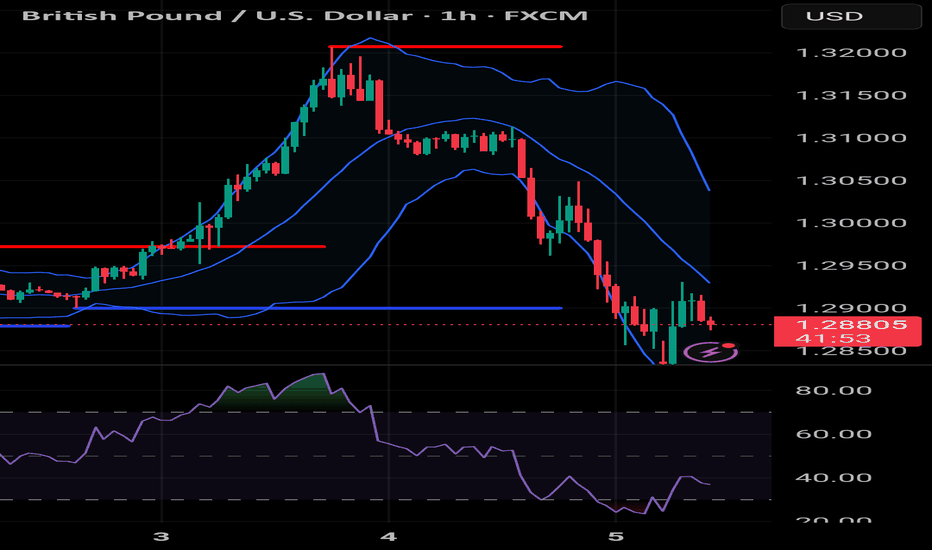

RSI + BB strategy - the strong duo you will ever need to win Hello traders!

This article shares with you a strategy employing two famous indicators that have stood the test of time and used by professionals and amateurs alike. A solid trading plan needs at least one solid strategy which will be your bread and butter. You can always add more strategies or game plans to your repertoire but you need to master one. Trading can be as complicated or simple as you make it. To make sense of it all, you should always try to be realistic and stick to a trading plan which is "simple and stupid" so that you free your mind from overthinking and focus on the market movements instead. A good strategy, along with constant market trend analysis, good risk management, news awareness and emotion control can ultimately transition you to being a consistent profitable trader. Indeed, there are times where the odds will not be in your favour and you will have losing trades. However, the key to success is to think of trading as a game of probability and developing a winning edge that ensures you are profiting more than losing. A 1:2 RRR is the least you have to accept when entering a trade, else sit tight and wait for the next opportunity. As Jesse Livermore quoted, "It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!".

RSI

Developed by J. Welles Wilder Jr. In 1978, the relative strength index is a momentum indicator that measures the speed and magnitude of price changes. At 70+, RSI is considered overbought and a retracement in price may occur. At 30-, RSI is considered oversold and price may go up. The middle line is the mean of recent prices, usually during a 14 days period.

BB

Developed by John Bollinger much later in the 1980s, BB is a volatility indicator which measures the speed and extent of price changes. A wider band signals high volatility and a narrow band signals low volatility. When price reaches the upper band, the asset is considered overbought and price may retract. When price reaches the lower band, the asset is considered oversold, meaning there are less and less sellers in the market and price may go up. The middle line is usually a simple moving average, showing the mean price across a time period.

RSI + BB strategy

The combination relies, and truthfully so, on the fact that the price of an asset usually hovers around its mean. Unless there are significant macroeconomic changes and news are strong (ultimately forming a new trend), price does not deviate much from its mean. It continues and builds its existing trend and moves up and down the moving average. By meauring both the momentum and volatility of the price, while keeping an eye on the direction of the trend, a trader can place small trades with a minimum 1:2 RRR as the asset moves in a range, an uptrend or a downtrend. The indicators give you insight on where to buy and place your SL and TP.

Trading set ups

- RSI 70+, BB touching upper band, no news, BB horizontal (showing a ranging market), price at major resistance zone - sell because price is likely to move through the moving average towards to lower band

- RSI 30-, BB touching lower band, no news, BB horizontal (showing a ranging market), price at major support zone- buy because price is likely to move through the moving average towards to upper band

- RSI 70+, BB touching upper band (price climbing up the BB ladder), BB moving upwards (uptrend), strong good news - buy because price is in uptrend and trend is likely to continue

- RSI 30-, BB touching lower band (price falling off the BB cliff), strong bad news - sell because price is in downtrend and trend is likely to continue

Sitting tight

-Playing on a 1hr timeframe, there won't be many instances when all these stars align. That is when you sit tight and wait.

- When price is hovering in between the RSI grid and BB band - sit tight and wait because the odds are not in your favour and it is impossible to predict which way price will move. Let the market do its thing, protect your capital and wait for the market to show you what to do next.

Note

- When the conditions are met, always enter the trade as soon as you get confirmation. If you are late in entry, skip the trade and wait

- Place your SL just above the upper BB if selling or just below the lower BB if buying

- TP is essential so you can lock in profits, especially in ranging markets where price quickly touches the BB band and bounces back. If you are in a trade and not able to monitor it, a TP ensures you have closed your trade at your desired and predicted price. TP is placed close to the lower band if selling or close to the upper band if buying

-Ensure that all your other criteria such as news, RRR and emotion control are met to enter a trade. If one is not met, this trade is not for you.

- Familiarise yourself using alerts. You have to be able to be present when the opportunity presents itself. Tradingview's lowest paid plan gives you 20 alerts, which is more than sufficient if you are focusing on 4-5 assets only. Alerts add to your winning edge and enable you to be trading the best set ups when they form.

Please do not hesitate to share your thoughts if you do use RSI and/or BB and have had positive outcomes. :)

GL to all!

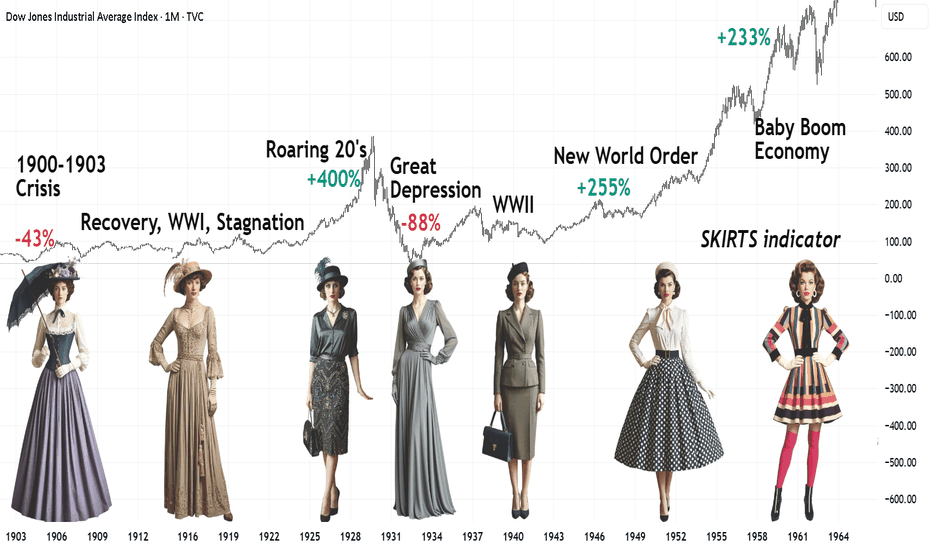

Skirt Lengths as Market Indicators: A Socionomics PerspectivePart of the #Socionomics series.

How fashion and societal moods shifted in the first half of the 20th century.

1900–1910

Economy: The rise of industrialization in the U.S. — Ford’s assembly line (1908), booming cities, and a growing wealth gap between the elite and the working class. In Europe, colonial powers raced for survival, fueling military spending (sound familiar?).

Mood: Faith in technological progress clashed with protests against exploitation. Suffragettes smashed London storefronts (1908), while New York’s Triangle Shirtwaist Factory fire (1911) galvanized labor rights movements.

Fashion: Rigid corsets and floor-length skirts symbolized Victorian morality. Yet rebels like designer Paul Poiret introduced hobble skirts — a tentative step toward freedom of movement.

1910–1920

Economy: World War I (1914–1918) reshaped the globe: Europe lay in ruins, while the U.S. profited from arms sales. Postwar hyperinflation crippled Germany, and the Spanish Flu (1918–1920) claimed millions.

Mood: Women replaced men in factories, only to be pushed back into domestic roles after the war. A feminist explosion: American women won voting rights in 1920.

Fashion: Skirts rose to ankle-length for practicality. By the decade’s end, the flapper emerged — straight-cut dresses, beaded necklaces, and cigarettes in hand, defying tradition. A sign of the stock market’s brewing boom.

1920–1929

Economy: The "Roaring Twenties" — jazz, speculation, and Prohibition. The stock market quadrupled; ordinary Americans borrowed heavily to invest, then borrowed again against rising shares.

Mood: Hedonism reigned. Speakeasies and Gatsby-esque parties masked pre-crash euphoria.

Fashion: Knees on display! Fringed dresses, bobbed haircuts, and gartered stockings. By 1929, subdued silhouettes crept in — an omen of crisis.

1930–1940

Economy: The 1929 bubble burst: Wall Street crashed, triggering the Great Depression (1929–1939). U.S. unemployment hit 25%. Europe veered toward fascism and war.

Mood: Despair from Dust Bowl migrations and hunger marches. Yet Hollywood’s Golden Age offered escapism.

Fashion: Skirts lengthened — modesty returned. Long dresses dominated, while cheap fabrics and turbans (to hide unwashed hair) became staples.

1940–1950

Economy: World War II (1939–1945). Postwar Europe rebuilt via the Marshall Plan; the U.S. embraced consumerism.

Mood: Patriotism ("Rosie the Riveter") and postwar hope. The baby boom idealized domesticity.

Fashion: War mandated minimalism: knee-length skirts and padded shoulders. In 1947, Christian Dior’s New Look rebelled — voluminous ankle-length skirts symbolized postwar opulence.

1950–1960

Economy: America’s "Golden Fifties" — middle-class expansion, cars, and TV. Europe recovered, but colonial wars (Algeria, Vietnam) exposed crises.

Mood: Conformity (suburban perfection) vs. teenage rebellion (James Dean, Elvis’s rock ‘n’ roll).

Fashion: Sheath dresses and midi skirts emphasized femininity. By the late 1950s, Mary Quant experimented with mini-skirts — a harbinger of the sexual revolution.

1960s: Peak of Postwar Prosperity

Economy: U.S. GDP grew 4-5% annually; unemployment dipped below 4%. Baby boomers (1946–1964) fueled suburban housing and education demand.

Fashion: The mini-skirt became an era-defining manifesto of freedom, paired with bold go-go boots. Economic optimism bred experimentation: neon synthetics (nylon, Lycra) and psychedelic hues.

Conclusion

Women’s fashion mirrors its era. Crises (1930s) hide knees; liberating times (1920s, 1960s) bare them. Even war skirts (1940s’ knee-length pragmatism) carried hope.

💡 Like and subscribe for insights your economics textbook won’t reveal!

#beginners #learning_in_pulse #interesting

#socionomics #history #fashiontrends

RSI 101: Scalping Strategy with RSI DivergenceFX:XAUUSD

I'm an intraday trader, so I use the H1 timeframe to identify the main trend and the M5 timeframe for entry confirmation.

How to Determine the Trend

To determine the trend on a specific timeframe, I rely on one or more of the following factors:

1. Market Structure

We can determine the trend by analyzing price structure:

Uptrend: Identified when the market consistently forms higher highs and higher lows. This means price reaches new highs in successive cycles.

Downtrend: Identified when the market consistently forms lower highs and lower lows. Price gradually declines over time.

2. Moving Average

I typically use the EMA200 as the moving average to determine the trend. If price stays above the EMA200 and the EMA200 is sloping upwards, it's considered an uptrend. Conversely, if price is below the EMA200 and it’s sloping downwards, it signals a downtrend.

3. RSI

I'm almost use RSI in my trading system. RSI can also indicate the phase of the market:

If RSI in the 40–80 range, it's considered an uptrend.

If RSI in 20 -60 range, it's considered a downtrend.

In addition, the WMA45 of the RSI gives us additional trend confirmation:

Uptrend: WMA45 slopes upward or remains above the 50 level.

Downtrend: WMA45 slopes downward or stays below the 50 level.

Trading Strategy

With this RSI divergence trading strategy, we first identify the trend on the H1 timeframe:

Here, we can see that the H1 timeframe shows clear signs of a new uptrend:

Price is above the EMA200.

RSI is above 50.

WMA45 of RSI is sloping upward.

To confirm entries, move to the M5 timeframe and look for bullish RSI divergence, which aligns with the higher timeframe (H1) trend.

RSI Divergence, in case you're unfamiliar, happens when:

Price forms a higher high while RSI forms a lower high, or

Price forms a lower low while RSI forms a higher low.

RSI divergence is more reliable when the higher timeframe trend remains intact (as per the methods above), indicating that it’s only a pullback in the bigger trend, and we’re expecting the smaller timeframe to reverse back in line with the main trend.

Stop-loss:

Set your stop-loss 20–30 pips beyond the M5 swing high/low.

Or if H1 ends its uptrend and reverses.

Take-profit:

At a minimum 1R (risk:reward).

Or when M5 ends its trend.

You can take partial profits to optimize your gains:

Take partial profit at 1R.

Another part when M5 ends its trend.

The final part when H1 ends its trend.

My trading system is entirely based on RSI, feel free to follow me for technical analysis and discussions using RSI.

How to Use the TradingView Search Bar Efficiently 01. Introduction to the TradingView Search Bar

The TradingView Search Bar is one of the most essential tools in your charting journey. Located at the top-left corner of the interface, this feature allows you to instantly switch between stocks, indices, crypto assets, forex pairs, futures, and more — without leaving your current chart tab.

Whether you're a day trader looking for high-volume movers or an investor monitoring global indices, the search bar makes it effortless to pull up symbols with lightning speed.

One of the best parts? You don’t even need to click anything — just start typing on your keyboard while a chart is open, and the search bar automatically activates.

Pro Tip: The TradingView Search Bar supports symbol auto-suggestions with exchange suffixes (like .NS for NSE stocks), making it ultra-fast for Indian markets too.

02. How to Open the Symbol Search Bar

Opening the symbol search bar in TradingView is incredibly intuitive — and can be done in multiple ways depending on how fast you want to move.

Here are the top 3 ways to launch the search bar:

• 🔘 Click the Symbol: Go to the top-left corner of your chart and click the current symbol (e.g., NIFTY or BTCUSD) to open the search panel.

• ⌨️ Start Typing: When your chart is focused, just begin typing any symbol directly — the search window pops up instantly.

• 📚 Use the Watchlist: Open a saved symbol from your Watchlist using a simple click, and it automatically replaces the current chart.

Shortcut Key:

Just press your keyboard and type RELIANCE or NIFTY without clicking anywhere — TradingView immediately opens the search popup.

Works on both Windows and Mac.

03. Extended: Exploring the Search Interface (Tab-by-Tab Breakdown)

The TradingView Symbol Search Interface is more than just a place to look up stock names. It’s a powerful filtering system designed to help traders and investors access any instrument—globally and across asset classes—in just a few clicks. Let’s break down each tab and filter in detail:

🔍 1. Asset Type Tabs

Located at the top of the search panel, these tabs let you narrow down by instrument type:

• All – View all available instruments.

• Stocks – Equity shares from global exchanges (e.g., NSE, NASDAQ, BSE, etc.).

• Funds – Includes ETFs, mutual funds, and index funds.

• Futures – Derivative contracts across commodities, indices, etc.

• Forex – Currency pairs like USDINR, EURUSD, GBPJPY, etc.

• Crypto – Popular cryptocurrencies like BTC, ETH, and exchange pairs.

• Indices – Market indices like NIFTY50, S&P 500, NASDAQ100.

• Bonds – Government and corporate bond listings.

• Economy – Macro-economic indicators like GDP, unemployment, CPI.

• Options – Derivative instruments based on options chain availability.

💡 Pro Tip: Use these tabs before typing a symbol to narrow down your focus instantly.

🌍 2. All Countries Filter

You can choose to see instruments only from specific countries. Selecting this opens a country-wise list showing all supported exchanges under each country.

• USA: NASDAQ, NYSE, CBOE, OTC

• India: NSE, BSE

• UK: LSE

• Germany: XETRA, FWB

🔎 Use Case: If you only want Indian stocks, choose India to limit the results to NSE/BSE only.

🧾 3. All Types Filter (Only under Stocks Tab)

This filter lets you refine your equity instrument type, such as:

• Common Stock

• Preferred Stock

• Depository Receipt (like ADR/GDR)

• Warrant

🔍 Use Case: Great for global investors looking specifically for ADRs or warrants.

🧭 4. All Sectors Filter (Only under Stocks Tab)

This is one of the most powerful tools for equity screening. You can filter stocks based on their sector like:

• Finance

• Technology Services

• Health Technology

• Consumer Durables

• Electronic Technology

• ... and 20+ more industry segments

💼 Use Case: Perfect for sector-based trading or thematic investing.

⚙️ Power Feature: All filters can be used in combination. Example: You can search only Technology sector stocks from India, of Common Stock type — all in seconds.

05: Using the Flag to Add Symbols to Watchlist

The 🚩 flag icon in TradingView allows you to tag symbols with color-coded labels for easy watchlist management. You can organize your stocks by strategy, sector, volatility, or timeframe using these flags.

🎯 What Does the Flag Icon Do?

• Click the 🚩 icon next to any symbol in the search panel.

• Choose from 7 different colors to group stocks by theme.

• Flagged stocks immediately appear under that color in your Watchlist.

You can create multiple groups — like F&O, Crypto, Sectors, Swing Picks — all visually organized.

🔍 06: Smart Search Tricks (Symbol Syntax, Exchanges, Shortcuts)

The TradingView Symbol Search bar supports intelligent filters, shortcuts, and exchange-based syntax to save time and improve accuracy. Mastering these tricks will allow you to switch charts and find instruments faster than ever.

🧠 1. Use Exchange Prefixes

You can directly use exchange prefixes to narrow your search:

NSE: – National Stock Exchange of India

BSE: – Bombay Stock Exchange

NASDAQ: – U.S. Nasdaq-listed stocks

NYSE: – New York Stock Exchange

👉 Example: NSE:RELIANCE shows Reliance on NSE instantly.

💡 2. Partial Name Works Too

You can type partial symbols after the exchange code and TradingView will auto-suggest:

🔎 Example: Typing NSE:REL shows Reliance Industries and others.

⚡ 3. Avoid Full Company Names

Typing full company names like “Reliance Industries Ltd” might not show accurate results quickly. Instead, use ticker codes or shortcuts with exchange prefixes for better precision.

🎯 4. Type Directly to Open Search

No need to click the 🔍 icon! Just start typing on the chart:

Windows/Mac: Type any symbol (e.g. INFY)

Use Arrows: ⬆️ ⬇️ to move between results

Press Enter: to select symbol instantly

🌐 5. Use Filter Tabs Above Search

TradingView lets you filter across:

Markets: All / India / US / Global

Types: Stocks / Crypto / Forex / Futures

Sectors: Banks / Tech / Pharma / Energy

💡 Pro Tip: Combine NSE: + partial ticker + filters to drill down fast without leaving the chart screen

Could Bitcoin Crash 60%—But Only 20% of Traders Lose?Analyzing the current BTC/USDT chart, we see that Bitcoin is hanging just above a critical support zone—what many traders recognize as “the most important support level” from a volume perspective on Binance. The chart illustrates a potential 60.37% drop, which would pull BTC down nearly $49,000, back toward the high-volume range near $30K.

This sounds catastrophic, right? But here’s the twist...

🔍 Why Only 20% of Traders Might Actually Lose

According to Binance's volume profile data:

The majority of buying activity and position accumulation happened below $35,000.

Most long-term holders and smart money entered during the 2022-2023 accumulation range.

The Volume Profile Visible Range (VPVR) shows significant support below the current price, with minimal trading volume at higher levels.

💡 That means only a minority (approx. 20%) of traders bought BTC during its late-stage bull run above $70K. These are the traders most at risk if a drop occurs.

In contrast, the majority are still sitting in profit—or near break-even—even if Bitcoin retraces back to its base.

📊 So while the price could drop 60%, 80% of holders might remain safe, having entered at lower levels.

🧠 What This Means for You:

If you're a late bull, it’s time to assess risk.

If you're a smart accumulator, the pullback could offer another golden entry.

If you're a bear, this chart supports your thesis—but don't forget the whales are watching this zone closely.

Stay sharp. Stay informed.

Example of how to draw a trend line using the StochRSI indicator

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I have explained how to draw a trend line before, but I will take the time to explain it again so that it is easier to understand.

-

When drawing a trend line, it must be drawn on the 1M, 1W, and 1D charts.

However, since I focused on understanding the concept of drawing a trend line and the volatility period that can be seen with a trend line, I will explain it only with a trend line drawn on the 1D chart.

Please note that in order to calculate a somewhat accurate volatility period, support and resistance points drawn on the 1M, 1W, and 1D charts are required.

I hope this was helpful for understanding my thoughts on the concept of drawing trend lines and how to interpret them.

The main reason for drawing trend lines like this is so that anyone who sees it can immediately understand why such a trend line was drawn.

Then, there will be no unnecessary disagreements about the drawing, and each person will be able to share their opinions on the interpretation.

--------------------------

When drawing trend lines, the StochRSI indicator is used.

The reason is to secure objectivity.

When the StochRSI indicator touches the oversold zone and rises, the low corresponding to the peak is connected to draw a trend line between low points.

And, when the StochRSI indicator touches the overbought zone and falls, the Open of the downward candle corresponding to the peak is connected to draw a trend line between high points.

If the peak is not a downward candle, it moves to the right and is drawn with the Open of the first downward candle.

If you refer to the candlesticks of the arrows in the chart above, you will understand.

The trend line drawn as a dot is a high-point trend line, but it is a proper trend line because it does not touch the overbought zone between highs.

Therefore, you can draw a trend line corresponding to trend line 1.

Accordingly, around March 25-29, around April 8, and around April 14 correspond to the volatility period.

-

You can see how important the low-point trend line (2) is.

If the high-point trend line is properly created this time and the low-point trend line and the high-point trend line are displayed in the same direction, the trend is likely to continue along that channel.

If the StochRSI indicator rises and a peak is created in the overbought zone, you will draw a high-point trend line that connects to point A.

-

Thank you for reading to the end. I hope your transaction will be successful.

--------------------------------------------------

Mastering Market Trends: Your Guide to Clearer Trading DecisionsTrends shape every decision you make in the markets, even if you’re unaware of it. Understanding how to identify and adapt to these market phases is your foundational skill - one that separates successful traders from the rest.

Today, let’s simplify and clarify the three essential types of market trends. By mastering this, you’ll approach trading decisions with more confidence and clarity.

⸻

📈 1. Uptrend – Riding the Bull

• What is it?

An uptrend is like climbing stairs upward. Each step (low) is higher than the previous one, and every leap (high) sets a new peak.

• What drives it?

Buyers dominate, optimism rules, and demand pushes prices upward.

• Trading tip:

Identify support levels and look for retracements as potential entry points. Be cautious about chasing prices that have moved too far without a pullback.

⸻

📉 2. Downtrend – Navigating the Bearish Territory

• What is it?

Visualize going down a staircase. Each step down (low) surpasses the previous one, and every upward bounce (high) falls short of the prior peak.

• What drives it?

Sellers control the market, bearish sentiment takes over, and supply outweighs demand.

• Trading tip:

Look for resistance areas to identify potential short entries or wait patiently for signs of a reversal if you’re bullish.

⸻

➡️ 3. Sideways Market – The Calm Before the Storm

• What is it?

Imagine a tug-of-war with evenly matched teams. The price moves back and forth in a narrow range without breaking decisively higher or lower.

• What drives it?

Uncertainty, indecision, or equilibrium between buyers and sellers.

• Trading tip:

Stay patient! Either look to trade range extremes (buying support and selling resistance) or wait for clear breakout signals to catch the next big move.

⸻

🔍 Pro Tip for Trend Analysis:

• Multi-timeframe analysis is key: Always check higher timeframes (weekly, daily, or hourly) to confirm the primary trend. Don’t let short-term noise mislead your trading decisions.

⸻

🚀 Why It Matters:

Aligning your strategies with the correct market trend significantly improves your odds. It’s like sailing with the wind at your back instead of battling against it.

Now, tell us in the comments: Which trend type do you find most challenging to trade?

Trade smarter. Trade clearer.

Clear DayTrading strategy video. The "Inside Bar"🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Understanding the ICT Venom ModelIn this video I break down the ICT Venom Model as recently described by the man himself on his YouTube channel. I am sure he has more details on the model he has not released, but I basically attempt to give my two cents on NQ and the model itself.

I hope you find the video useful in your endeavours regarding learning ICT concepts as well as trading in general.

- R2F Trading

Using Fibonacci/Measured Moves To Understand Price TargetThis video is really an answer to a question from a subscriber.

Can the SPY/QQQ move downward to touch COVID levels (pre-COVID High or COVID Low).

The answer is YES, it could move down far enough to touch the pre-COVID highs or COVID lows, but that would represent a very big BREAKDOWN of Fibonacci/ElliotWave price structure.

In other words, a breakdown of that magnitude would mean the markets have moved into a decidedly BEARISH trend and have broken the opportunity to potentially move substantially higher in 2025-2026 and beyond (at least for a while).

Price structure if very important to understand.

Measured moves happen all the time. They are part of Fibonacci Price Theory, Elliot Wave, and many of my proprietary price patterns.

Think of Measured Moves like waves on a beach. There are bigger waves, middle waves, smaller waves, and minute waves. They are all waves. But their size, magnitude, strength vary.

That is kind of what we are trying to measure using Fibonacci and Measured Move structures.

Watch this video. Tell me if you can see how these Measured Moves work and how to apply Fibonacci structure to them.

This is really the BASICS of price structure.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

The Power of Technical Indicators: ETH 4H Chart Breakdown📈 In this analysis, I demonstrate how a combination of key technical indicators can provide high-probability trade setups. By using Auto Fibonacci Gauge, Quantum Moving Average, Momentum Charge Theory, and Smart Money Concept, we can decode market movements with precision.

🔹 Auto Fibonacci Gauge: The Perfect Retracement

The Auto Fib Gauge shows a textbook retracement, respecting key levels like 23.6% & 61.8%.

These levels act as potential reversal zones where price reacts based on trader sentiment.

🔹 Quantum Moving Average & Momentum Charge Theory: Trend Confirmation

The Quantum Moving Average aligns perfectly with the momentum shift, confirming trend direction.

The Momentum Charge Theory further validates entry & exit signals, showing confluence with the Fib levels.

🔹 Smart Money Concept: Tracking Institutional Moves

The SMC method helps identify where large institutional orders (aka smart money) are likely placed.

Key structure points like BOS (Break of Structure) & CHoCH (Change of Character) signal potential trend shifts.

📊 Why is this important?

Combining these indicators enhances probability of successful trades.

Understanding retracements, momentum, and institutional order flows helps traders avoid weak setups and trade with confidence.

🚀 What’s your take? Do you use similar confluences in your trading? Let me know in the comments!

Mastering RSI Divergence: A Complete Guide to Trend ReversalsWhat Are Divergences?

In this guide, we will explore the concept of divergence and how it can be effectively utilized alongside the Relative Strength Index (RSI), one of the most popular momentum indicators in technical analysis. Divergence occurs when the price of an asset moves in the opposite direction of an indicator, such as the RSI. Understanding RSI divergence can be a powerful tool for identifying potential trend reversals or continuations. In this guide, we'll delve into the various types of divergence that can occur with the RSI and how to incorporate them into your trading strategy.

Types of Divergences?

There are three primary types of divergence: bullish, bearish, and hidden divergence. Each signals a distinct market condition and potential outcome, and understanding these nuances is key to using divergence effectively in your trading.

1. Bullish Divergence Bullish divergence happens when the price of an asset makes a lower low, while the RSI forms a higher low. This indicates that although the price is declining, momentum is weakening. The failure of the RSI to confirm the new low in price suggests that selling pressure is diminishing, potentially signaling that a reversal to the upside could occur. Essentially, the market is losing its downward momentum, setting the stage for a potential bullish move.

2. Bearish Divergence Bearish divergence occurs when the price forms a higher high, but the RSI forms a lower high. This indicates that although the price is rising, momentum is weakening. It suggests that the uptrend may be losing steam, signaling that a potential reversal to the downside could be on the horizon. As the price continues higher, but the RSI fails to confirm the new highs, it may indicate that the market is becoming overextended and ready for a correction.

3. Hidden Divergence Hidden divergence differs from regular divergence in that it signals a continuation of the existing trend, rather than a reversal. It typically occurs during pullbacks or retracements in a strong trend. Hidden divergence can appear in both uptrends and downtrends, providing traders with an indication that the prevailing trend is likely to continue after the short-term retracement is over. This type of divergence serves as a confirmation of trend strength and helps traders stay in profitable positions during market pullbacks.

Why Are RSI Divergences a Powerful Tool?

RSI divergence is a powerful tool in trading because it offers early insights into potential trend reversals or shifts in momentum before these changes are fully reflected in price movements. By recognizing divergence, traders can anticipate shifts in market sentiment and make timely decisions. One of the main reasons RSI divergence is so effective is that it serves as an early warning system. It signals when the momentum behind a price trend, whether up or down, is starting to weaken.

For example, in a strong uptrend, if prices continue to make new highs, but the RSI fails to reach new highs, this could signal that the buying momentum is losing strength, even though the price is still rising. This divergence indicates that a reversal or pullback might be imminent, allowing traders to exit their positions or prepare for a potential shift in market direction. Understanding this early warning can provide traders with an edge, helping them avoid being caught in the late stages of a trend and positioning themselves ahead of a change.

How to Trade RSI Divergences?

When the price makes a higher high but the RSI fails to confirm with a higher high, this is known as bearish divergence. While this situation suggests weakening momentum, it doesn’t necessarily mean a correction is imminent. The price may continue to rise for some time, and eventually, the RSI could catch up and make a higher high in line with the price action. Essentially, the market could remain in an uptrend, and the RSI could still align with the price over time.

This highlights the importance of not jumping to conclusions solely based on RSI divergence. Divergence can act as a useful warning, but it should not be relied upon as a definitive signal of a trend reversal. To increase the reliability of the signal, traders should wait for additional confirmation, such as a candlestick pattern indicating a potential trend reversal. Candlestick patterns like engulfing patterns, doji candles, or shooting stars at key support or resistance levels can provide stronger evidence that the trend may be about to change.

Therefore, it’s wise to wait for a more comprehensive confirmation from price action before making a move, rather than acting on divergence alone. Combining RSI divergence with other technical tools, such as candlestick patterns or chart patterns, can help increase the accuracy of your trade decisions.

Conclusion:

Divergence is a powerful tool that provides valuable insights into potential trend reversals or continuations. By understanding the different types of divergence and knowing how to identify them, traders can make more informed decisions. However, divergence should always be used in conjunction with other technical analysis tools to enhance the accuracy of your strategy. With practice, patience, and proper risk management, divergence trading can become a profitable strategy for identifying key market turning points. Whether you are seeking trend reversals or confirming ongoing trends, RSI divergence can be an essential component of your trading toolkit.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

PL Dot Shapes (Detailed Summary)This idea shall focus on the behavior and structure of PL Dot Shapes, which are crucial in identifying market trends, congestion phases, and potential reversals. Let's deep dive on how to interpret PL Dot formations and recognize patterns that signal market movements.

1. Understanding PL Dot Behavior

- Trend:

PL Dots form a straight line, indicating a clear market direction. A trend stops when the market enters congestion.

- Congestion:

PL Dots move horizontally or “snake” sideways, signaling indecision or balance between buyers and sellers.

- Higher Time Period (HTP) Influence:

PL Dots from the HTP influence those in the Lower Time Period (LTP). Inconsistencies between them may indicate no clear pattern.

- Dot Distance:

Refers to the vertical price difference between consecutive PL Dots.

- Increasing Dot Distance: Indicates trend continuation or strength.

- Decreasing Dot Distance: Suggests trend exhaustion or potential reversal.

2. Key PL Dot Patterns

✅ Yes Pattern (Energy Termination Pattern)

Indicates the end of a trend and potential reversal. This pattern is characterized by signs of exhaustion:

1. PL Dot Pullback: PL Dot moves off the main trend channel, and the angle starts sloping down.

2. Decreasing Dot Distance: Dots get closer together, signaling waning momentum.

3. Exhaustion Signs: The dot pulls within range, with closes moving towards the PL Dot, causing congestion entrance.

4. Block Occurrence: Price likely returns to the area of 2-3 dots back.

5. Crest Formation: A PL Dot crest forms, indicating a potential market top.

6. Directional Shift: Dot directions begin turning downward.

7. Challenges: Be alert to price challenging PL Dot crests and valleys.

---

❌ No Pattern (Non-Termination Pattern)

Indicates that the trend is likely to continue without exhaustion:

1. Similar early behavior to the Yes Pattern but lacks signs of exhaustion.

2. No Significant Pullback: PL Dot may pull within range, but no congestion entrance signs appear (bullish).

3. Price Holds: Prices do not return to the 2-3 dots back area.

4. Weak Crests: No strong crest formation, or it's shallow.

5. Stable Direction: Dot direction struggles to turn down.

6. No Challenges: No challenges to PL Dot crests or valleys, confirming trend strength.

---

3. Trend Pattern (Trend Continuation Pattern)

Describes the start or continuation of a trend, especially in the LTP:

1. Dot Opening: PL Dot opens up, with increasing distance between dots, signaling strong momentum.

2. No Exhaustion: Continuation without signs of exhaustion.

3. Energy Refresh: If price reaches the area of 2-3 dots back, expect high energy on any PL Dot refresh.

4. Dots Out of Range: PL Dots move outside the prior bar’s range, confirming a strong trend.

5. Strong Challenges: Challenges to crests only add momentum to the trend.

6. Stable Direction: Dot direction maintains strength with minimal reversals.

---

4. PL Dot Shapes in Congestion

When the market is in congestion, expect the following:

1. Sideways Dots: PL Dots snake sideways, indicating market indecision.

2. Support/Resistance Holding: The 6-1 lines hold both sides of the congestion area.

3. Congestion Exit Signs: Look for signs indicating the market is ready to break out of congestion.

---

Key Takeaways:

- Trend Continuation: Increasing dot distance and out-of-range dots suggest a strong trend.

- Trend Exhaustion (Yes Pattern): Decreasing dot distance, dot pullbacks, and crest formation signal potential reversals.

- No Pattern: Indicates no exhaustion, suggesting the trend will continue.

- Congestion Behavior: PL Dots snake sideways with key support/resistance levels holding firm.

Understanding these patterns helps traders anticipate market behavior, identify trend reversals early, and manage trades effectively.

FXAN & Heikin Ashi TradeOANDA:AUDCHF

In this video, I’ll be sharing my analysis of AUDCHF, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Triangle Chart Patterns: How to Identify and Trade ThemTriangle Chart Patterns: How to Identify and Trade Them

Triangle chart patterns are essential tools in technical analysis, helping traders identify potential trend continuations. These formations build as the price consolidates between converging trendlines, signalling an upcoming move in the market. In this article, we’ll explore the three types of triangle patterns—symmetrical, ascending, and descending—and how traders use them to analyse price movements.

What Are Triangle Chart Patterns?

Triangle chart patterns are a common tool used to understand price movements in the market. These patterns form when the price of an asset moves within two converging trendlines, creating a triangle shape on a chart. The lines represent support and resistance levels, and as they get closer together, it signals a potential breakout in one direction.

Symmetrical, ascending, and descending are three types of triangle patterns. Each of these patterns reflects a different market sentiment, with symmetrical triangles showing indecision, ascending triangles suggesting a bullish bias, and descending triangles hinting at bearish momentum. These formations are useful because they help traders spot potential breakouts, where the price might move sharply up or down after a period of consolidation.

It’s important to note that triangles and wedge patterns are similar but not the same. Both patterns involve converging trendlines, but wedges tend to slope upward or downward. Triangles, on the other hand, either feature one horizontal trendline and a sloping trendline or two sloping trendlines at roughly the same angle.

Below, we’ll cover the three triangle types. If you’d like to follow along, head over to FXOpen and TradingView to get started with real-time charts.

Symmetrical Triangle

The symmetrical triangle is a popular chart pattern that shows up when the price of an asset starts consolidating within a tighter range. Unlike other triangle patterns, it doesn’t lean heavily in either direction—bullish or bearish—making it a neutral signal. It forms when buyers and sellers are in a bit of a standoff, with no clear trend in sight. However, this period of indecision often leads to a significant move once the price breaks out of the pattern.

What Does It Look Like?

- Two converging trendlines;

- One sloping down from the highs (resistance);

- One sloping up from the lows (support);

- The price oscillates between these two lines, forming lower highs and higher lows;

- The formation narrows as the lines get closer together, creating a point of breakout.

What Does It Indicate?

A symmetrical triangle pattern indicates a period of indecision in the market. Buyers and sellers are evenly matched, causing the price to move within a narrowing range. As it gets smaller, the pressure builds, and the price is likely to break out either up or down. Since the formation is neutral, the breakout could occur in either direction, and traders wait for this moment to see where the market is heading.

How Do Traders Use It?

Traders typically watch for a breakout from the symmetrical triangle to signal the next significant price movement. They often look for an increase in trading volume alongside the breakout, as this can confirm the strength of the move. In most cases, it’s used as a signal for potential price continuation. However, some traders see it as a reversal indicator, depending on what the preceding trend looks like.

Ascending Triangle

An ascending triangle is a bullish triangle pattern that’s often looked for when analysing potential price breakouts. It usually forms during an uptrend but may also appear in a downtrend. It suggests that buyers are becoming more aggressive, while sellers are struggling to push the price lower, creating a situation where the market might break upwards.

What Does It Look Like?

- A horizontal resistance line at the top (price struggles to break above this level);

A rising trendline at the bottom, connecting higher lows (buyers are stepping in earlier each time);

- The price moves between these two lines, creating a triangle shape;

- The formation narrows over time, putting pressure on the resistance level.

What Does It Indicate?

An ascending triangle pattern signals that buyers are gaining control. While the price keeps hitting a ceiling (resistance), the higher lows show that the market’s buying pressure is increasing. This often leads to a breakout above the resistance level, where the price can make a significant upward move. Traders usually see this formation as a sign that the market is primed for a continuation of the current uptrend. However, sometimes it can appear in a downtrend and signal a trend reversal.

How Do Traders Use It?

Traders typically use the ascending triangle to spot potential breakouts above the resistance level. When the price finally moves and closes above this line, it’s seen as confirmation that the upward trend is continuing. Many also pay close attention to the trading volume during this breakout—rising volume can confirm that the breakout is genuine.

In some cases, the price may break through the resistance quickly, while in others, it could take time before the upward move happens. There may also be false breakouts before the true bullish move occurs, with the price typically closing below resistance.

Descending Triangle

A descending triangle is a bearish chart pattern that signals potential downward movement in the market. It typically forms during a downtrend but can also appear in an uptrend. It shows that sellers are becoming more dominant, while buyers are struggling to push the price higher, which could lead to a breakdown below a key support level.

What Does It Look Like?

- A horizontal support line at the bottom (price struggles to break below this level);

- A descending trendline at the top, connecting lower highs (sellers are pushing the price down);

- The price moves between these two lines, creating a triangle shape;

- The formation narrows over time, with the pressure building on the support level.

What Does It Indicate?

A descending triangle chart pattern suggests that sellers are in control. While the price holds at the support level, the series of lower highs shows that selling pressure is increasing. This often leads to a breakdown below the support line, where the price might experience a sharp decline. Traders see the formation as a bearish signal, indicating that the market could continue its downward trend.

How Do Traders Use It?

Traders typically use the descending triangle to identify potential breakdowns below the support level. When the price falls and closes below this line, it’s considered confirmation that the sellers have taken over and that further downside movement could follow.

Similar to other triangle patterns, it’s common to watch for a rise in trading volume during the breakdown, as it can confirm the strength of the move. It’s also possible to see false breakouts below the support level when the price closes back inside the pattern almost immediately.

How Traders Use Triangle Patterns in Technical Analysis

These patterns are just one piece of the puzzle in technical analysis, but they can offer us valuable insights when used correctly.

Triangle Pattern Trading: Entry, Stop-Loss, and Profit Targets

Entry Points

Traders typically wait for a confirmed breakout from the triangle formation’s boundaries before entering a trade. For ascending triangles, this means watching for the price to break above the upper trendline (resistance), while for descending triangles, they look for a breakdown below the lower trendline (support). In a symmetrical triangle, the breakout may be in either direction, usually informed by the broader market trend.

The entry is often confirmed by a closing candle above or below these key levels to reduce the risk of false breakouts.

Stop-Loss Placement

Stop-loss orders are crucial here. For ascending triangles, stop losses might be placed just below the last swing low, while for descending triangles, they might be set just above the recent swing high. In the case of symmetrical triangles, traders often place the stop-loss just outside the formation’s apex.

Profit Targets

To set profit targets, traders typically use the triangle's height (the distance between the highest and lowest points). This height is then projected from the breakout point, offering a realistic target for the trade. For example, if a triangle stock pattern’s height is $10 and the breakout occurs at $50, the target would be $60 for a bullish move.

Combining with Market Context

Triangles may become more reliable when considered in the context of the broader market environment. Traders don’t just look at the pattern in isolation—they analyse the prevailing trend, market sentiment, and even macroeconomic factors to gauge whether a breakout aligns with the larger market movement. For instance, an ascending formation in a strong uptrend adds confidence to the idea of a bullish breakout.

Using Other Indicators for Confirmation

While triangles provide a useful framework, they’re usually combined with other technical indicators for confirmation. Traders often align triangles with volumes, moving averages, or momentum indicators to assess whether the breakout has strong support behind it. For instance, a breakout confirmed by high volume or a moving average crossover might add confluence to the trade.

Limitations and Considerations of Triangle Patterns

Triangles are useful tools in technical analysis, but they come with limitations and important considerations. While they can signal potential breakouts, it’s essential to approach them cautiously.

- False Breakouts: Triangles often experience false breakouts, where the price briefly moves beyond the trendline but quickly reverses. This may trap traders in unfavourable positions.

- Subjectivity: These formations are open to interpretation. Different people may draw trendlines slightly differently, leading to varying conclusions about where the breakout occurs.

- Need for Confirmation: Relying solely on patterns can be risky. They may work better when combined with other indicators, such as volume or moving averages, to confirm the trend direction.

- Market Conditions: In volatile or news-driven markets, chart patterns may not behave as expected, reducing their reliability. They may provide false signals or lose significance in these situations.

The Bottom Line

Triangle chart patterns are popular tools among those looking to analyse market movements and potential breakouts. Whether it’s a symmetrical, ascending, or descending triangle, these patterns provide valuable insights into price consolidation and future trends. While no pattern guarantees a winning trade, combining triangles with other indicators may improve market analysis.

Ready to apply your knowledge? Open an FXOpen account to explore chart patterns in more than 700 live markets and take advantage of our low-cost, high-speed trading environment backed by advanced trading platforms.

FAQ

What Is a Triangle Chart Pattern?

A triangle chart is a pattern in technical analysis that forms when the price of an asset moves between converging trendlines, creating a triangle shape on a price chart. They typically signal a period of consolidation before a strong potential breakout in price.

What Are the Patterns of Triangles?

There are three main types of triangles in chart patterns: symmetrical, ascending, and descending. Symmetrical triangles indicate indecision in the market while ascending triangles are often bullish, and descending triangles tend to be bearish.

How to Trade a Triangle?

Traders typically wait for a confirmed breakout from the triangle’s trendlines. According to theory, entry points are based on a breakout above resistance or below support, with stop-loss orders placed just outside the triangle. Profit targets are often set based on the height (the distance between the highest and lowest points) of the pattern.

What Is the Triangle Pattern Strategy?

The triangle pattern strategy involves waiting for a breakout and using the formation’s height to set profit targets. It’s combined with tools like volume, moving averages, and momentum indicators to confirm the move and avoid false breakouts.

Is the Triangle Pattern Bullish or Bearish?

They can be both bullish and bearish. Ascending triangles are generally seen before a bullish movement, descending triangles are bearish, and symmetrical triangles can be either.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EDUCATION: The $5 Drop: How Trump’s Tariffs Sent Oil TumblingOil markets don’t move in a vacuum. Politics, trade wars, and global economic shifts all play a role in price action. Case in point: the recent $5 drop in oil prices following Trump’s latest tariff announcement.

What Happened?

Markets reacted swiftly to Trump’s renewed push for tariffs, targeting key trading partners. The result? A ripple effect that sent oil prices tumbling as traders anticipated lower global demand. The logic is simple—higher tariffs slow trade, slowing trade weakens economies, and weaker economies use less oil.

Why It Matters to Traders

For traders, this kind of volatility is both an opportunity and a risk. Sharp price drops like this shake out weak hands while rewarding those who position themselves with clear strategies. If you trade crude oil, understanding the macro picture—beyond just supply and demand—can make or break your positions.

The Next Move

Is this just a knee-jerk reaction, or the start of a larger trend? Smart traders are watching key levels, tracking institutional order flow, and looking for confirmation before making their next move.

How do you react when headlines move the market? Do you panic, or do you position yourself with a plan? Drop a comment and let’s talk strategy.

Trump's Tariff Wars : What To Expect And How To Trade Them.I promised all of you I would create a Trump's Tariff Wars video and try to relate that is happening through the global economy into a rational explanation of HOW and WHY you need to be keenly away of the opportunities presented by the new Trump administration.

Like Trump or not. I don't care.

He is going to try to enact policies and efforts to move in a direction to support the US consumer, worker, business, and economy.

He made that very clear while campaigning and while running for office (again).

This video looks at the "free and fair" global tariffs imposed on US manufacturers and exports by global nations over the past 3+ decades.

For more than 30+ years, global nations have imposed extreme tariffs on US goods/exports in order to try to protect and grow their economies. The purpose of these tariffs on US good was to protect THEIR workers/population, to protect THEIR business/economy, to protect THEIR manufacturing/products.

Yes, the tariffs they imposed on US goods was directly responsible for THEIR economic growth over the past 30-50+ years and helped them build new manufacturing, distribution, consumer engagement, banking, wealth, and more.

The entire purpose of their tariffs on US goods was to create an unfair advantage for their population to BUILD, MANUFACTURE, and BUY locally made products - avoiding US products as much as possible.

As I suggested, that is why Apple, and many other US manufacturers moved to Asia and overseas. They could not compete in the US with China charging 67% tariffs on US goods. So they had to move to China to manufacture products because importing Chinese-made products into the US was cheaper than importing US-made products into China.

Get it?

The current foreign Tariffs create an incredibly unfair global marketplace/economy - and that has to STOP (or at least be re-negotiated so it is more fair for everyone).

And I believe THAT is why Trump is raising tariffs on foreign nations.

Ultimately, this will likely be resolved as I suggest in this video (unless many foreign nations continue to raise tariff levels trying to combat US tariffs).

If other foreign nation simply say, "I won't stand for this, I'm raising my tariff levels to combat the new US tariffs", then we end up where we started - a grossly unfair global marketplace.

This is the 21st century, not the 18th century.

Step up to the table and realize we are not in the 1850s or 1950s any longer.

We are in 2025. Many global economies are competing at levels nearly equal to the US economy in terms of population, GDP, manufacturing, and more.

It's time to create a FREE and FAIR global economy, not some tariff-driven false economy on the backs of the US consumers. That has to end.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$100, $1,000, $100,000 — When Numbers Become Turning PointsHey! Have you ever wondered why 100 feels... special? 🤔

Round numbers are like hidden magnets in the market. 100. 500. 1,000. They feel complete. They stand out. They grab our attention and make us pause. In financial markets, these are the levels where price often slows down, stalls, or makes a surprising turn.

I’ll admit, once I confused the market with real life. I hoped a round number would cause a reversal in any situation. Like when I stepped on the scale and saw a clean 100 staring back at me, a level often known as strong resistance. I waited for a bounce, a sudden reversal... but nothing. The market reacts. My body? Not so much. 🤷♂️

The market reacts. But why? What makes these numbers so powerful? The answer lies in our minds, in market dynamics, and in our human tendency to crave simplicity.

-------------------------------------

Psychology: Why our brain loves round numbers

The human mind is designed to create structure. Round numbers are like lighthouses in the chaos — simple, memorable, and logical. If someone asks how much your sofa cost, you’re more likely to say "a grand" than "963.40 dollars." That’s normal. It’s your brain seeking clarity with minimal effort.

In financial markets, round numbers become key reference points. Traders, investors, even algorithms gravitate toward them. If enough people believe 100 is important, they start acting around that level — buying, selling, waiting. That belief becomes reality, whether it's rational or not. We anchor decisions to familiar numbers because they feel safe, clean, and "right."

Walmart (WMT) and the $100 mark

Round numbers also carry emotional weight. 100 feels like a milestone, a finish line. It’s not just a number, it’s both an ending and a beginning.

-------------------------------------

Round numbers in the market: Resistance and support

Round number as a resistance

Imagine a stock climbing steadily: 85, 92, 98... and then it hits 100. Suddenly, it stalls. Why? Investors who bought earlier see 100 as a "perfect" profit point. "A hundred bucks. Time to sell." Many pre-set sell orders are already waiting. Most people don’t place orders at $96.73. They aim for 100. A strong and symbolic.

At the same time, speculators and short sellers may step in, viewing 100 as too high. This creates pressure, slowing the rally or pushing the price back down.

If a stock begins its journey at, say, $35, the next key round levels for me are: 50, 100, 150, 200, 500, 1,000, 2,000, 5,000, 10,000…

Slide from my training materials

These levels have proven themselves again and again — often causing sideways movement or corrections. When I recently reviewed the entire S&P 500 list, for example $200 showed up consistently as a resistance point.

It’s pure psychology. Round numbers feel "high" — and it's often the perfect moment to lock in profits and reallocate capital. Bitcoin at $100,000. Netflix at $1,000. Tesla at $500. Walmart at $100. Palantir at $100. These are just a few recent examples.

Round number support: A lifeline for buyers

The same logic works in reverse. When price falls through 130, 115, 105... and lands near 100, buyers often step in. "100 looks like a good entry," they say. It feels like solid ground after a drop. We love comeback stories. Phoenix moments. Underdogs rising. Buy orders stack up and the price drop pauses.

Some examples:

Meta Platforms (META)

Amazon.com (AMZN) — $100 acted as resistance for years, then became support after a breakout

Tesla (TSLA)

-------------------------------------

Why round numbers work for both buyers and sellers

Buyers and the illusion of a bargain

If a stock falls from 137 to 110 and approaches 100, buyers feel like it’s hit bottom. Psychologically, 100 feels cheap and safe. Even if the company’s fundamentals haven’t changed, 100 just "feels right." It’s like seeing a price tag of $9.99 — our brain rounds it down and feels like we got an epic deal.

Sellers and the "perfect" exit

When a stock rises from 180 to 195 and nears 200, many sellers place orders right at 200. "That’s a nice round number, I’ll exit there." There’s emotional satisfaction. The gain feels cleaner, more meaningful, when it ends on a round note.

To be fair, I always suggest not waiting for an exact level like 200. If your stock moved through 145 > 165 > 185, don’t expect perfection. Leave room. A $190 target zone makes more sense. Often, greed kills profit before it can be realized. Don’t squeeze the lemon dry.

Example: My Tesla analysis on TradingView with a $500 target — TESLA: Money On Your Screen 2.0 | Lock in Fully…

Before & After: As you see there, the zone is important, not the exact number.

-------------------------------------

Round numbers in breakout trades

When price reaches a round number, the market often enters a kind of standoff. Buyers and sellers hesitate. The price moves sideways, say between 90 and 110. Psychologically, it’s a zone of indecision. The number is too important to ignore, but the direction isn’t clear until news or momentum pushes it.

When the direction is up and the market breaks above a key level, round numbers work brilliantly for breakout trades or strength-based entries.

Slide from my training materials

People are willing to pay more once they see the price break through a familiar barrier. FOMO kicks in. Those who sold earlier feel regret and jump back in. And just like that, momentum builds again — until the next round-number milestone.

Berkshire Hathaway (BRK.B) — every round number so far has caused mild corrections or sideways action. I’d think $500 won’t be any different.

-------------------------------------

Conclusion: Simplicity rules the market

Round numbers aren’t magic. They work because we, the people, make the market. We love simplicity, patterns, and emotional anchors. These price levels are where the market breathes, pauses, thinks, and decides. When you learn to recognize them, you gain an edge — not because the numbers do something, but because crowds do.

A round number alone is never a reason to act.

If a stock drops to 100, it doesn’t mean it’s time to buy. No single number works in isolation. You need a strategy — a set of supporting criteria that together increase the odds. Round numbers are powerful psychological levels, but the real advantage appears when they align with structure and signals.

Keep round numbers on your radar. They’re the market’s psychological mirror, and just like us, the market loves beautiful numbers.

If this article made you see price behavior differently, or gave you something to think about, feel free to share it.

🙌 So, that's it! A brief overview and hopefully, you found this informative. If this article made you see price behavior differently, or gave you something to think about, feel free to share it & leave a comment with your thoughts!

Before you leave - Like & Boost if you find this useful! 🚀

Trade smart,

Vaido