Smart Money Technique (SMT) Divergences - The Ultimate GuideIntroduction

SMT Divergences are a powerful concept used by professional traders to spot inefficiencies in the market. By comparing correlated assets, traders can identify hidden opportunities where one market shows strength while the other shows weakness. This guide will break down the major SMT divergences: EURUSD/GBPUSD, US100/US500, and XAUUSD/XAGUSD .

---

What is SMT Divergence?

SMT Divergence occurs when two correlated assets do not move in sync, signaling potential liquidity grabs or market inefficiencies. These divergences can be used to confirm trend reversals, identify smart money movements, and improve trade precision.

Key Concepts:

- If one asset makes a higher high while the correlated asset fails to do so, this suggests potential weakness in the pair making the higher high.

- If one asset makes a lower low while the correlated asset does not, this suggests potential strength in the pair that did not make a lower low.

- Smart Money often exploits these inefficiencies to engineer liquidity hunts before moving price in the intended direction.

---

EURUSD vs. GBPUSD SMT Divergence

These two forex pairs are highly correlated because both share the USD as the quote currency. However, when divergence occurs, it often signals liquidity manipulations.

How to Use:

- If GBPUSD makes a higher high but EURUSD does not, GBPUSD may be trapping breakout traders before reversing.

- If EURUSD makes a lower low but GBPUSD does not, EURUSD might be in a liquidity grab, signaling a potential reversal.

---

US100 vs. US500 SMT Divergence

The NASDAQ (US100) and S&P 500 (US500) are both major indices with a strong correlation, but tech-heavy NASDAQ can sometimes lead or lag the S&P.

How to Use:

- If US100 makes a higher high but US500 does not, it suggests US100 is extended and may reverse soon.

- If US500 makes a lower low but US100 does not, US500 might be experiencing a liquidity grab before a reversal.

---

XAUUSD vs. XAGUSD SMT Divergence

Gold (XAUUSD) and Silver (XAGUSD) have a historic correlation. However, due to differences in volatility and liquidity, they can diverge, presenting trading opportunities.

How to Use:

- If Gold makes a higher high but Silver does not, Gold might be overextended and ready to reverse.

- If Silver makes a lower low but Gold does not, Silver might be in a liquidity grab, signaling strength.

---

Indicator Used for SMT Divergences

To simplify the process of identifying SMT divergences, this guide utilizes the TradingView indicator TehThomas ICT SMT Divergences . This tool automatically detects divergences between correlated assets, highlighting potential trade opportunities.

You can access the indicator here:

Why Use This Indicator?

- Automatically plots divergences, saving time on manual comparisons.

- Works across multiple asset classes (Forex, Indices, Metals, etc.).

- Helps traders spot Smart Money inefficiencies with ease.

---

Final Tips for Trading SMT Divergences

1. Use Higher Timeframes for Confirmation: SMT Divergences on 1H or 4H hold more weight than those on lower timeframes.

2. Combine with Other Confluences: ICT concepts like Order Blocks, FVGs, or liquidity sweeps can strengthen the SMT setup.

3. Wait for Market Structure Confirmation: After spotting SMT divergence, look for a market structure shift before entering trades.

4. Be Mindful of Economic Events: Divergences can appear due to news releases, so always check the economic calendar.

---

Conclusion

SMT Divergences are a valuable tool for traders looking to gain an edge in the markets. By analyzing inefficiencies between correlated assets, traders can anticipate smart money movements and improve trade precision. Practice spotting these divergences on real charts, and soon, you'll develop a keen eye for hidden liquidity traps.

Happy trading!

Trend Analysis

Precision Trading – How Our Trade Played Out PerfectlyIntroduction

In trading, precision and patience are everything. We don’t chase trades—we wait for the perfect confluence of technical factors to align. This trade idea followed our systematic approach, utilizing ranges, Fibonacci levels, internal & inducement liquidity, break of structure (BOS), entry confirmation patterns, and harmonics. Here’s a breakdown of how it all unfolded.

1. Identifying the Range

Before executing, we mapped out the market structure to establish a clear range. The price action showed a well-defined consolidation zone, which helped us anticipate liquidity grabs and potential reversal points.

2. Fibonacci Confluence – 78.20% Level

Using the Fibonacci retracement tool, we identified the 78.20% level as a strong reaction point. This aligned with other key technicals, increasing our confidence in the trade setup.

3. Internal & Inducement Liquidity

Liquidity is key in trading. We spotted internal liquidity zones where price was likely to manipulate weak hands before the actual move. Inducement liquidity was also present, providing additional confirmation that price would tap into deeper levels before reversing.

4. Break of Structure (BOS) and Entry Confirmation

Once BOS occurred in alignment with our anticipated liquidity grab, we looked for our **entry pattern**. The market printed a textbook confirmation, allowing us to enter with precision and minimal risk.

5. Harmonic Pattern for Additional Confluence

The final piece of confirmation was a harmonic pattern, further validating our entry. These patterns, when combined with our overall strategy, add an extra layer of probability to our trades.

Trade Outcome

The execution was flawless! 🎯 The price respected our levels, moved in our favor, and hit our target zones with precision. This is the power of structured analysis and disciplined execution.

📉 Key Takeaway:Never trade blindly! Always have a solid confluence of technicals before taking a trade.**

🔎 What’s your go-to confirmation before entering a trade? Let’s discuss in the comments! 📩

#ForexTrader #ForexLifestyle #ForexSignals #DayTrading #TradingMindset #ForexMoney #PipsOnPips #ForexSuccess #ForexMotivation #MillionaireMindset #TradingStrategy #FXMarket #ForexWins #TradeSmart #MarketAnalysis #WealthBuilding #Investing #PriceAction #ChartAnalysis #Scalping #SwingTrading #FinancialFreedom #MakingMoneyMoves #HustleHard #NoDaysOff #MoneyMindset

The Greatest Opportunity of Your Life : Answering QuestionsThis video is an answer to Luck264's question about potential price rotation.

I go into much more details because I want to highlight the need to keep price action in perspective related to overall (broader) and more immediate (shorter-term) trends.

Additionally, I try to highlight what I've been trying to tell all of you over the past 3+ years...

The next 3-%+ years are the GREATEST OPPORTUNITY OF YOUR LIFE.

You can't even imagine the potential for gains unless I try to draw it out for you. So, here you go.

This video highlights why price is the ultimate indicator and why my research/data is superior to many other types of analysis.

My data is factual, process-based, and results in A or B outcomes.

I don't mess around with too many indicators because I find them confusing at times.

Price tells me everything I need to know - learn what I do to improve your trading.

Hope you enjoy this video.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

ICT Concepts for FX and GOLD traders: 2025 edition🔍 ICT (Inner Circle Trader) is a trading methodology developed by Michael J. Huddleston. It focuses on market structure, smart money concepts (SMC), and how institutions manipulate liquidity to trap retail traders.

📚 It's not about indicators or over-complication — it's about reading the price action like a pro, understanding where liquidity is, and trading with the banks, not against them.

📐 1. Market Structure

Understand Highs & Lows: Identify break of structure (BOS) and change of character (CHOCH)

Follow the macro to micro flow: D1 > H4 > M15 for precision entries

🧱 2. Order Blocks (OBs)

An order block is the last bullish or bearish candle before a major price move.

Banks and institutions place large orders here.

Smart traders look for price to return to these areas (mitigation), then enter with tight stop losses.

👉 Think of OBs as institutional footprints on the chart.

💧 3. Liquidity Zones

Equal highs/lows, trendline touches, support/resistance — these are liquidity traps.

ICT teaches that price often hunts liquidity before reversing. That’s why many retail traders get stopped out.

Learn to trade into liquidity, not off it.

🔄 4. Fair Value Gaps (FVGs)

Also called imbalances — when price moves too fast and leaves gaps.

Price often retraces to "fill the gap" — a key entry point for ICT traders.

🥇 ICT for Gold & Forex in 2025

💰 Why It Works for XAUUSD & Majors:

Gold is a highly manipulated asset, perfect for ICT-style trading.

It responds beautifully to liquidity grabs, order blocks, and Asian–London–New York session transitions.

Forex majors (EUR/USD, GBP/USD, etc.) are also ideal since they’re heavily influenced by institutional flow and news-driven liquidity hunts.

🕐 Timing Is Everything

Trade Killzones:

📍 London Killzone: 2AM–5AM EST

📍 New York Killzone: 7AM–10AM EST

These are high-volume sessions where institutions make their moves.

📈 Typical ICT Setup

▪️Spot liquidity zone above or below recent price

▪️Wait for liquidity sweep (stop hunt)

▪️Identify nearby order block or FVG

▪️Enter on a pullback into OB/FVG

▪️Set tight SL just past the recent swing

Target internal range, opposing OB, or next liquidity level

👨💻 Why FX/GOLD Traders Love ICT

✅ It’s clean, no indicators, and highly logical

✅ Great for part-time trading — 1 or 2 trades a day

✅ Feels like "leveling up" your understanding of the market

✅ Perfect for backtesting and journaling on platforms like TradingView or SmartCharts

✅ Easy to integrate into algo-based systems or EAs for semi-automation

If you’re tired of indicators and guessing, and want to trade like the institutions, ICT is a game changer. In 2025, more prop firms and traders are applying ICT concepts to dominate markets like gold, forex, and even crypto.

🧭 Master the method. Understand the logic. Ride with the smart money.

🔥 Welcome to the next level of trading.

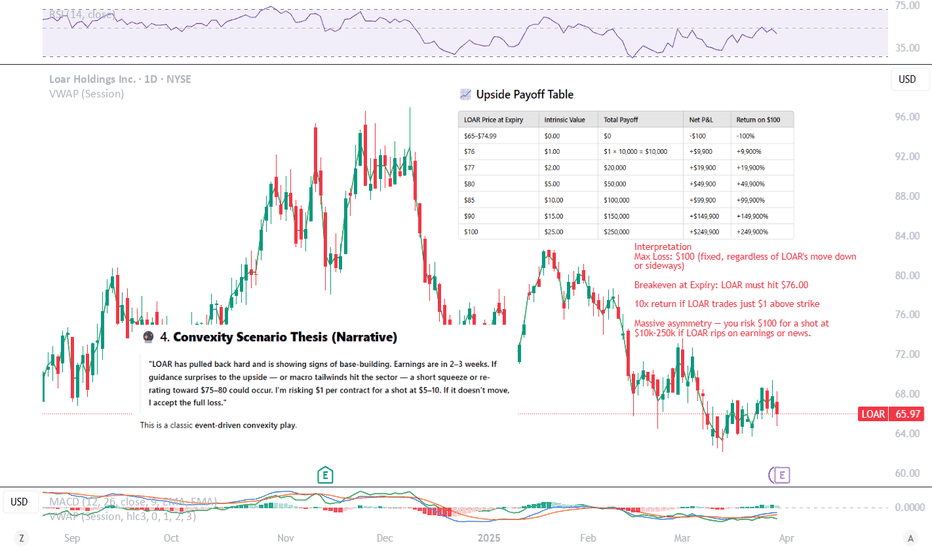

Convexity-based trade scenario using LOAR stock and the April 17Yo traders -

Let’s map out a convexity-based trade scenario using LOAR stock and the April 17, 2025 $75 Call option — currently trading at $1.00, with the stock at $65.97 and only 18 days to expiry.

🔍 Step-by-Step Breakdown:

🧠 1. Basic Structure

You’re buying the LOAR Apr17 $75 call at $1.00.

This is a deep OTM bet (~13.7% above current price).

You’re betting on a short-term move to $75+, meaning volatility spike or news catalyst.

⚙️ 2. Convexity Setup

Convexity means:

Small risk, asymmetric reward

If LOAR stays flat or dips → you lose $1 per contract

If LOAR rips to $80+ → this option could return 5x to 10x+

LOAR Price at Expiry Option Intrinsic Value Profit/Loss

$66 (flat) $0 -$1.00

$70 $0 -$1.00

$75 (strike) $0 -$1.00

$77 $2.00 +$1.00

$80 $5.00 +$4.00 (5x)

$85 $10.00 +$9.00 (9x)

🧾 3. Chart + Sentiment Setup

Looking at the TradingView chart:

Price Action:

LOAR is basing around $66 after a steep downtrend — potential reversal pattern

Volume is light, but some buy pressure is visible

MACD:

Appears to be flattening and potentially crossing bullish

RSI:

~40s: Oversold-to-neutral zone. Could support upward bounce.

Earnings coming up (E icon):

Strong potential for a catalyst move

This setup enhances convexity, because earnings can produce gap moves that DOTM options profit from disproportionately.

🔮 4. Convexity Scenario Thesis (Narrative)

"LOAR has pulled back hard and is showing signs of base-building. Earnings are in 2–3 weeks. If guidance surprises to the upside — or macro tailwinds hit the sector — a short squeeze or re-rating toward $75–80 could occur. I’m risking $1 per contract for a shot at $5–10. If it doesn’t move, I accept the full loss."

This is a classic event-driven convexity play.

⚠️ 5. Risks & Considerations

Time decay is brutal: With only 18 days left, theta decay accelerates daily

IV Crush post-earnings could hurt even if the stock moves

You need a fast, strong move, ideally before or at earnings

Position sizing is critical: This is a "lottery ticket" — don’t over-allocate

✅ 6. Ideal for Your Strategy If:

You're making many small bets like this across tickers/catalysts

You’re not trying to be “right” often, but “big” occasionally

You have capital discipline and uncorrelated base assets

🧮 Position Size:

Option price = $1.00 per contract

You buy 100 contracts of the $75 call

Total risk = $100

Each $1.00 move above $75 = $100 profit per $1, since 100 contracts × 100 shares/contract = 10,000 shares exposure

📈 Upside Payoff Table

LOAR Price at Expiry Intrinsic Value Total Payoff Net P&L Return on $100

$65–$74.99 $0.00 $0 -$100 -100%

$76 $1.00 $1 × 10,000 = $10,000 +$9,900 +9,900%

$77 $2.00 $20,000 +$19,900 +19,900%

$80 $5.00 $50,000 +$49,900 +49,900%

$85 $10.00 $100,000 +$99,900 +99,900%

$90 $15.00 $150,000 +$149,900 +149,900%

$100 $25.00 $250,000 +$249,900 +249,900%

🧠 Interpretation

Max Loss: $100 (fixed, regardless of LOAR's move down or sideways)

Breakeven at Expiry: LOAR must hit $76.00

10x return if LOAR trades just $1 above strike

Massive asymmetry — you risk $100 for a shot at $10k–250k if LOAR rips on earnings or news.

📌 Real-World Considerations:

You might exit early if the option spikes in value before expiry (e.g., stock runs to $72 with 5 days left).

Liquidity may limit large size fills.

Volatility matters: IV spike pre-earnings or a big gap post-earnings increases your chance of profit.

📊 Convex Payoff Table for LOAR Apr17 $75 Call (100 Contracts, $100 Risk)

LOAR Price at Expiry % Move from $65.97 Intrinsic Value Total Payoff Net P&L Return on $100

$65–$74.99 0% to +13.6% $0.00 $0 -$100 -100%

$76 +15.2% $1.00 $10,000 +$9,900 +9,900%

$77 +17.0% $2.00 $20,000 +$19,900 +19,900%

$80 +21.3% $5.00 $50,000 +$49,900 +49,900%

$85 +28.9% $10.00 $100,000 +$99,900 +99,900%

$90 +36.4% $15.00 $150,000 +$149,900 +149,900%

$100 +51.6% $25.00 $250,000 +$249,900 +249,900%

🧠 Takeaway:

Even a 15% move turns your $100 into $10,000 — this is why convex trades are so powerful.

But the trade-off is probability: the odds of a 15–50%+ move in 18 days are low, which is why risk is capped and position sizing matters.

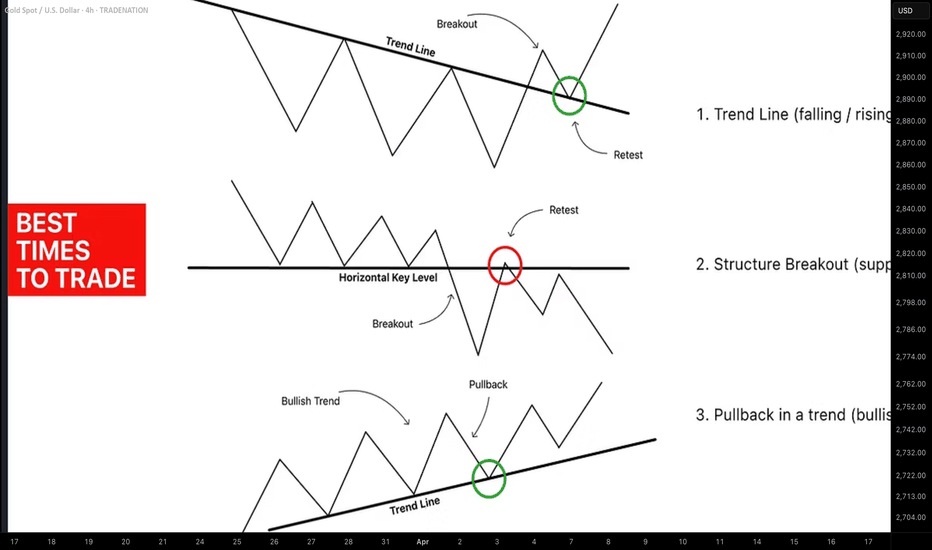

3 Best Trading Opportunities to Maximize Profit Potential

Hey traders,

In the today's article, we will discuss 3 types of incredibly accurate setups that you can apply for trading financial markets.

1. Trend Line Breakout and Retest

The first setup is a classic trend line breakout.

Please, note that such a setup will be accurate if the trend line is based on at least 3 consequent bullish or bearish moves.

If the market bounces from a trend line, it is a vertical support.

If the market drops from a trend line, it is a vertical resistance.

The breakout of the trend line - vertical support is a candle close below that. After a breakout, it turns into a safe point to sell the market from.

The breakout of the trend line - vertical resistance is a candle close above that. After a breakout, it turns into a safe point to buy the market from.

Take a look at the example. On GBPJPY, the market was growing steadily, respecting a rising trend line that was a vertical support.

A candle close below that confirmed its bearish violation.

It turned into a vertical resistance .

Its retest was a perfect point to sell the market from.

2. Horizontal Structure Breakout and Retest

The second setup is a breakout of a horizontal key level.

The breakout of a horizontal support and a candle close below that is a strong bearish signal. After a breakout, a support turns into a resistance.

Its retest is a safe point to sell the market from.

The breakout of a horizontal resistance and a candle close above that is a strong bullish signal. After a breakout, a resistance turns into a support.

Its retest if a safe point to buy the market from.

Here is the example. WTI Crude Oil broke a key daily structure resistance. A candle close above confirmed the violation.

After a breakout, the broken resistance turned into a support.

Its test was a perfect point to buy the market from.

3. Buying / Selling the Market After Pullbacks

The third option is to trade the market after pullbacks.

However, remember that the market should be strictly in a trend .

In a bullish trend, the market corrects itself after it sets new higher highs. The higher lows usually respect the rising trend lines.

Buying the market from such a trend line, you open a safe trend-following trade.

In a bearish trend, after the price sets lower lows, the correctional movements initiate. The lower highs quite often respect the falling trend lines.

Selling the market from such a trend line, you open a safe trend-following trade.

On the chart above, we can see EURAUD pair trading in a bullish trend.

After the price sets new highs, it retraces to a rising trend line.

Once the trend line is reached, trend-following movements initiate.

What I like about these 3 setups is the fact that they work on every market and on every time frame. So no matter what you trade and what is your trading style, you can apply them for making nice profits.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

What Are the Inner Circle Trading Concepts? What Are the Inner Circle Trading Concepts?

Inner Circle Trading (ICT) offers a sophisticated lens through which traders can view and interpret market movements, providing traders with insights that go beyond conventional technical analysis. This article explores key ICT concepts, aiming to equip traders with a thorough understanding of how these insights can be applied to enhance their trading decisions.

Introduction to the Inner Circle Trading Methodology

Inner Circle Trading (ICT) methodology is a sophisticated approach to financial markets that zeroes in on the behaviours of large institutional traders. Unlike conventional trading methods, ICT is not merely about recognising patterns in price movements but involves understanding the intentions behind those movements. It is part of the broader Smart Money Concept (SMC), which analyses how major players influence the market.

Key Inner Circle Trading Concepts

Within the ICT methodology, there are many concepts to learn. Below, we’ve explained the most fundamental ideas central to ICT trading.

Structure

Understanding the structure of a market is fundamental to effectively employing the ICT methodology. In the context of ICT, market structure is defined by the identification of trends through specific patterns of highs and lows.

Market Structure

A market trend is typically characterised by a series of higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend. This sequential pattern provides a visual representation of market sentiment and momentum.

Importantly, market trends are fractal, replicating similar patterns at different scales or timeframes. For example, what appears as a bearish trend on a short timeframe might merely be a corrective phase within a larger bullish trend. By understanding this fractal nature, traders can better align their strategies with the prevailing trend at different trading intervals.

Break of Structure (BOS)

A Break of Structure occurs when there is a clear deviation from these established patterns of highs and lows. In an uptrend, a BOS is signalled by prices exceeding a previous high without falling below the most recent higher low, confirming the strength and continuation of the uptrend.

Conversely, in a downtrend, a BOS is indicated when prices drop below a previous low without breaching the prior lower high, signifying that the downtrend remains strong. Identifying a BOS gives traders valuable clues about the continuation of the current market direction.

Change of Character (CHoCH)

The Change of Character in a market happens when there is a noticeable alteration in the behaviour of price movements, suggesting a potential reversal of a given trend. This might be seen in an uptrend where the price fails to reach a new high and then breaks below a recent higher low, indicating that the buying momentum is waning and a bearish reversal is possible.

Identifying a CHoCH helps traders recognise when the market momentum is shifting, which is critical for adjusting positions to capitalise on or protect against a new trend.

Market Structure Shift (MSS)

A Market Structure Shift is a significant change in the market that can disrupt the existing trend. This specific type of CHoCH is typically marked by a price moving sharply (a displacement) through a key structural level, such as a higher low in an uptrend or a lower high in a downtrend.

These shifts can signal a profound change in market dynamics, with the sharp move often preceding a new sustained trend. Recognising an MSS allows traders to reevaluate their current bias and adapt to a new trend, given its clear signal.

Order Blocks

Order blocks are a central component of ICT trading, providing crucial insights into potential areas where the price may react strongly due to significant buy or sell interests from large market participants.

Regular Order Blocks

A regular order block is an area on the price chart representing a concentration of buying (demand zone) or selling (supply zone) activity.

In an uptrend, a bullish order block is identified during a downward price movement and marks the last area of selling before a substantial upward price movement occurs. Conversely, a bearish order block forms in an uptrend where the last buying action appears before a significant downward price shift.

In the ICT trading strategy, order blocks are seen as reversal areas. So, if the price revisits a bullish order block following a BOS higher, it’s assumed that the block will hold and prompt a reversal that produces a new higher high.

Breaker Blocks

Breaker blocks play a crucial role in identifying trend reversals. They are typically formed when the price makes a BOS before reversing and breaking beyond an order block that should hold if the established market structure is to be maintained. This formation indicates that liquidity has been taken.

For instance, in an uptrend, if the price creates a new high but then reverses below the previous higher low, the bullish order block above the low becomes a breaker block. A breaker block can be an area that prompts a reversal as the new trend unfolds; it’s a similar concept to support becoming resistance and vice versa.

Mitigation Blocks

Mitigation blocks are similar to breaker blocks, except they occur after a failure swing, where the price attempts but fails to surpass a previous peak in an uptrend or a previous trough in a downtrend. This pattern indicates a loss of momentum and potential reversal as the price fails to sustain its previous direction.

For example, in an uptrend, if the price makes a lower high and then breaks the structure by dropping below the previous low, the order block formed at the previous low becomes a mitigation block. These blocks are critical for traders because they’re also expected to produce a reversal if a new trend has been set in motion.

Liquidity

Liquidity refers to areas on the price chart with a high concentration of trading activity, typically marked by stop orders from retail traders.

Buy- and Sell-Side Liquidity

Buy-side liquidity is found where there is a likely accumulation of short-selling traders' stop orders, typically above recent highs. Conversely, sell-side liquidity is located below recent lows, where bullish traders' stop orders accumulate. When prices touch these areas, activating stop orders can cause a reversal, presenting a potential level of support or resistance.

Liquidity Grabs

A liquidity grab occurs when the price quickly spikes into these high-density order areas, triggering stops and then reversing direction. In ICT theory, this action is often orchestrated by larger players aiming to capitalise on the flurry of orders to execute their large-volume trades with minimal slippage. It's a strategic move that temporarily shifts price momentum, usually just long enough to trigger the stops before the market direction reverses.

Inducement

An inducement is a specific type of liquidity grab that triggers stops and entices other traders to enter the market. It often appears as a peak or trough, typically into an area of liquidity, in a minor counter-trend within the larger market trend. Inducements are designed by smart money to create an illusion of a trend change, prompting an influx of retail trading in the wrong direction. Once the retail traders have committed, the price swiftly reverses, aligning back with the original major trend.

Trending Movements

In the Inner Circle Trading methodology, two specific types of sharp trending movements signal significant shifts in market dynamics: fair value gaps and displacements.

Fair Value Gaps

A fair value gap (FVG) occurs when there is a noticeable absence of trading within a price range, typically represented by a swift and substantial price move without retracement. This gap often forms between the wicks of two adjacent candles where no trading has occurred, signifying a strong directional push.

Fair value gaps are important because they indicate areas on the chart where the price may return to "fill" the gap, usually before meeting an order block, offering potential trading opportunities as the market seeks to establish equilibrium.

Displacements

Displacements, also known as liquidity voids, are characterised by sudden, forceful price movements occurring between two chart levels and lacking the typical gradual trading activity observed in between. They are essentially amplified and more substantial versions of fair value gaps, often spanning multiple candles and FVGs, signalling a heightened imbalance between buy and sell orders.

Other Components

Beyond these ICT concepts, there are a few other niche components.

Kill Zones

Kill Zones refer to specific timeframes during the trading day when market activity significantly increases due to the opening or closing of major financial centres. These periods are crucial for traders as they often set the tone for price movements based on the increased volume and volatility:

Optimal Trade Entry

An optimal trade entry (OTE) is a type of Inner Circle trading strategy, found using Fibonacci retracement levels. After an inducement that prompts a displacement (leaving behind an FVG), traders use the Fibonacci retracement tool to pinpoint entry areas.

The first point is set at the major high or low that prompts the displacement, while the second point is set at the next significant swing high or low that forms. In a bearish movement, for example, the initial point is set at the swing high before the displacement and the subsequent point at the new swing low. Traders often look to the 61.8% to 78.6% retracement level for entries.

Balanced Price Range

A balanced price range is observed when two opposing displacements create FVGs in a short timeframe, indicating a broad zone of price consolidation. During this period, prices typically test both extremes, attempting to fill the gaps. This scenario offers traders potential zones for trend reversals as the price seeks to establish a new equilibrium, as well as key levels to watch for a breakout.

The Bottom Line

Understanding ICT concepts gives traders the tools to decode complex market signals and align their strategies with the influential trends shaped by the largest market participants. For those looking to apply these sophisticated trading techniques practically, opening an FXOpen account can be a great step towards engaging with the markets through a robust platform designed to support advanced trading strategies.

FAQs

What Are ICT Concepts in Trading?

ICT (Inner Circle Trading) concepts encompass a series of advanced trading principles that focus on replicating the strategies of large institutional players. These concepts include liquidity zones, order blocks, market structure shifts, and optimal trade entries, all aimed at understanding and anticipating significant market movements.

What Is ICT in Trading?

ICT in trading refers to the Inner Circle Trading methodology, a strategy developed to align smaller traders’ actions with those of more influential market participants. It utilises specific market phenomena, such as order blocks and liquidity patterns, to analyse price movements and improve trading outcomes.

What Is ICT Trading?

ICT trading is the application of concepts that seek to identify patterns and structures that indicate potential price changes driven by institutional activities, aiming to capitalise on these movements.

What Is ICT Strategy?

An ICT strategy combines market analysis techniques to identify where significant market players are likely to influence prices. This includes analysing price levels where large volumes of buy or sell orders are anticipated to occur and identifying key times when market moves are most likely.

Is ICT Better Than SMC?

Comparing ICT and SMC (Smart Money Concept) is challenging as ICT is essentially a subset of SMC. While SMC provides a broader overview of how institutional money influences the markets, ICT offers more specific techniques and terms like inducements and displacements. Whether one is better depends on the trader’s specific needs and alignment with these methodologies’ intricacies.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Title: How to Spot Potential Price Reversals: Part 2A subject within technical analysis that many find difficult to apply to their day-to-day trading is the ability to spot reversals in price.

Yesterday we posted part 1 of this 2 part educational series, where we used GBPUSD as an example of how you could identify and trade a Head and Shoulders/Reversed Head and Shoulders pattern.

In today’s post we discuss a Double Top/Double Bottom, using a recent US 100 example.

Our intention is to help you understand why price activity is reversing and highlight how knowledge of this may be applied within your own individual trading strategies.

The Double Top Reversal:

The Double Top, is formed by 2 distinct price highs.

This pattern highlights the potential,

• reversal of a previous uptrend in price, into a phase of price weakness

• reversal of a previous downtrend in price into a more prolonged period of price strength.

In this example, we are going to talk about a bearish reversal in price called a Double Top.

Points to Note: A Double Top

• An uptrend in price must be in place for the pattern to form.

• A Double Top pattern is made up of 2 clear highs and one low, forming a letter ‘M’ shape on a price chart.

• This pattern reflects an inability of buyers to push price activity above a previous peak in price, potentially highlighting a negative shift in sentiment and sellers gaining the upper hand. This is regarded as a ‘weak test’ of a previous price failure high and leaves 2 price peaks at, or very close to each other.

• A horizontal trendline is drawn at the low between the 2 peaks, which highlights the neckline of the pattern. If this is broken on a closing basis, the pattern is completed, reflecting a negative sentiment shift and the potential of further price weakness.

Point to Note: To understand a bullish reversal, known as a ‘Double Bottom’ please simply follow the opposite analysis of what is highlighted above.

US 100 Example:

In the chart below, we look at the US 100 index and the formation of a Double Top pattern from earlier in 2025.

As with any bearish reversal in price, a clear uptrend and extended price advance must have been seen for the reversal pattern to be valid. On the chart above, this was reflected by the advance from the August 5th 2024 low up into the December 16th price high.

The Double Top pattern is made up of 2 price highs close or at the same level as each other, with a low trade in the middle, which forms a letter ‘M’ on the chart (see below).

In this example above, the highs are marked by 22142, the December 16th and 22226, the February 18th highs, with the 20477 level posted on January 13th represents the low traded in the middle, which helps to form the ‘M’.

The Neckline of the pattern is drawn using a horizontal line at the 20477 January 13th low, with the Double Top pattern completed on closes below this level. Potential then turns towards a more extended phase of price weakness to reverse the previous uptrend, even opening the possibility a new downtrend in price being formed.

Does the Double Top Pattern Suggest a Potential Price Objective?

Yes, it does. This can be done by measuring the height of the 2nd peak in price down to the Neckline level at that time, this distance is projected lower from the point the neckline was broken, suggesting a possible minimum objective for any future price decline.

In the example above, the 2nd high was at 22226, posted on February 18th 2025, with the Neckline at 20477, meaning the height of the pattern was 1749 (points). On February 27th the Neckline of the pattern was broken on a closing basis.

This means… 20477 – 1749 = 18728 as a minimum potential price objective for the Double Top pattern.

Of course, as with any technical pattern, completion is not a guarantee of a significant phase of price movement, with much still dependent on future sentiment and price trends.

Therefore, if initiating a trade based on a Double Top pattern, you must ALWAYS place a stop loss to protect against any unforeseen event or price movement.

This stop loss should initially be placed just above the level of the 2nd price high, as any break negates the pattern, meaning we were wrong to class the pattern as we did.

Hopefully, as prices fall after completion of the pattern, you can consider moving your stop loss lower, keeping it just above lower resistance levels to protect your position and lock in potential gains.

While both the Head and Shoulders and Double Top/Bottom patterns can take a prolonged period to form and we must be patient to wait for completion, they reflect important signals indicating potential changes in price sentiment and direction.

By understanding how and why these patterns form can offer an important insight to potential price activity that can help to support day to day decision making when deciding on trading strategies.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Trading Minest. Welcome to the most difficult game in the worldUnfortunately, you will be playing against some of the sharpest, fastest, smartest, most intelligent, well-informed, irrational, and, in many cases, unethical intellects in the world.

You are fighting a computer that reacts faster than you.

A trader who has more experience than you.

A fund that has more money than you.

An insider who has more information than you.

Others who misinform you.

An inner voice that will do everything it can to stop you.

So, give up your dreams of making a quick and easy buck.

Your first goal is survival.

Your first absolute goal is to learn how to stay in the game.

You can only do this by marking your territory.

By understanding how the competition thinks and acts.

By having a clear game plan.

And by choosing your attacks very, very carefully.

I've been sharing my knowledge on TradingView for years, but I'm sure this post will help you, too.

I want to talk about Trading Minest. After I set up a trading firm, I realized that this is the knowledge that most traders lack.

1. Survive at all costs

The higher your survival rate, the better trader you'll be.

If you disagree with that, you better give your money to me.

You don't have a survival instinct.

A strong survival instinct is an essential personal quality you must possess.

It teaches you to jump out of losing deals and hold on to winning ones with a dead grip.

That's what your inner attitude should be. It's essential because trading is all about survival.

It's also the essence of our lives.

2. You must be constantly afraid

You have to evaluate the opponent. If he is a stone, be water; if he is water, I will be a stone.

Maximize objective assessment of your opponent and adapt to him, but most people lack enough fear.

And if we don't have fear, we can open any trade.

And we won't use stop losses.

We're gonna do everything wrong.

And lose.

I want you to be afraid.

Example: If you are not afraid to lose, and we have the same trade, who will choose the more defensive tactic?

Whoever thinks I'm not afraid of all this nonsense, I have plenty of money. With that attitude, you will lose.

But if I am scared to death, I will use stops, watch what is happening in the market, and calculate my actions. But if a person has no fear, he will act recklessly, and then all of a sudden, bam, bam, and disaster will happen.

Many traders have lost money and committed suicide because they had no fear.

3.The ability to win when things aren't going well for you

The most essential quality of an athlete is the ability to score points when they need to catch up.

You should be able to win when you fall behind or have four losing trades; that is the difference between good traders and bad traders.

You say to yourself, "I'm behind; I'm not doing well."

And you have a choice to throw up the white flag and give up.

Or you can say, "To hell with it. I'm just gonna grit my teeth and get back in the ring and give it my best."

That's what your inner attitude should be.

You have to be able to win when you're behind.

You have to learn how to win when you're in a losing position.

That's how you have to set yourself up.

Otherwise, you will be in big trouble because no one can avoid losses in market trading.

And at some point, you are guaranteed to have a losing trade.

Only optimists can trade.

You're all so damn optimistic.

Because you think you can win a game, many people believe it's impossible. Many people say how much they lost in the market, but if they failed, someone made millions of dollars every year waiting for me to take money from the dealing. You're donating money to people who don't know the basic rules.

4. Use only proven methods

Do what works and don't do what doesn't work.

Reinforce the strong.

Best Regards, EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Entry Psychology Hey guys, Ray here, and I just entered a trade here.

Doesn't matter buy or sell,

or what currency your trading.

We all enter the market and none of us can ever know the "perfect price".

Therefore, our Stop Loss is inadvertently a key factor in our entries, lot sizes, and psychology.

In this video I explain what I mean...

Please comment if you found this insightful!

How to Spot Potential Price Reversals - Part 1: GBPUSD ExampleA subject within technical analysis that many traders find difficult to apply to their day-to-day trading is the ability to spot reversals in price.

The misreading of price activity when a reversal is materialising can often lead to incorrect decisions, such as entering a trade too early, which can result in being stopped out of a potentially successful trade before price activity moves in the intended direction.

In this piece today, and part 2 tomorrow, we want to look at 2 types of reversal in price – the Head and Shoulders/Reversed Head and Shoulders and the Double Top/Double Bottom.

The intention is to help you understand why price activity is reversing and highlight how knowledge of this may be applied within your own individual trading strategies.

The Head and Shoulders Pattern

This pattern highlights the potential,

• reversal of a previous downtrend in price into a more prolonged period of upside strength

• reversal of a previous uptrend in price into a phase of weakness

In this example, we are going to outline in more detail a bullish reversal in price, which is called a ‘Reversed Head and Shoulders’.

Points to Note: Reversed Head and Shoulders

• A downtrend in price must have been in place.

• A Reversed Head and Shoulders is made up of 3 clear troughs on a price chart.

• The middle trough (called the Head) is lower than the 2 outer price troughs (called the

Left Hand Shoulder and the Right Hand Shoulder).

• The 3rd low in price (Right Hand Shoulder) being higher than the Head, reflects the

inability of sellers to be able to break under a previous low in price. This is regarded as a

‘weak test’ of a previous price extreme, suggesting buyers may be gaining the upper hand,

readying for a potential positive sentiment shift and price strength.

• A trendline connecting highs in price that mark the upper extremes of the Head is drawn.

This highlights the Neckline of the pattern, which if broken on a closing basis, completes

the reversal, to represent a positive shift in sentiment and the potential of further price strength.

Point to Note: To understand a bearish reversal, known as a ‘Head and Shoulders Top’ please simply follow the opposite analysis of what is highlighted above.

GBPUSD Example:

In the chart below, we look at the recent activity of GBPUSD, which formed a bullish Reversed Head and Shoulders Pattern between December 20th 2024 and February 13th 2025, when the pattern was completed.

As with any bullish reversal in price, a clear downtrend and extended price decline must have been seen previously, for the reversal pattern to be valid. On the chart above, this was reflected by the decline from the September 20th 2024 high at 1.3434, into the January 13th price low at 1.2100.

The Head and Shoulders pattern is made up of 3 troughs in price and in this example, these are marked by the period between December 30th 2024 to January 7th 2025 which forms the Left Hand Shoulder , between January 7th to February 5th 2025 which was the Head developing , and between February 5th to February 13th 2025, which then formed the Right Hand Shoulder .

The Neckline of the pattern is drawn connecting the December 30th 2024 high and the February 5th 2025 highs, which was broken on a closing basis on February 13th 2025. It was on this day, the Reversed Head and Shoulders Pattern was completed with potential then turning towards a more extended phase of price strength.

Does the Head and Shoulders offer an Insight into a Potential Price Objective?

Yes, it does, by measuring the height from the bottom of the Head to the level of the Neckline at the time that low was posted, we can project this distance higher from the point the neckline was broken. This suggests a possible minimum objective for any future price strength.

In the example above, a low of 1.2100 was registered on January 13th 2025, at which time the Neckline stood at 1.2576. This means the height of the Head was 0.0476 (476 pips). On February 13th when the Neckline was broken on a closing basis, the Neckline stood at 1.2529.

As such…

1.2529 + 0.0476 = 1.3005, which would be the minimum potential price objective for the Reversed Head and Shoulders. This level was in fact achieved on March 18th 2025.

Of course, while the Head and Shoulders pattern is regarded as one of the most reliable patterns within technical analysis, it is not a guarantee of a significant price movement, as much will still depend on future sentiment and price trends.

Therefore, if initiating a trade based on a Reversed Head and Shoulders pattern, you must ALWAYS place a stop loss to protect against any unforeseen event or price movement.

The stop loss should initially be placed just under the level of the Right Hand Shoulder, as any break of this point negates the pattern, meaning we were wrong to class the pattern as we did.

However, if prices rise after completion of the pattern, you can consider moving a stop loss higher, keeping it just under higher support levels to protect your position.

We highlighted the formation of the potential GBPUSD reversed Head and Shoulders pattern on February 13th 2025, so please take a look at our timeline for further details.

Remember to watch out for tomorrow’s Part 2 post

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Five powerful trading psychology tips to help youHere are five powerful trading psychology tips to help you cope with losses and stay in the game without giving up:

1. Accept Losses as Part of the Game

Losses are inevitable in trading—even the best traders lose. Instead of fearing them, see losses as the cost of doing business and a learning opportunity. Keep a trading journal to analyze your mistakes and improve over time.

2. Control Your Emotions & Stick to the Plan

Emotions like fear and greed lead to revenge trading and overleveraging. Set clear rules for stop-losses, position sizing, and risk per trade. Never move your stop loss out of desperation—respect your trading plan.

3. Manage Your Risk Like a Pro

Follow the 1-2% risk per trade rule to protect your capital. If you lose small, you can always come back. A good risk-to-reward ratio (at least 1:2 or 1:3) ensures that even a 40% win rate can still be profitable in the long run.

4. Take Breaks & Maintain a Strong Mindset

If you experience a streak of losses, step away from the charts for a while. Clear your mind, do something unrelated to trading, and return with a fresh perspective. Trading with a stressed or emotional mindset leads to bad decisions.

5. Focus on the Long-Term Vision

Trading success doesn't happen overnight. Many traders blow their accounts because they want quick riches. Instead, focus on consistency, discipline, and skill-building. If you trust the process and stay patient, the results will come.

Below is an example of a trading checklist that I follow before I take any trade, this helps me stay disciplined, manage risk, and avoid emotional decisions:

✅ Trading Psychology Checklist

🔹 Before Entering a Trade:

☐ Did I follow my trading plan? (No random trades, only high-probability setups)

☐ Am I trading based on logic, not emotions? (No FOMO, revenge trading, or overconfidence)

☐ Is my risk properly managed? (1-2% risk per trade, proper lot size)

☐ Does this trade have a good risk-to-reward ratio? (At least 1:2 or 1:3)

☐ Did I place my stop loss and take profit before executing the trade?

🔹 While in a Trade:

☐ Am I sticking to my original plan? (No moving stop losses or take profit out of emotions)

☐ Am I avoiding overtrading? (Only taking quality setups, not forcing trades)

☐ Am I managing my emotions? (Staying calm, not panicking over small fluctuations)

🔹 After Closing a Trade:

☐ Did I journal my trade? (Win or lose, record entry, exit, and emotions during the trade)

☐ Did I review what went right or wrong? (Learn from mistakes and improve)

☐ Am I sticking to my daily trading limit? (No excessive trading after wins or losses)

☐ Am I taking breaks and staying mentally refreshed? (Not glued to charts 24/7)

Feel free to copy. But remember to support this with a boost if you enjoyed reading it.

BTC EMA TRADING STRATEGYIn this video, I show you guys how I trade using the higher timeframe 12,21 EMA bands to find entries on 1min timeframe and capture the bigger trend with tight SL and huge R/R.

Benefits

1. Tight invalidation, leading to Massive winners

2. Entry and SL is based on pure Market structure.

3. Price first apporach

Mastering Fibonacci Retracements & Extensions on TradingView!1. Introduction to Fibonacci in Trading

Fibonacci levels are widely used in trading to identify potential reversal zones, support, and resistance levels. These levels are derived from the Fibonacci sequence, a mathematical pattern found in nature and financial markets. Traders rely on Fibonacci retracements to find potential entry points and Fibonacci extensions to determine profit targets. The most critical area of interest is the golden pocket zone, which ranges between 0.618 and 0.65. Price often reacts strongly in this zone, either reversing or continuing its trend, making it a key level for traders to watch.

2. Key Fibonacci Levels for Trading

Several Fibonacci levels are commonly used in trading. The 0.5 level, although not an actual Fibonacci number, is often observed as a psychological retracement level. The golden pocket zone, which consists of the 0.618 and 0.65 levels, is considered the most important for potential reversals. The 0.786 level represents a deeper retracement and is frequently used by traders for more precise entries before a strong price move. On the other hand, Fibonacci extensions, such as -0.618 and -1.618, are used to project potential price targets. These levels serve as reference points for identifying support and resistance, allowing traders to make more informed trading decisions.

3. How to Draw Fibonacci Retracements on TradingView

To effectively use Fibonacci retracements, traders must first identify a swing high and a swing low on the chart. This process starts by recognizing a strong uptrend or downtrend. Once identified, the Fibonacci tool in TradingView can be used to plot retracement levels. By selecting the swing low and dragging it to the swing high in a bullish setup, or vice versa in a bearish setup, traders can visualize the key Fibonacci levels. It is essential to adjust the settings to only display 0.5, 0.618, 0.65, 0.786, -0.618, and -1.618 for better clarity. This method provides a structured approach to analyzing potential price reactions and planning trades with greater accuracy.

4. Trading Strategies Using Fibonacci Levels

A. The Golden Pocket Entry Strategy (0.618–0.65)

One of the most reliable trading strategies involving Fibonacci retracements is based on the golden pocket zone. When price retraces to the 0.618–0.65 area, traders look for confirmation signals before entering a trade. These confirmations may include bullish or bearish candlestick patterns, such as engulfing candles, pin bars, or hammer formations. Additionally, traders may use momentum indicators like RSI or MACD to identify divergences, which suggest a potential trend reversal. A spike in volume at these levels can further validate the trade setup. A typical strategy involves entering a trade within the golden pocket, setting a stop-loss slightly below the 0.786 level for risk management, and targeting Fibonacci extensions for profit-taking.

B. Fibonacci Extensions (-0.618 & -1.618) for Profit Targets

Fibonacci extensions serve as valuable tools for setting take-profit levels in trending markets. Once price confirms a reversal from a retracement level, traders use extensions to project future price movements. The -0.618 extension is often considered a conservative target, providing an early profit-taking opportunity. Meanwhile, the -1.618 extension is a more aggressive target, generally used in strong trends where price momentum is high. By integrating Fibonacci extensions into their strategy, traders can optimize their exits, ensuring they capture the full potential of a move while minimizing premature exits.

5. Common Mistakes & How to Avoid Them

Despite its effectiveness, Fibonacci analysis requires proper execution. One common mistake traders make is drawing Fibonacci levels incorrectly by selecting the wrong swing points. Accuracy in identifying the correct high and low points is crucial for reliable retracement levels. Another mistake is over-reliance on Fibonacci without additional confirmations. Traders should always seek confluence with other technical indicators, such as support and resistance levels, moving averages, or volume analysis. Additionally, failing to wait for confirmation signals can lead to premature entries, increasing the risk of losses. Understanding these pitfalls and applying Fibonacci with proper validation techniques can significantly improve trading outcomes.

6. Pro Tips for Using Fibonacci Like a Pro

For best results, traders should use Fibonacci analysis on higher timeframes, such as the 1-hour, 4-hour, or daily charts, as these provide more reliable signals compared to lower timeframes. Confluence plays a crucial role in validating Fibonacci levels, so traders should always look for overlapping support and resistance, trendlines, or moving averages. Additionally, backtesting Fibonacci strategies using TradingView’s replay mode can help traders refine their approach and gain confidence in their setups before applying them in live trading. By combining Fibonacci with other technical tools and maintaining discipline in execution, traders can enhance their decision-making process and improve their overall trading success.

Final Thoughts

Mastering Fibonacci retracements and extensions can significantly improve trade accuracy. By focusing on the golden pocket zone (0.618–0.65) and using Fibonacci extensions like -0.618 and -1.618 as profit targets, traders can refine their strategies and maximize profitability. Understanding how price interacts with these levels and applying additional confirmations ensures more precise trade entries and exits. With practice and proper analysis, Fibonacci can become a powerful tool in any trader’s arsenal.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Mastering Market Movements: Understanding Impulses and CorrectioHello,

Navigating the stock market successfully isn’t just about luck—it requires a keen understanding of market trends and the ability to spot price patterns. One of the most useful concepts traders rely on is the interplay between impulses and corrections. Recognizing these alternating phases can provide valuable insights into potential price movements, allowing you to make more confident and informed trading decisions.

In this article, we’ll break down what impulses and corrections are, how to identify them, and how you can use them to improve your trading strategy.

Understanding Impulses and Corrections

Stock prices move in cycles, alternating between strong trends (impulses) and temporary retracements (corrections). These movements are driven by market psychology, where shifts in supply and demand dictate price action.

Impulses: The Driving Force of Trends

Impulses are powerful, directional moves in the market that reflect strong momentum. These often occur when sentiment aligns with fundamental catalysts, such as positive news, strong earnings reports, or broader market trends. Impulses are the backbone of trends and can provide great opportunities for traders who know how to recognize them.

To spot impulses, look for:

Strong Price Movement: Impulses are characterized by significant and sustained price shifts, indicating a surge in buying or selling pressure. This is as shown in the

Volume Expansion: When an impulse occurs, trading volume typically increases, confirming that more market participants are involved and supporting the price movement.

Break of Key Resistance or Support Levels: Impulses often push through important technical levels, signaling strength and the continuation of a trend.

Corrections: The Market Taking a Breather

Corrections, also called retracements or pullbacks, are temporary price reversals within an ongoing trend. They provide opportunities for the market to pause before resuming its dominant direction.

To identify corrections, watch for:

Counter-Trend Price Movement: Corrections move against the main trend but usually retrace only a portion (25% to 50%) of the previous impulse.

Lower Volume: Unlike impulses, corrections occur on decreased trading volume, suggesting a temporary decline in market participation.

Support and Resistance Levels: Corrections often find support or resistance at previously established price levels, which can serve as potential reversal zones.

Applying Impulses and Corrections in Trading

Understanding these market phases can significantly improve your trading approach. Here’s how:

Identifying Trends: By observing a sequence of impulses and corrections, you can determine the overall market direction and align your trades accordingly.

Finding Entry and Exit Points: Impulses signal strong trends, while corrections present opportunities to enter trades at better prices before the next move higher or lower.

Managing Risk: Setting stop-loss levels strategically—such as below key support levels during corrections—can help minimize losses while allowing room for potential gains.

Final Thoughts

Recognizing and utilizing impulses and corrections can make a huge difference in your trading success. By learning to identify these patterns, you’ll gain deeper insights into market behavior, improve your timing, and enhance your ability to make smart, strategic moves.

Take a look at the US500FU chart—it clearly illustrates impulses and corrections in action.

Good luck, and happy trading!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Vanguard - “We are the invisible hand of Adam Smith” John BogleIf anyone ever thought of erecting a monument to the person who did the most for American investors — the choice would fall on John Bogle. These words are not from a promotional brochure but a quote from Warren Buffett himself.

Book summary

But most people don’t even know who Bogle is. And certainly don’t realize that he didn’t just “create index funds.” He built an invulnerable power machine disguised as client care.

📈 From a thesis to $10 trillion under management

Bogle’s story begins with an ordinary guy born during the Great Depression. Through poverty, scholarship-based education, and working from age 10 — he makes his way into Princeton, where he writes a thesis on a topic that would change the industry: "mutual funds."

Over the years, his philosophy turned into what we now know as "passive investing." From day one, the Vanguard he created operated on the principle: "maximum benefit to the investor, minimum — to the managers." No fees, no speculation, no marketing. And it worked. But here’s the paradox: ▶ Vanguard gave up profit for the mission.

▶ The world responded — investors were tired of the noise.

▶ As a result — "Vanguard grew into a monster capable of managing the economies of entire nations."

🧠 A revolutionary idea: a fund owned by investors

Bogle built a structure where "the fund owners are the investors themselves."

Sounds beautiful: no shareholders, no profit pressure — only long-term client interests. But then who de facto manages these trillions?

⚠️ Vanguard is not a public company.

⚠️ Its shares are not traded.

⚠️ The real ownership mechanism — a black box.

It’s the perfect system for... "invisible control." And this isn’t a conspiracy theory, but logic:

If you can’t find the ultimate beneficiary — it means they’re either too big, or hiding for a reason.

🕸️ The “Big Three” and the invisible hand effect

Vanguard, BlackRock, and State Street — three funds that hold between 3% to 8% of shares in most of the world’s largest corporations. It seems small, but only 15–20% of shares are in free float.

❗ This gives the Big Three “real power”: from voting at meetings to influencing media narratives and climate policy.

📌 They own stakes in CNN, Fox, and Disney.

📌 Invest in oil companies that violate human rights.

📌 And at the same time — push the “green transition” agenda.

Conflict of interest? No. It’s “total control over both sides of the conflict.”

🤫 Why Vanguard is impossible to destroy

If you think Vanguard is just an investment fund, here are a few facts:

🔒 No company shares → can’t buy a controlling stake.

🔒 Over 400 legal entities → can’t file a single lawsuit.

🔒 Every investor essentially becomes a “co-owner” → responsibility is blurred.

🔒 All stakes split below 10% → bypass antitrust laws.

You can’t sue a ghost.

You can’t attack a network if you don’t know where its center is.

🧭 What’s next?

Today, Vanguard manages over $10 trillion, which is more than the GDP of Germany, India, and Brazil combined.

Though the fund’s founder passed away as “the conscience of Wall Street,” his creation became an "architecture of global control" that even the U.S. Federal Reserve couldn’t handle.

🎤 “We are the invisible hand of Adam Smith,” John Bogle once said.

A more detailed book review will follow below. I understand how important this is in our time and I appreciate it.

📘 General Concept of the Book:

The book is at once the autobiography of John Bogle, the story of the founding and development of Vanguard, and a manifesto of index investing philosophy. A runaway waiter, Princeton graduate, and "Wall Street rebel," Bogle creates Vanguard — a company that changed the investment world by making it more fair and accessible.

📑 Structure of the Book:

The book is divided into four parts:

Part I — The History of Vanguard.

Part II — The Evolution of Key Funds.

Part III — The Future of Investment Management.

Part IV — Personal Reflections, Philosophy, and Values of the Author.

💡 Key Ideas of the Book (Introductory Chapters, Preface):

- Index investing is the most important financial innovation of the 20th century.

- Passive management beats active managers in returns and costs.

- Vanguard’s mission is not to make money off investors, but to serve them.

- Criticism of Wall Street: high fees, conflicts of interest, short-term thinking.

- Financial revolution — a mass shift of investors from active to index funds.

🧠 Bogle's Values:

- Long-term thinking. Don’t give in to market “noise.”

- Honesty and transparency in investing.

- Minimal costs = maximum return for the investor.

- Fiduciary duty: protecting the client’s interest comes first.

📗 Part I: The History of Vanguard

🔹 Chapter 1: 1974 — The Prophecy

Context:

John Bogle is in a difficult position — he’s fired as head of Wellington Management Company.

During a trip to Los Angeles, he meets John Lovelace of American Funds, who warns: if you create a truly mutual investment company, you’ll destroy the industry.

Main Idea:

⚡ Bogle decides to go against the profit-driven industry and creates Vanguard — a company owned by investors, not managers.

Key Moments:

- Vanguard is founded in 1974 — in the middle of a crisis.

- The company has no external shareholders — all “profits” are returned to investors through lower fees.

- In 1975, the first index fund for individual investors is launched — a revolutionary idea, initially ridiculed as “Bogle’s madness.”

Important Quotes:

"Gross return before costs is market return. Net return after costs is lower. Therefore, to get the maximum, you must minimize costs."

– Bogle’s fundamental rule

🔹 Chapter 2: 1945–1965 — Background: Blair Academy, Princeton, Fortune, and Wellington

Early Life:

Bogle studies at Blair Academy on a scholarship, works as a waiter.

He enters Princeton. Struggles with his economics course, but…

In the library, he accidentally finds the Fortune article “Big Money in Boston” — about mutual funds.

Turning Point:

This article inspires Bogle to write his thesis:

“The Economic Role of the Investment Company”, where he argues:

- Funds should work for investors;

- Don’t expect them to beat the market;

- Costs must be minimized;

- Fund structure must be fair and transparent.

Career Start:

Work at Wellington Management (Philadelphia).

Starts from scratch, rising from junior analyst to president of the company.

Under Walter Morgan’s leadership, he learns the principles of discipline and serving investors.

✍️ Interim Summary

What’s important from these early chapters:

- Vanguard was born from the ruins of Bogle’s former career — an example of how failure can be the beginning of greatness.

- Already in college, Bogle saw the issue of conflicts of interest in the industry.

- His philosophy is idealism in action: don’t play guessing games — just invest in the market and reduce costs.

📘 Chapter 3: 1965–1974 — Rise and Fall

🚀 Appointed President of Wellington Management:

In 1965, at just 35 years old, John Bogle becomes president of Wellington.

He decides to modernize the business and bring in young star managers from Wall Street, especially from the firm Thorndike, Doran, Paine & Lewis.

⚠️ Risky Alliance:

Bogle makes a fatal mistake — he merges with the new management company without ensuring value alignment.

The new partners are focused on profit and short-term gains, not building a strong long-term foundation.

This leads to internal conflict, loss of trust, and poor fund performance.

💥 Dismissal:

In 1974, after a series of conflicts, the board removes Bogle.

He loses control of the company he built for nearly 25 years.

Bogle’s comment:

"I was fired, but I was still chairman of the Wellington mutual funds — and that turned out to be a lifeline."

📘 Chapter 4: 1974–1975 — The Birth of Vanguard

🧩 A Unique Legal Loophole:

Though Bogle was fired from the management company, he remained head of the Wellington Fund trustees — giving him the opportunity to build a new independent structure.

🛠 Creating Vanguard:

In December 1974, he launches The Vanguard Group — a company owned by the investors (shareholders) themselves.

Model: the fund belongs to the investors → the fund owns the management company → no outside profit, only cost recovery.

⚙️ "Vanguard" as a Symbol:

The name was inspired by Admiral Horatio Nelson’s ship — HMS Vanguard.

A symbol of leadership, courage, and moving against the tide.

Key Idea:

Vanguard would be the only truly mutual investment organization — a model where clients = owners.

📘 Chapter 5: 1975 — The First Index Fund

🤯 Revolution: The Indexing Approach

Bogle decides to create the first index mutual fund for retail investors.

Name: First Index Investment Trust (later — Vanguard 500 Index Fund).

Idea: invest in all S&P 500 stocks to reflect the market’s return instead of trying to beat it.

🪓 A Blow to the Industry:

The financial world reacts harshly:

- “Bogle’s madness”;

- “This is a failure”;

- “Who would want to just match the market?”

🔧 Humble Beginning:

The goal was to raise $150 million, but only $11 million was collected — tiny by industry standards.

But Bogle didn’t give up:

"It was a small step, but with a powerful message."

💡 Summary of Chapters 3–5: How Vanguard Was Built

🔑 Event 💬 Meaning

Loss of control at Wellington ----- Collapse of the old model, beginning of a new path

Creation of Vanguard------------- Innovative, investor-first structure

Launch of index fund--------------Start of the indexing revolution, Bogle’s core philosophy

📝 Quotes for Thought:

"All I did was apply common sense. I just said: Let’s leave the returns to the investors, not the managers." — John Bogle

"This is a business where you get what you don’t pay for. Lower costs = better results." — Bogle’s favorite saying, debunking “more is better”

📘 Chapter 6: 1976–1981 — The Survival Period

⏳ Tough Start:

After launching the index fund, Vanguard faces slow growth and constant skepticism.

For 83 straight months (nearly 7 years!), Vanguard sees net outflows — investors are hesitant to trust this new model.

🧱 Laying the Foundation:

Bogle and his team focus on:

- Transparency

- Lowering costs

- Investor education (they explain what it means to “stay the course”)

💬 The Core Dilemma:

"All investors want to beat the market. But no one wants to pay the price: high fees, taxes, risks. We offered an alternative — reliability, simplicity, and low cost."

📈 Small Wins:

Despite modest volume, Vanguard starts building a reputation as an “honest player.”

It becomes evident: investors using Vanguard achieve better long-term results than those chasing trendy funds.

📘 Chapter 7: 1982–1991 — Growth and Recognition

💡 The Power of Philosophy:

Bogle keeps repeating: “Stay the course” — don’t try to predict the market, don’t fall for fear and greed.

This message becomes especially powerful after the 1982 and 1987 market crises.

🏆 The First Fruits:

A slow but steady increase in assets begins.

Vanguard launches new index funds:

- Total Stock Market Index

- Bond Index

- International Index

📣 Educational Mission:

Bogle writes books, articles, gives interviews.

He isn’t just running a fund — he’s changing how people think about investing.

A community of followers emerges — the Bogleheads.

📊 Key Stats:

By 1991, Vanguard's assets reach around $130 billion.

Index funds begin receiving positive reviews from analysts, including Morningstar.

📘 Chapter 8: 1991–1999 — Industry Leadership

🚀 Explosive Growth:

In the 1990s, index funds go mainstream.

Investors realize that most active funds underperform the market — and they vote with their money for Vanguard.

🧰 Expanding the Product Line:

Vanguard introduces:

- Retirement funds

- Bond funds

- International and balanced funds

- Admiral Shares — low-cost funds for loyal investors

📢 Open Fight with the Industry:

Bogle continues to harshly criticize Wall Street:

- For greed, manipulation, and lack of transparency

- For prioritizing company profit over client interest

"The industry hates Vanguard because it proves you can be honest and still succeed."

⚠️ Internal Challenges:

In the late 1990s, Bogle’s health declines.

He passes leadership to Jack Brennan but retains influence on company strategy.

📊 Midpoint Summary (Chapters 6–8)

📅 Phase 📈 Essence

1976–1981 Quiet survival: building the model, fighting for trust

1982–1991 Slow growth: philosophy attracts investors

1991–1999 Recognition and leadership: indexing becomes dominant

💬 Bogle Quotes from These Chapters:

"Investing is not a business. It’s a service. Those who forget this lose everything."

"Every dollar spent on fees is a dollar lost to your future."

"Volatility is not the enemy. The real enemy is you, if you panic."

📘 Chapter 9: Leadership as a Calling

💡 A Leader ≠ A Manager:

Bogle contrasts a true leader with just an efficient executive.

A real leader:

- Puts others’ interests above their own

- Has a moral compass, not just KPIs

- Makes hard, unpopular decisions

🛤 His Leadership Style:

"Don’t ask others to do what you wouldn’t do yourself."

"Always explain why — people follow meaning, not orders."

He genuinely believes Vanguard should be more than a successful business — it should be a force for good in the market.

"Leadership is loyalty to an idea bigger than yourself."

🔄 Feedback Principle:

Bogle constantly interacts with clients, employees, and journalists.

He never isolates himself in an “ivory tower” — he believes this openness is a leader’s true strength.

📘 Chapter 10: Client Service — Vanguard’s Mission

🧭 The Mission:

"Maximize investor returns — not company profits."

Vanguard is built around fiduciary responsibility: every decision must pass the test — is this in the investor’s best interest or not?

🧾 How It’s Implemented:

- Fees below market average → investors keep more

- No ads for “hot” funds → Vanguard sells stability, not trends

- No sales commissions → no one profits off pushing funds to clients

- Ethical code — “Don’t do anything you wouldn’t want on the front page of the newspaper.”

"We’re not trying to be the best for Wall Street. We’re trying to be the best for you."

📘 Chapter 11: The Market Should Serve Society

📉 Critique of Modern Wall Street:

Bogle argues that finance has drifted from its original purpose.

Investing has turned into trading.

The investor became a cash cow, not a partner.

"The market now serves itself — and we’re still paying the price."

🌱 What the System Should Look Like:

- Companies should serve society

- Investors should be owners, not speculators

- Funds should be transparent, accountable, and honest

📢 Call for Reform:

Bogle calls for a rethinking of finance:

- Restore the human element

- Make mission more important than profit

- Protect long-term interests of millions of ordinary investors

"If we want capitalism with a human face, we must return finance to serving society."

📊 Summary of Chapters 9–11: Bogle's Philosophy

📌 Direction------------💬 Essence

Leadership-------------Morality, leading by example, purpose-driven

Business---------------First and foremost — service to the client

Financial System-------Must work for society, not just for profit of the few

✨ Inspirational Quotes:

"The most important thing you can invest is not money — it’s your conscience."

"Honesty in business is not a competitive edge. It’s a duty."

"I’m not against capitalism. I’m against capitalism without morals."

📘 Chapter 12: The Future of Investing — Where the Industry Is Headed

🌐 Bogle sees three main trends:

Victory of Passive Investing:

- Index funds continue to displace active management

- Their share of assets under management is growing rapidly

- More investors are realizing the power of simplicity

Fee Pressure:

- Fees are approaching zero (some funds are effectively free)