Bitcoin Income: STRK vs IBIT – Dividends, Covered CallsThis video provides a performance breakdown between two Bitcoin-related financial instruments—STRK (Strike) and IBIT—through the lens of passive income generation. I compare traditional buy-and-hold strategies with more active income tactics such as covered calls. Key insights include:

STRK provided the best return YTD (26%) and yielded approximately 1.54% in passive dividends, requiring minimal effort—just buy, hold, and collect.

IBIT, while slightly trailing in growth (13%), is optimized for a covered call strategy, offering an impressive 6% income yield through active options trading.

The analysis highlights the trade-off between simplicity and engagement—STRK is more passive-friendly, while IBIT offers higher yields for those willing to manage options.

This is ideal for tech-savvy investors exploring Bitcoin ETFs and derivative income strategies, weighing convenience versus return potential.

Community ideas

SPY/QQQ Plan Your Trade EOD Update : Memorial Weekend RisksThis EOD update is to help you try to position for the risks associated with a further breakdown in price trends over the lone Memorial Day weekend.

I know this video will be posted late in the day - but I want you to learn how to hedge against risks and try to learn to take your profits when they are THERE.

This is a really quick video.

Stay safe this weekend and thank you to all our VETS for your service and sacrifices.

We honor you this weekend.

GET SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

BITCOIN DAILY CHARTBITCOIN daily chart seems to have updated the supply roof in 111k zone and the current all time high will be under correction as whales will be booking profit .on technical the supply roof is updated and am seeing immediate take profit by net long position .the breakout zone remains 97k-100k for potential retest and possible buy position.

#bitcoin#fx #btc

GOLD President Donald Trump spoke today, May 23, 2025. He made several public statements and announcements, including:

Announcing that he is recommending a 50% tariff on imports from the European Union starting June 1 due to stalled trade negotiations.

Warning Apple that it would face a 25% tariff on iPhones not made in the United States, urging domestic manufacturing.

Commenting on ongoing trade talks with the EU, expressing frustration over lack of progress.

Posting on Truth Social about a “major prisoner swap” between Russia and Ukraine, though this was not officially confirmed by either side.

Planning to sign additional executive orders today as courts continue to block some of his previous actions.

on technical GOLD broke out of descending trendline connecting the 3500$ /oz all time high and the last high .

dxy continues to sink, until the geopolitical instability normalizes we will continue to experience volatility in the market

Gold Short: Completed 5 waves of wave 1 (higher degree)I believe that Gold has completed the 5th wave. Here are the evidence:

1. Drawn out 5-wave structure with breakdowns.

2. Fibonacci measurement: wave 5 is almost equals to wave 1.

3. RSI is lower at the 5th wave compared to 3rd wave although price is higher (price-rsi divergence).

Stop is $3272.

Take Profit is $3285.

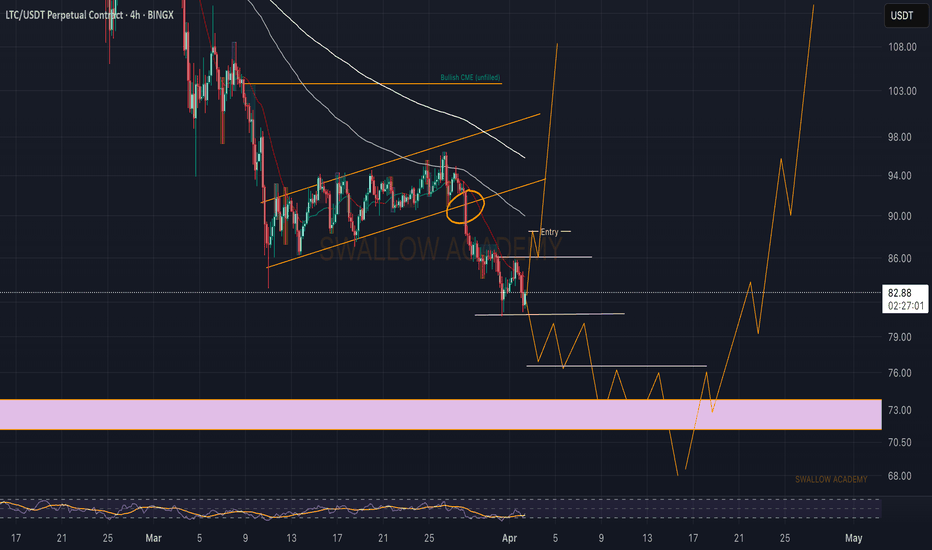

Litecoin(LTC): Broken Bullish Trend / Good RR Trade Can Be TakenLitecoin has made a really good breakdown from the local bullish trend, where we are now waiting for either a BoS to form or an MSB, which would give us more clarity on upcoming movement.

More in-depth info is in the video—enjoy!

Swallow Team

Ripple (XRP): Looking For Shorting Zones and ConfimationsRipple coin can form here a good downward movement where we are still waiting for any signs of weakness in the markets. In our opinion, this coin is doomed for fall so let's see how things will unfold!

More in-depth info is in the video—enjoy!

Swallow Team

Cardano (ADA): Possible 1:3 RR Trades Can Be Taken in Both Wayswe are seeing some sort of buying volume building up at the beginning of month where we might see a full-scale breakout and a move of 50%, but if we look on weekly timeframe picture is completely different.

More in-depth info is in the video—enjoy!

Swallow Team

Cardano (ADA): We Are In Bullish Trend | Reaching Pressure PointCardano is in the bullish trend where, on smaller timeframes, we are seeing a good small scalp that can be taken, but be careful...on the 4-hour timeframe, we are approaching the pressure point between the resistance, EMAs, and bullish trend.

More in-depth info is in the video—enjoy!

Swallow Academy

GOLD President Donald Trump spoke today, May 23, 2025. He made several public statements and announcements, including:

Announcing that he is recommending a 50% tariff on imports from the European Union starting June 1 due to stalled trade negotiations.

Warning Apple that it would face a 25% tariff on iPhones not made in the United States, urging domestic manufacturing.

Commenting on ongoing trade talks with the EU, expressing frustration over lack of progress.

Posting on Truth Social about a “major prisoner swap” between Russia and Ukraine, though this was not officially confirmed by either side.

Planning to sign additional executive orders today as courts continue to block some of his previous actions.

He also attended a black-tie gala and is expected to give a commencement speech at the U.S. Military Academy at West Point on Saturday.

GOLD REACTED .

Dow Jones breakdown or setup for 15 percent rally?The Dow looks weak but this might be the setup traders dream of. We break down two possible bullish patterns forming — an inverse head and shoulders and an ascending triangle — and explain how Trump’s EU tariffs could shape the next move. Target gains up to 15 percent with risk reward ratios as high as 7.5 to 1.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

UK inflation surprise and US tax bill fuel GBPUSD breakoutGBPUSD just broke out. In this video, we explain how UK inflation and the US tax bill pushed it higher. We also look at the technical setup, the double top breakout, and the target at 1.4778. Will this rally last or is it a trap?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

SPY/QQQ Plan Your Trade for 5-23 : Carryover PatternLooking at the charts today, I want to say that it certainly looks like the SPY Cycle Patterns are blending into a consolidated CRUSH/BOTTOM pattern (see the weekend patterns) today and possibly "carrying over" into the early trading next week.

I have been warning of a pending rollover/breakdown in this uptrend for weeks. Today's breakdown seems a bit aggressive, but it is what it is.

If the patterns are consolidating/blending into a bigger breakdown over the Memorial Day weekend, then we could be looking at a very big downward/rotational move in the SPY/QQQ/Bitcoin over the next 5+ trading days while Gold/Silver continue to rally.

Silver is lagging Gold right now, but I don't think that lasts. Once Gold gets back above $3400, I believe Silver will start to make a big move higher.

The big question in my mind is - how does this carry into Monday's holiday trading schedule and into Tuesday's OPEN?

I'll have to see how things play out today - but it certainly looks like I'll be adding some SPREADS to potentially catch any big move over this weekend.

GET SOME.

This could play out exceptionally well for skilled traders.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver